Iran As Currency Wars Escalate Obama To Approve Gold Sanctions

Commodities / Gold and Silver 2012 Dec 12, 2012 - 05:58 AM GMTBy: GoldCore

Today’s AM fix was USD 1,712.50, EUR 1,315.59 and GBP 1,061.69 per ounce.

Today’s AM fix was USD 1,712.50, EUR 1,315.59 and GBP 1,061.69 per ounce.

Yesterday’s AM fix was USD 1,709.75, EUR 1,318.23 and GBP 1,063.41 per ounce.

Silver is trading at $33.14/oz, €25.54/oz and £20.51/oz. Platinum is trading at $1,643.00/oz, palladium at $693.00/oz and rhodium at $1,070/oz.

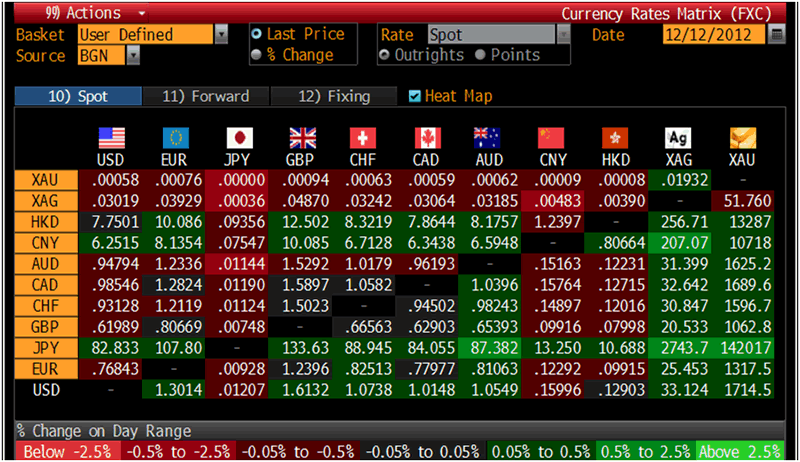

Cross Currency Table – (Bloomberg)

Gold was down $1.60 or 0.09% in New York yesterday and closed at $1,710.00/oz. Silver finished down 24 cents to $32.95/oz for a loss of 0.72%.

Gold is hovering unchanged ahead of the U.S. FOMC policy statement that takes place at 1730 GMT and Ben Bernanke’s news conference is at 1915 GMT. Investors believe that the Fed will reveal more bond purchases and a continued loose monetary stance which will favour gold and silver’s appeal as hedges against inflation.

U.S. President, Barack Obama and John Boehner, Speaker of the House of Representatives, spoke by phone on Tuesday after exchanging new proposals on the fiscal cliff. Fiscal cliff concerns are likely affecting U.S. consumer and business confidence in the run up to Christmas and this will likely impact an already vulnerable U.S. economy.

Gold-backed ETF’s climbed again to a new record at 76.178 million ounces on Dec. 10th, after dropping off a record high in the prior session, due to robust demand – particularly from the institutional sector.

Gold should reach a new record again in 2013 according to UBS in their daily note today.

Gold reached a record nominal high of $1,921.15/oz (12% below today’s price of $1,714/oz) 15 months ago in September 2011.

Gold analyst Edel Tully said “we remain gold bulls” and maintains an average gold estimate of $1,900/oz for 2013 – 11% above today’s price.

She cited continuing loose central-bank monetary policies as a key driver of new record high prices.

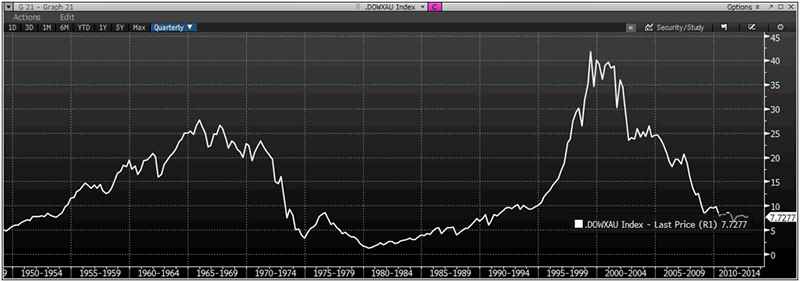

Dow Jones Priced in Gold 1950-2012 – (Bloomberg)

Turkey’s trade balance may turn on whether President Barack Obama vetoes more stringent sanctions against Iran after the U.S. Senate passed a measure targeting loopholes in gold exports to the Islamic Republic.

Turkey’s gold trade with neighbouring Iran has helped shrink its trade deficit over the past year according to Bloomberg.

Incredibly, precious metals accounted for about half of the almost $21 billion decline.

That’s calmed investor concern over its current-account gap, and helped persuade Fitch Ratings to give Turkey its first investment-grade rating since 1994.

The U.S. Senate voted 94-0 on Nov. 30 to approve new sanctions against Iran, closing gaps from previous measures, including trade in precious metals. Obama, who opposes the move on the grounds it may undercut existing efforts to rein in the nation’s nuclear ambitions, signed an executive order in July restricting gold payments to Iranian state institutions.

Turkey exported $11.9 billion of gold in the first 10 months of the year, according to the Ankara-based statistics agency’s website.

A very large 85% of the shipments went to Iran and the United Arab Emirates.

Iran is buying the gold with payments Turkey makes for natural gas it purchases in liras, Turkish Deputy Prime Minister Ali Babacan told a parliamentary committee in Ankara on Nov. 23.

Iran provides Turkey with between 21% and 25% of its gas, data from the Energy Market Regulatory Authority and Energy Minister Taner Yildiz showed.

The current-account deficit may fall to $57.3 billion by year-end, according to a bi-weekly survey of economists by the central bank published on Dec. 6. That compares with $77.1 billion last year, when Turkey had the second-biggest deficit in the world, behind the U.S.

The U.S. and the European Union say Iran is secretly pursuing a nuclear weapons capability. Iran says its nuclear program is strictly for civilian energy and medical research.

The trade with Iran is a strategic necessity for Turkey, and the government will view any new U.S. sanctions according to its own interests, Prime Minister Recep Tayyip Erdogan said in Istanbul on Dec. 3. Turkey isn’t concerned with how it pays for the gas it buys from Iran and would pay in “potatoes” if necessary, Yildiz said two days later.

The proposed U.S. amendment introduced by senators Robert Menendez and Mark Kirk is confusing and inconsistent in applying sanctions, according to an e-mail from the White House on Nov. 29 that was obtained by Bloomberg News.

The Menendez-Kirk amendment would allow purchases of Iranian natural gas if payments are made in local currencies into an account that Iran could only use for approved trade.

The State Department said Dec. 7 that nine oil-importing nations, including Turkey, will continue to be exempt from the sanctions aimed at Iran, according to an e-mailed statement. A spokeswoman at the U.S. embassy in Ankara, who asked not to be identified in line with policy, declined to comment the next day.

The gold debate poses a dilemma for Turkey, and the nation’s finances may be affected by the outcome, according to Nilufer Sezgin, chief economist at Erste Securities in Istanbul.

The Turkey Iran gold for energy trade shows the benefits of gold.

While not a productive asset, it can create much employment, preserve wealth and has important monetary uses – especially in times of crisis.

Gold is becoming an essential means of payment again in the Middle East again. We expect to see this trend continue in the coming months as competitive currency devaluations are pursued by nations globally in order to prevent deep recessions and depression.

In time other large energy exporters such as Russia and Venezuela may take payment for their oil exports in gold.

Those continuing to simplistically call gold “a bubble” have yet to realise how gold is becoming money again.

As doubts grow about the euro, the dollar, the pound and fiat currencies internationally we expect currency devaluations and currency and gold wars to intensify.

Gold is going from a fringe investment asset to a mainstream store of wealth held by prudent individuals, institutions, banks and nations.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.