Japan Big Bank QE, Weakening Yen to Inflate Economy and Stocks

Economics / Japan Economy Dec 20, 2012 - 12:28 PM GMTBy: Gary_Dorsch

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some. And not one man in a million will detect the theft,” John Maynard Keynes wrote in 1920.

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some. And not one man in a million will detect the theft,” John Maynard Keynes wrote in 1920.

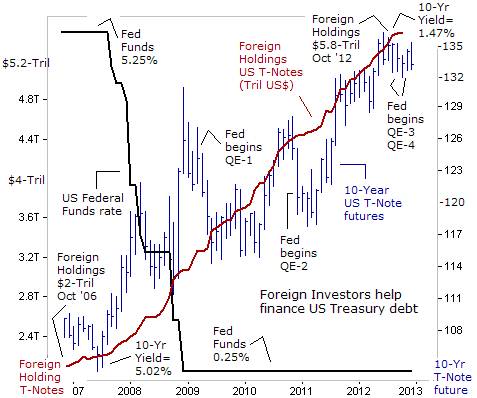

On Dec 12th, a shadowy group of political lackeys, voted 11-1 to launch what’s popularly dubbed as “Infinity QE-4,” – the Federal Reserve’s most radical scheme ever, that’s designed to enable the US-government to continue borrowing as much as $1-trillion per year, for the next several years, if necessary, in order to finance the burgeoning US-welfare state. US-lawmakers are negotiating over the details of the so-called “fiscal cliff,” but are simply nibbling at the edges of $1-trillion budget deficits. Yet US-politicians from both sides of the isle, believe they can stave off significant tax hikes and spending cuts, without having to pay a penalty of sharply higher interest rates, which normally follows such fiscal recklessness.

In an unprecedented step, the Federal Reserve said on Dec 12th, that it would hold short-term Treasury yields near zero –percent until the US-jobless rate falls to 6.5% as it launched a new round of T-bond purchases to inflate the US-money supply. Fed officials committed to monthly purchases of $45-billion in Treasuries on top of the $40-billion per month in mortgage-backed bonds they started buying in September. The new round of government bond-buying dubbed “Infinity QE-4” will be funded by essentially creating new money, and further expanding the Fed's $2.8 trillion balance sheet today, to as much as $6-trillion by the end of 2015.

“The Fed continues to operate an open bar for the fiscal drunks in Washington,” says economist Ed Yardmen, referring to the Fed’s readiness to finance Washington’s massive budget deficits. And since the Fed returns any interest payments on the T-notes, back to the Treasury, the federal government is able to borrow money at no cost. However, there is a cost to be paid by the American people, - a massive inflation tax, that will eventually take effect, when the cost of living in America begins to accelerate at a frightening pace, and the cost of goods and services far exceeds the current levels of US-household income.

The Fed is trying to cloak its mischievous role as the chief financier of the US-government, by arguing that its objective, according to Fed chief Ben Bernanke, “is to help the American middle class. This is a Main Street policy because what we are about here is trying to get jobs going,” Bernanke said at a press conference, where reporters are only allowed to ask softball type questions. “If people feel that their financial situation is better because their 401(k) looks better, their house is worth more, they are more willing to go out and spend and that’s going to provide the demand that firms need in order to be willing to hire and to invest,” the former Princeton professor said, explaining Bernanke’s theory of “trickle down” Economics.

Yet with 10-year US T-Note yields already suppressed at historic lows, and pegged below the US-inflation rate, it is hard to argue that what’s needed is to make credit even cheaper is another $1-trillion of extra liquidity from the Fed. And with $1.5-trillion of excess reserves in the US-banking system, it is hard to believe that the Wall Street banking Oligarchs need more liquidity to bolster their balance sheets. Instead, what Fed is trying to enforce is what’s called “financial repression,” - defined as the “totalitarian control of credit under which Treasury financing can be arranged cheaply in spite of a massive increase in the size of the national debt, thru a system of combined and interconnected open-market policies.”

The Fed, the chief financier of the US-government is now holding $1.65-trillion of US T-notes. It’s also spinning a well-packaged web of lies that’s being sold to the masses, gradually, and if somebody tries to speak the truth about the coming wave of hyper inflation, about to sweep the US-welfare state, the “Boy who cries Wolf,” is made to seem utterly preposterous and a raving lunatic. The US-public is fed information about the rate of inflation, that’s under the control of the apparatchiks at the US Labor department, - now touting new ideas, such as the chained-CPI, that’s designed to eliminate future cost of living increases for entitlements.

Dallas Fed chief Richard Fisher, among the few token hawks at the Fed, laments that with quantitative easing (QE), “Financiers we have become. The US-Treasury is hooked on the monetary morphine we provided, when we performed massive reconstructive surgery during the 2008-09 panic. We have filled the gas tank and then some,” he said. But more morphine is needed. The Fed has been asked by the ruling political elite to buy $40-billion of US-T-Notes each month in the year ahead. The Fed is stepping its QE injections, because America’s biggest lender, - China, - is no longer willing to bankroll the US-Treasury. Beijing was a net seller of $95-billion of US Treasury notes over the 12-months ending October 31st.

As of October 31st, foreign investors, - mainly central banks, were holders of $5.85-trillion of US-T-Notes, up +11% from a year earlier. However, in October, the pace of foreign buying slowed to a trickle- a tiny $4-billion increase, which was far less than the average $50.7-billion of purchases per month, over the previous 11-months.

Without the support of “Infinity QE-4”, US T-Note prices could sink under the weight of an $965-billion of new US-government debt to be auctioned in fiscal 2013. Without QE-4, US-T-bond yields could rise sharply, and deal a major blow to the US-stock markets, where traders are now treating blue-chip companies that pay higher yielding dividends and arrange stock buybacks, as surrogates for fixed income bonds. “I place economy among the first and most important virtues, and public debt as the greatest of dangers. To preserve our independence, we must not let our rulers load us with perpetual debt,” Thomas Jefferson warned.

Tokyo Prepares to Launch “Big-Bang” QE,

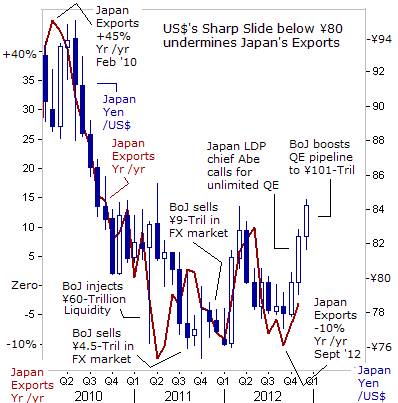

One of the side-effects of the Fed’s QE schemes is to weaken the US-dollar’s exchange rate against other currencies. And that’s a major threat to the economic health of many Asian economies that depend upon a high level of exports abroad. Perhaps no other Asian country has been as badly damaged from the Fed’s ultra-easy money policies, than Japan. Its economy contracted at an annualized -3.5% rate in the third quarter, the worst contraction since last year’s earthquake as exports slumped and consumer spending fell.

Japan’s exports have fallen for six straight months in a row, compared with a year ago. Shipments to China, Japan’s top export market, were -14.5% lower in November than a year earlier, because of a Chinese consumer boycott of Japanese goods. Exports to Europe plunged -20% from a year ago, and were down for a 14th straight month. As a result, Japan’s trade deficit for the first 11-months of 2012, widened to a record ¥6.2-trillion yen ($76.4-billion). Japan’s economy is expected to contract -0.4% in the fourth quarter, meeting the textbook definition of a recession. Nikkei-225 companies suffered a combined drop of -31% in net income in the third quarter compared with a year ago.

However, in the hours after midnight on Dec 16th, it became clear that Japanese citizens had voted for change. With its coalition partner, New Komeito, the Liberal Democratic Party (LDP) will control at least 323-seats, securing a two-thirds super-majority in the 480-seat lower house. The Democratic Party of Japan (DPJ) is expected to win no more than 77 seats, - a stunning collapse in support, compared with the 308-seat landslide it won in 2009. Its leader, PM Yoshihiko Noda, is stepping down as party chief as a result of the crushing defeat. Instead, (LDP) chief Shinzo Abe is returning as prime-minister, after 3-years in political exile.

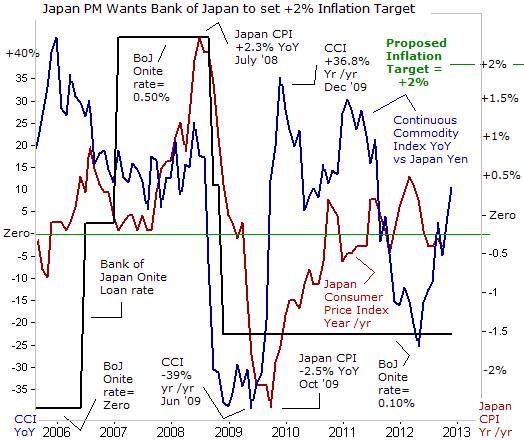

Shinzo Abe campaigned as a “currency warrior,” and is anxious to push back against the Fed’s QE-4 scheme, with his own prescription for Japan’s economic recovery. Abe met with Bank of Japan chief Masaaki Shirakawa on Dec 18th and urged the central bank to set an annual inflation target of +2% for the consumer price index. In their chat held a day ahead of a two-day BoJ Policy Board meeting, Abe also told Shirakawa that his incoming government wants the BoJ to keep printing Japanese yen, until the inflation rate hits +2%.

The idea is to weaken the yen and kick-start Japan’s economy. According to some press reports, leaked to the media, the LDP is preparing to detonate “Big-Bang” QE as early as January 22nd, and flood the world money markets with $1.2-trillion worth of Japanese yen. "We need to overcome the crisis Japan is undergoing. We have promised to pull Japan out of deflation and correct a strong yen. The situation is severe, but we need to do this,” Abe said on Dec 16th. “Quantitative easing by the BoJ will help correct a strong yen and push up stock prices. That will help boost investment and lead to rises in wages, jobs and household revenues. We’d like to shorten the time needed for this to happen,” Abe said.

It could take several years for Japan’s consumer price index (CPI) to reach +2%, from a negative -0.4% in October, because LDP Apparatchiks are in charge of calculating Japan’s CPI, of course! Furthermore, every five years, Japan’s government routinely changes the items included in its CPI, preferring to lower of weighting of items that are rising in price, while increasing the weighting of items that are declining in price. This way, Japan’s CPI stays near zero-percent, and provides political cover for the BoJ to monetize the government’s debts.

Likewise, the Fed says it would consider suspending its QE-4 operation, if the US-consumer price inflation rate climbs significantly above its +2.5% target rate. However, Fed chief Bernanke says it’s a mistake to include the prices of globally traded commodities, such as food and energy, when calculating the rate of inflation. “As is often the case, inflation has been pushed up and down in recent years by fluctuations in the price of crude oil and other globally traded commodities, including the increase in farm prices brought on by this summer's drought. But the ebbs and flows in commodity prices have had only transitory effects on inflation,” he told the Economic Club of New York on Nov 20th.

Essentially, the Fed has given itself plenty of leeway to interpret a rise in the inflation rate above +2.5% as transitory and temporary, and thereby not requiring a pause in QE, let alone a tightening in monetary policy, - just like the Bank of England, which has permitted above target inflation for the past three years, in complete disregard of its legal mandate.

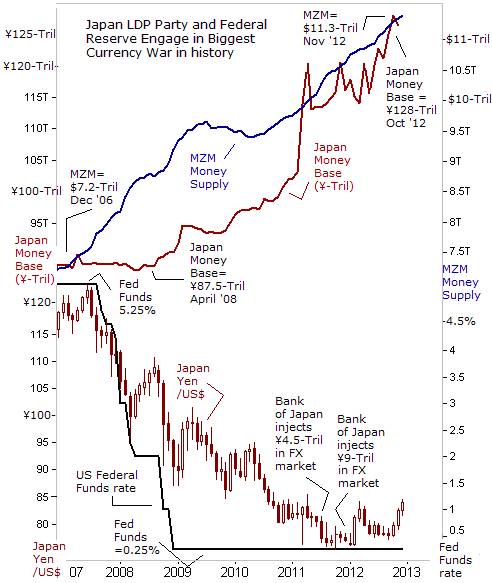

Currency War among World’s Top-2 Debtors, The battle over the US$ /yen exchange rate has been raging for the past 4-½ years. Since April 2008, the BoJ has expanded Japan’s monetary base, the most liquid form of cash in the banking system, by +46% to an all-time high of ¥128-trillion. At the same time, Fed has steadily increased the MZM money supply, the most liquid form of cash, to a record $11.3-trillion today. That’s an annual rate of increase of +9.5%, on average. Until recently, Tokyo was losing the battle, even after injecting ¥14-trillion into the foreign exchange market in 2011, through direct intervention that was left unsterilized. As a courtesy to Washington, Tokyo recycled $128-billion of its intervention effort into US Treasuries, - monetizing a big chunk of the US-budget deficit. No wonder US president Barack Obama wants to meet Mr Abe in the White House in January 2013.

Yet Tokyo’s massive intervention effort failed to give the US$ a sustainable lift above ¥82. The US$ was stuck in quicksand, because the Fed continually upped its QE ante, with bigger and bigger dosages of liquidity. Also weighing heavily upon the US-dollar, the Fed stripped the greenback of its interest rate advantage over Japan’s yen, and frequently reminds listeners that the US-fed funds rate would remain locked near zero percent for years to come. In other words, the Fed co-opted the QE and ZIRP blueprints that were originally designed by the BoJ. Both central banks are now using a new scheme - “inflation targeting.”

This tug-of-war, between the world’s top-2 debtor nations, over the US’s exchange rate versus the yen could last for many more years. It’s unlikely that Tokyo would opt for direct intervention in the currency market as its primary weapon of choice for influencing the yen’s exchange rate. It already owns $1.13-trillion of ultra-low yielding US Treasury notes. Instead, a determined LDP could make further progress in pushing the Euro and US$ higher versus the yen in the months ahead, by utilizing the Big-Bang” QE strategy. Tokyo could also push for negative short-term interest rates to achieve its objectives.

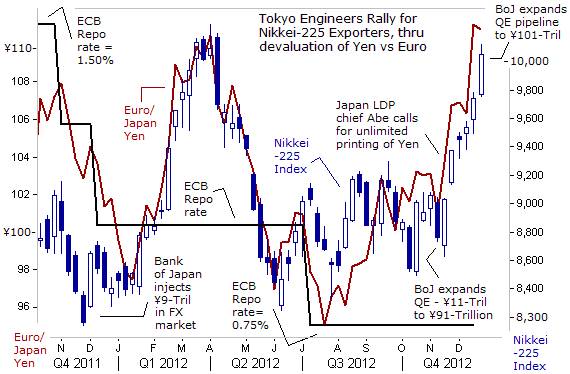

Until recently, Japan Inc was getting slammed by a double whammy. The Euro currency had fallen below the psychological ¥100-level, matching a 12-year low. The debt crisis in the Euro-zone, pushed its economy into a double-dip recession, and caused Japanese exports to plummet. The European Central Bank (ECB) slashed its overnight repo loan rate to a historic low of 0.75% in July, adding to selling pressure on the Euro versus the yen. Largely due to the super strong yen, the Nikkei-225 stock index was a laggard, and trapped below the 9,000-level. Some companies were hit harder than others.

Sony traded at less than ¥1,000, for the first time since 1980, the year it introduced the Walkman portable cassette player. Japan’s electronics giants, Sony, Panasonic, and Sharp became less competitive on pricing, and also lost their lead in cutting-edge technologies to their South Korean rivals, Samsung Electronics (005930:KS) and LG Electronics (066570:KS). Sony posted a $5.7-billion loss for the fiscal year, its fourth consecutive year in the red. Sharp lost $4.7-billion, forcing it to sell 10% of its shares to Taiwan’s Hon Hai Group. Panasonic’s losses were even larger totaling -$9.7-billion. Other less well-known Japanese companies such as semiconductor maker Renesas Electronics was also reporting losses.

The Bank of Japan was getting steamrolled, even after dumping ¥14.3-trillion ($178-billion) into the currency market and expanding its QE pipeline to ¥91-trillion in October. However, since November 16th, the US-dollar has jumped to ¥84.50 this week, - up from ¥78 earlier. The US$’s rebound is small in percentage terms, but it’s a big bonus for Japan’s top exporters. For example, every 1-yen increase in the US’s exchange rate leads to a +2.4% increase in Nissan Motor’s (7201.T) operating profit. Likewise, Toyota Motor’s profit increases by +3.3%. The US$’s rebound to ¥84.50 caught Japan’s Canon 7751.T by surprise. On Oct 16th, the camera and printer maker, which generates 80% of its revenue abroad, revised its forecast for the average US-dollar rate for the full year to ¥78, and kept its Euro rate forecast unchanged at ¥100. Since then however, the Euro has surged to ¥111.50.

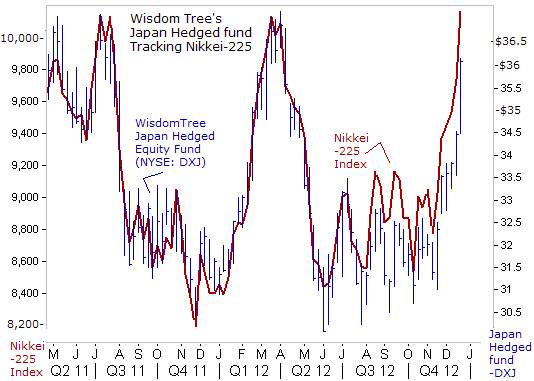

In turn, the Nikkei-225 stock index surged +1,200-points higher since Nov 16th to above the psychological 10,000-level on Dec 19th. Much of the Nikkei’s rally appears to be spearheaded by Euro-yen “carry traders,” who are also pocketing a currency profit. The Euro is gaining more ground against the yen, because the ECB is sterilizing its bond buying operations. For retail US-investors in Japan, there’s the potential for a currency loss. However, the Wisdom-Tree Japan Hedged Equity Fund (NYSE ticker: DXJ) does a reasonably good job of tracking the performance of the Nikkei-225 index, and its portfolio is hedged against a loss in the yen’s value against the US$, through short selling yen futures and forward-contracts. So if the Japanese yen continues to weaken, holders of DXJ could avoid the currency loss, while reaping the rewards of a stronger Japanese stock market.

On Nov 30th, the fund managers at Wisdom-Tree sought to increase increased DXJ’s exposure to Japanese companies that earn much of their revenue from exports, and can benefit from a weaker yen.Companies that earn more than 80% of their revenues inside Japan will now be excluded from the mix. Bumped from the top are NTT Docomo and Nippon Telegraph & Telephone, two names that generate all of their revenues from within Japan. Alternatively, Takeda and Canon will now be the #2 and #3 holdings, with weighting of 5% and 4.5%, respectively, up from 2.6% and 2.1% previously. In all, DXJ’s top-10 holdings earn 59% of their earnings from overseas, on average%, up from 27% under the previous mix.

Still, the massive US-budget deficit is turning into the biggest source of instability in the world markets today. More debt means more money printing by the Fed, which in turn, could lead to a full blown currency war, joined by many other central banks, all doing battle with each other. Unfortunately, the corruption and incompetence in Washington politics is beyond repair. Traders need to search for global opportunities to preserve their purchasing power.

“The national budget must be balanced. The public debt must be reduced; the arrogance of the authorities must be moderated and controlled. Payments to foreign governments must be reduced, if the nation doesn’t want to go bankrupt. People must again learn to work, instead of living on public assistance,” – warned Cicero, in 55 BC.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2012 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.