Renewed Interest In Gold As A Financial Asset

Commodities / Gold and Silver 2012 Dec 10, 2012 - 07:50 AM GMTBy: Peter_Schiff

Valentin Petkantchin writes: You may be among those investors who had the opportunity, but did not seize it, to buy gold cheap in the early 2000s. You may also be willing, but hesitant, to do so at current prices, while still desiring the "anti-crash insurance" it represents.

Valentin Petkantchin writes: You may be among those investors who had the opportunity, but did not seize it, to buy gold cheap in the early 2000s. You may also be willing, but hesitant, to do so at current prices, while still desiring the "anti-crash insurance" it represents.

However, you should be aware that the yellow metal is increasingly valued as a reserve asset, which will tend to push the price up, independently of all other factors. Due to new regulations, you may also have to bid in the future alongside financial institutions, including several banks, to acquire it.

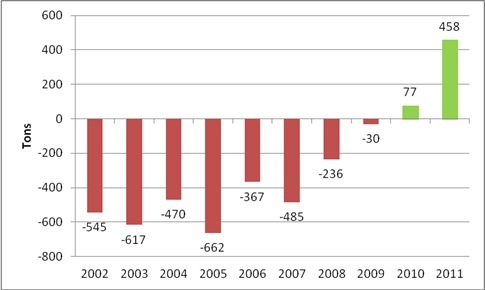

First, let's take a step back, at least as it regards central banks' attitude towards gold. The fact is that it has considerably changed. Central banks, which had sold gold for decades, have become - for the "first time in 21 years", dixit the World Gold Council - net buyers in 2010, i.e. the total quantities purchased by them have exceeded the quantities sold.

Net Purchases (Green) / Net Sales (Red) of Physical Gold from the Official Sector

The official sector is comprised of central banks and other official institutions. Source: World Gold Council

So while central banks fueled the supply of gold by 400-500 tons per year on average between 1989 and 2007, they are now increasing demand by the same factor. If this trend is to gain momentum due to the current crisis, the price of gold could soon become inaccessible to individual investors.

But central banks are not the only ones. There is also a renewed interest in gold as a safe and highly liquid asset, and this for two reasons:

First, physical gold is increasingly accepted - and therefore sought - as collateral in cases, for instance, of margin calls or securities loans. A growing number of clearing houses - such as CME Group (including its branch in Europe), ICE Europe, or LCH Clearnet Group - or of banks, like JP Morgan, now accept physical gold as collateral on their own.

Added to this is the willingness of public authorities - in line with the G20 meetings in 2009-2010 - to regulate the OTC derivatives market, including the eligible collateral that market intermediaries and central counterparties should accept. Thus, for instance, the new EU regulation on market infrastructure adopted last summer explicitly lists physical gold among the types of eligible "highly liquid collateral with minimal credit and market risk," alongside cash or government bonds. Scheduled to become fully operational in the summer of 2013, this regulation may have a clear bullish impact for the gold price in the longer term.

Second, commercial banks could also be a source of additional demand for the yellow metal due to the intricate regulation trying to transpose the so-called "Basel III" regulatory framework. Among other things, this framework introduces new criteria such as liquidity coverage ratios, requiring banks to hold certain assets considered highly liquid to serve, presumably, as a buffer in case of a liquidity crisis.

Despite its long history as a safe haven and its high liquidity (even during war times), gold was not originally included as part of those assets in Basel III, nor in the legislative package destined to its implementation in the EU and originally proposed by Brussels. The European Banking Authority, the European Securities and Market Authority, and the ECB are supposed to transmit to the Commission no later than June 30, 2013 a report that defines which assets should be considered, in their bureaucratic jargon, of "high and extremely high liquidity and quality."

The amended proposal by the European Parliament and the EU Council explicitly states in that regard that "it shall be assessed whether gold or other highly liquid commodities (...) can be considered" as such liquid assets.

Debates about the legislative package are still in progress, and the vote in Parliament is expected before the end of the year (with entry into force in 2015). But if gold is included in the finally adopted regulation, it will mean that in the next few years, the commercial banks could be compelled to buy gold just to meet their legal liquidity ratio requirements.

If you have not yet purchased your "anti-crash insurance" but you are willing to do it, you should follow closely those regulatory developments and act before they become fully effective. If you think the current price of gold is too high, wait to see what will happen when commercial banks start rushing to buy it too.

Valentin Petkantchin is a French economic and financial analyst. He holds a PhD in Economics from the University of Aix-Marseille III and is most recently the founder of the Economic Education Initiative (www.economic-education.org), a project aimed at publicizing sound economic thinking through comic books and cartoons.

This article appears in the December 2012 edition of Peter Schiff's Gold Letter, a monthly newsletter featuring original contributions from Peter Schiff, Casey Research, and other leading experts in the gold market. Click here for your free subscription. To learn more about Peter Schiff's gold & silver dealer, visit www.europacmetals.com.

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.