Monetary Malpractice: Dysfunctional Financial Markets, Mis-pricing and Malinvestments

Stock-Markets / Financial Markets 2013 Jan 04, 2013 - 03:10 AM GMTBy: Gordon_T_Long

One of the first axioms of analysis is: "Garbage In, Garbage Out"! If your data is flawed, everything you do with it and the decisions stemming from it are flawed and dangerous to your financial health. Experienced analysts will often be found relentlessly checking, rechecking and validating their inputs and assumptions.

One of the first axioms of analysis is: "Garbage In, Garbage Out"! If your data is flawed, everything you do with it and the decisions stemming from it are flawed and dangerous to your financial health. Experienced analysts will often be found relentlessly checking, rechecking and validating their inputs and assumptions.

If only our economists and the sell side analyst community were this diligent. But then it isn't their money. Only a year-end bonus for the 'extras' in their life is at risk.

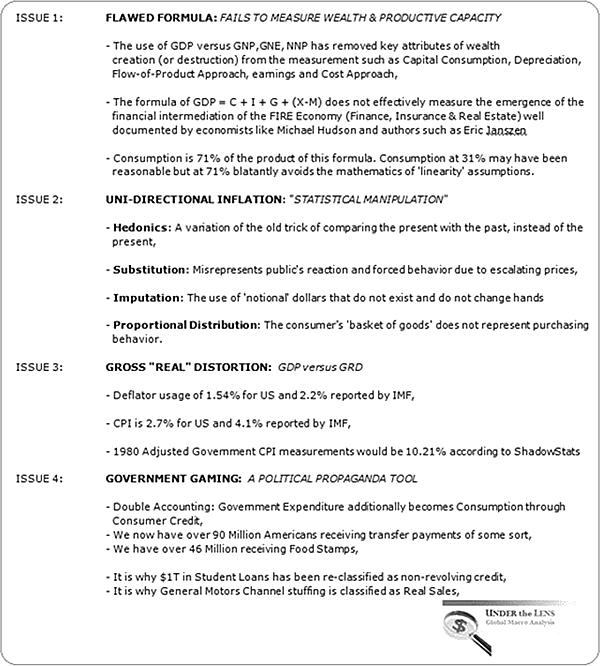

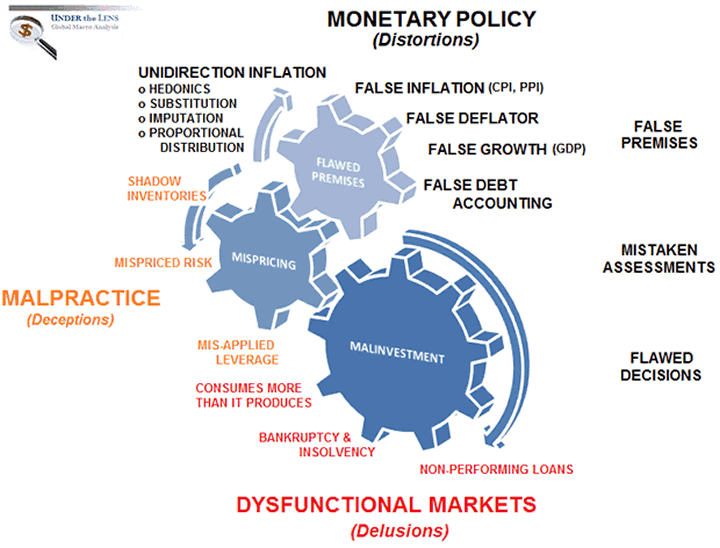

If economic practitioners were held to higher standards of accountability, they simply wouldn't accept the raft of fundamental data points that are the pillars of most economic assessment. I am talking specifically about government inflation numbers such as CPI and PPI, the Deflator and GDP growth statistics and true debt levels using sound GAAP accounting principles and reflecting off balance sheet special purpose entities, contingent liabilities and financial guarantees. The list of government reporting irregularities is pervasive and for unknown reasons, simply accepted.

If economic practitioners were held to higher standards of accountability, they simply wouldn't accept the raft of fundamental data points that are the pillars of most economic assessment. I am talking specifically about government inflation numbers such as CPI and PPI, the Deflator and GDP growth statistics and true debt levels using sound GAAP accounting principles and reflecting off balance sheet special purpose entities, contingent liabilities and financial guarantees. The list of government reporting irregularities is pervasive and for unknown reasons, simply accepted.

It is incredulous that we can just accept, without challenging, the statistical hyperbole of Hedonics, Substitution, Imputation and Proportional Distribution, justifying inflation numbers that don't even pass the common sense of an unemployed high school dropout. I don't mean to disparage the high school dropout, but I do point the figure at the 'six figure' analysts who accept this tripe as gospel, and from whose analysis fiduciary investment decisions are made with the unsuspecting public's hard earned savings.

This problem has been going on long enough that flawed data has resulted in broad based asset mispricing and malinvestment. Data points have become so distorted, as to be delusional, and have left the markets dysfunctional. How else do you explain $2 trillion excess investor savings over loans now sitting at US banks? How else do you explain Capital Investment (CAPEX) falling faster than Felix Baumgartner from 128,100 feet?

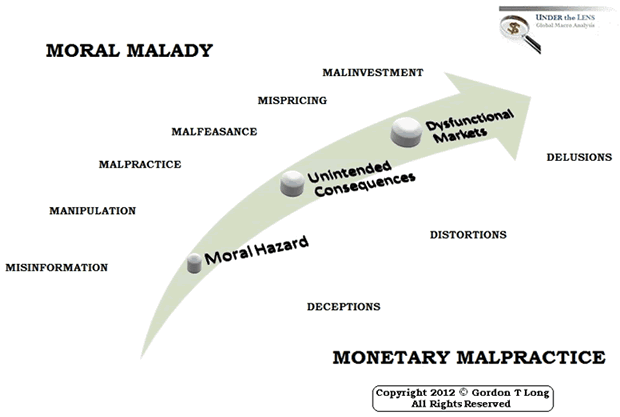

This is the third in a trilogy on Monetary Malpractice, so I will refer a lot of the discussion on the chart to the right, to those wishing to read MONETARY MALPRACTICE: Distortions, Deceptions and Delusions or MONETARY MALPRACTICE: Moral Malady.

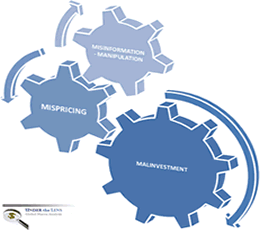

I would like instead to focus on the specific mechanism by which Monetary Malpractice has now delivered Dysfunctional Financial Markets. Before I drop you into the 'gearing' of it, let me show you the bottom line results.

Linkages

| APPROXIMATE SIZE of DELUSION | |||

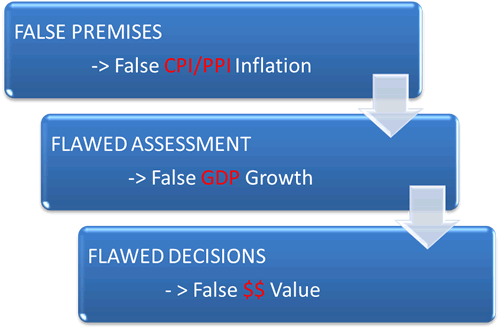

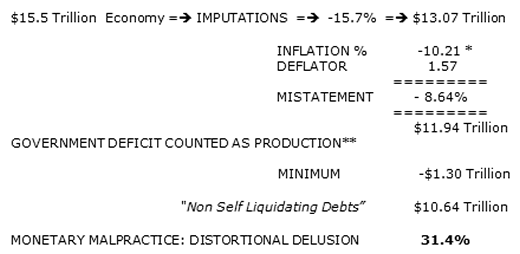

| FLAWED PREMISES | FALSE CPI / PPI INFLATION | UNDERSTATED BY | ~ 9% |

| FLAWED ASSESSMENT | FALSE GDP GROWTH | OVERSTATED BY | ~31% |

| FLAWED DECISIONS | FALSE $$ VALUE | OVERVALUED BY | ~40 - 60% |

When Goods and Services are MIS-VALUED by 40-60% then you have completely Dyfunctional Markets

Dysfunctional Markets exist when normal and expected 'causes and effects' no longer occur.

False Premises

If you distort the inflation data through misinformation and manipulation, then all data stemming from it is obviously flawed. If in turn that data is further distorted, then the delusion becomes greater until it disconnects from reality and the system becomes dysfunctional.

Let us therefore start with Inflation, remembering:

"Inflation is first and foremost a monetary phenomenon." ~ Milton Friedman

The manipulation and distortions presently occurring in the government's CPI & PPI inflation numbers are so significant that it requires an exhaustive discussion. An extensive number of presentations with leading analysts on this specific subject can be found in the Macro Analytics Library. I have compiled the following chart to best summarize the areas that must be covered in such a review.

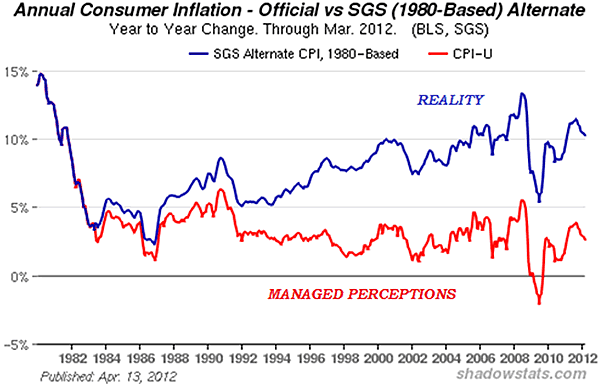

John Williams at ShadowStats.com has done meticulous and invaluabe service in tracking the insidious changes the government statistians have implemented to effectively achieve what I refer to as Uni-Directional Inflation. Nothing they do ever makes it larger, only smaller. This is so prevalent, that as the chart from ShadowStats illustrates below, the distortions now understate inflation by over 10%, if we assumed that in 1980 we knew what we were doing or even if we didn't, how we have inflation explode on a comparative basis. This has profound implications and cascades through to GDP Growth reporting and the Mispricing and Malinvestment decisons that subsequently result.

Imputations

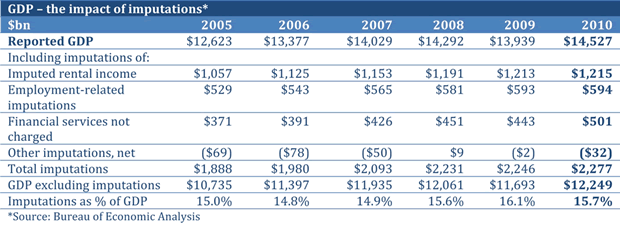

Of all the inflation distorted items in the category of "Uni-Directional Inflation" in my chart above, the one that few undertand, and even fewer publically discuss, is the concept of "Imputations". Imputations are fundamentals about dollars that do not exist and dollars that do not even change hands. They are in some instances a replacement measurement of "notional value".

The following table summarizes the degree to which they are applied and the magnitude of their current distortions. (The details are discussed in: Economic Growth - Fake Numbers, Real Growth, Consequences of Lies.)

False Growth

This level of distortion will quickly become fatal as corproations make investments based on expected economic growth. As we will show, corporations have been forced to stop believing government numbers. Their revenue and sales have shown reality is simply quite different from government distortions.

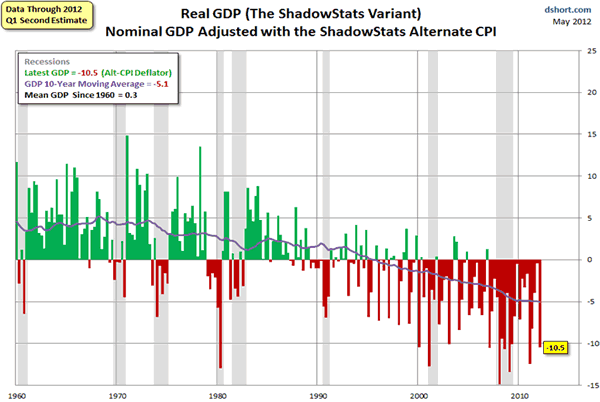

The reason John Williams started tracking government statistical adjustments was because his corporate accounts couldn't rationalize the difference. This was years ago and has now grown into an independent business operating a government "ShadowStats" service. Using simply ShadowStats inflation adjusted numbers, GDP growth is overstated by minimally 10.5%.

How the Distortions Grow

If you have false Inflation and false Growth, you will foster Mispricing and Malinvestment.

Mispricing

When an investment does not YIELD more than REAL inflation, plus a premium to REFLECT the additional risk of the underlying asset class, you have not only a poor invesment but an asset that is mispriced. An asset's value is based on this being achieved.

Monetary Malpractice of unsound money will consistently lead to mispricing.

When a nation's growth and inflation are overstated,

the nation's currency is overstated.

By our measures and many Forex professionals, the US dollar is presently overvalued by 40 - 60%. This has resulted in the following:

MISPRICING IMPACT: DUE TO US DOLLAR & RISK DISTORTIONS

US DOLLAR Example: It is Cheaper to 'offshore' than build where the dominate market exists

RESULT: 44,000 Manufacturers leave America over a 13 year period.

US DOLLAR Example: It is often Cheaper to throw away a Durable Good rather than Repair it.

RESULT: Complete destruction of Service Repair Industry (From Appliance repair to Cobblers)

US DOLLAR Example: Personal Goods (from shoes, clothing to household consumables) Rise slower than Disposable income

RESULTS: A 70% Consumption dependent economy emerges.

RISK Example: Cheap Corporate Financing makes a Leveraged Corporate Retail Chain more competitive than Small Independent Family enterprises.

RESULTS: "MA & PA" Replaced by corporate chains & an over-stored America

RISK Example: Leveraged, Bank Financed Buyouts are More Lucrative than Cash Stable Enterprises Innovatively Investing with Long Term Plans.

RESULTS: Gutted Industrial Base and Volatile Financial Markets.

SUSTAINED AND ACCELERATING MISPRICING

Mispricing will continue to occur and worsen due to:

- Ø Massive amounts of debt are being allowed by regulators to be kept "off balance sheet".

Whether structures such as SPVs, SPEs, SIVs etc., debt and material obligations are given no visisbility to investors in making valuation and pricing assessment.

- Ø Murky Contingent Liabilities agreements and Guarantees are presently unreported as 'off balance sheet' items. Extremely large derivative SWAP agreements are being unreported with potential collateral demands.

- Ø Large "material financial impact information" such as Shadow Housing Inventories and delayed foreclosures are being given forebearance by government regulators. This is stopping the price discovery process from working effectively and keeping prices artificially inflated. This is being done to protect collateral values and defer loan loss write downs.

- Ø Government is pressuring credit rating agencies to maintain elevated credit ratings on sovereign debt. This is distorting the risk free and risk adjusted valuations.

- Ø Sustained cheap money is allowing excess leverage to be used against investments that would be considered malinvestents if money was priced anywhere close to historical norms.

This list is only the tip of the iceberg since sustained Monetary Malpractice with its consequential Moral Hazard and Unintended (or INTENDED) Consequences has resulted in broad based mispricing and dysfunctional markets.

Malinvestment

A malinvestment in its most basic terms is an investment that does not produce more than it costs in real terms. A Malinvestment in Austrian Economics terms is one that is OVERPRICED due to excessive leverage available whether it be credit availability or abundance of paper fiat money created out of thin air.

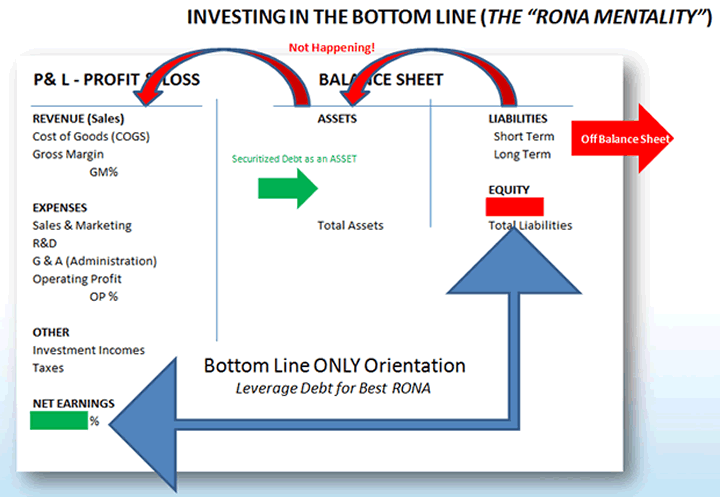

FLAWED & OBSOLETE ACCOUNTING

In the current Dysfunctional Markets, to an ever increasing degree, it can not be determined if an investment is a malinvestment, because the amount of debt, financial contingencies and financial guarantees are hidden from investors by offshore entities. Without visibility to this information no determination can be made. The entire global bond debt market, which approximates $200 Trillion, hinges on this blatant obvuscation.

NON-PERFORMING LOANS

If markets weren't dysfunctional and malinvestment running rampant, then the 'canary' of non-performing loans wouldn't be as prevalent as it is. Whether we are talking consumer debt from mortgages and HELOCS (Home Loans) to student loans, levels of delinquencies, forced refinancing, defaults and personal bankruptcies are at all time highs. If it wasn't for historic and unprecedently low interest rates, which allow commercial and government debt 'roll-overs', we would be witnessing bankruptcies on a massive scale. Malinvestments are presently being 'papered' over by the printing presses of the central bankers.

CAPITAL EXPENDITURES

When money is as cheap as it presently is, then it would be expected that opportunities should be endless to put money to work based on substantially lower hurdle rates. This is not the case because malinvestment is so pervasive, that CFO's cannot see satisfactory risk adjusted investments. Corporate takeovers are down substantially, IPO's are nearly non-existant and corporate capital expenditure is in near free fall as shown to the right. This is astounding when considering that REAL interest rates are negative.

SAVINGS VERSUS LOAN LEVELS

If investments weren't seen to be mostly malinvestments, than why is there $2 Trillion more in bank savings than in bank loans? These are bank deposits paying close to zero. The short answer is there is nothing worth investing in when considered on a real, risk adjusted valuation basis.

LEVERAGE REQUIRED AND DEBT HELD

Many investments today are currently only profitable through the application of excessive, cheap leverage. Based on the 'greater fool' philosophy of investing, leveraged investors hope to 'flip' and be out before cheap leverage shifts against them.

Conclusion

DYSFUNCTIONAL MARKETS

Markets have become so dysfunctional with so much cheap money chasing so few real opportunities, that collateral values within the rehypothecation process are now in jeopardy and exposed to collateral contagion.

Real economic growth cannot return without real top line corporate growth. It simply isn't there as is seen by falling CAPEX and money going into savings.The financialization focus continues to be strictly on bottom line growth and specifically non operating income. This is the area where the financial engineers are employed today. This works for profits in the short term but strangles growth and profits in the long term.

"In America the smartest engineers are primarily engaged in creating financial ways to take money out of the pockets of other" ~ Chinese Government Economic Official

What would things look like if the Fed wasn't engaged in Monetary Malpractice?

- Interest rates would be higher, - People would save more and spend less, - Government would spend within its means, - People would spend within their means, - There would be decreased consumption, - People would invest more, - Stock values would track company value and efficiency more closely, - Government would shrink, - America would produce and manufacture more, - Trade deficits would shrink,

The economy would recover and become healthy.

Sign Up for our FREE 2013 Thesis Paper. To read more, go to GordonTLong.com

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.