UK House Prices Tumble Tracking GDP Growth Rate Lower

Housing-Market / UK Housing Mar 02, 2008 - 11:11 AM GMTBy: Nationwide

House prices fell by 0.5% in February, the fourth consecutive monthly decline

House prices fell by 0.5% in February, the fourth consecutive monthly decline- The annual rate of house price inflation fell from 4.2% to 2.7%

- UK recession “a remote risk for the UK economy”

| Headlines | February 2008 | January 2008 |

|---|---|---|

| Monthly index * Q1 '93 = 100 | 363.3 |

365.0 |

| Monthly change* | -0.5% |

-0.3% |

| Annual change | 2.7% |

4.2% |

| Average price | £179,358 |

£180,473 |

* seasonally adjusted

Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said: “The price of a typical house fell by 0.5% during February, bringing the annual rate of house price growth down to 2.7%. This is the fourth consecutive monthly fall in house prices and brings the annual rate of house price inflation to its lowest since November 2005. The trend in prices is clearly weakening, but the size of the drop in the annual rate between January and February perhaps overstates the rate of cooling as it partly reflects the particularly strong increase in prices in February last year. The 3-month on 3-month rate of price growth rate fell to -1% in February, down from -0.4% the previous month. The average price of a typical property now stands at £179,358, an increase of £4,653, or £12.75 per day, over the last 12 months.“

Bank rate cut by 0.25%...

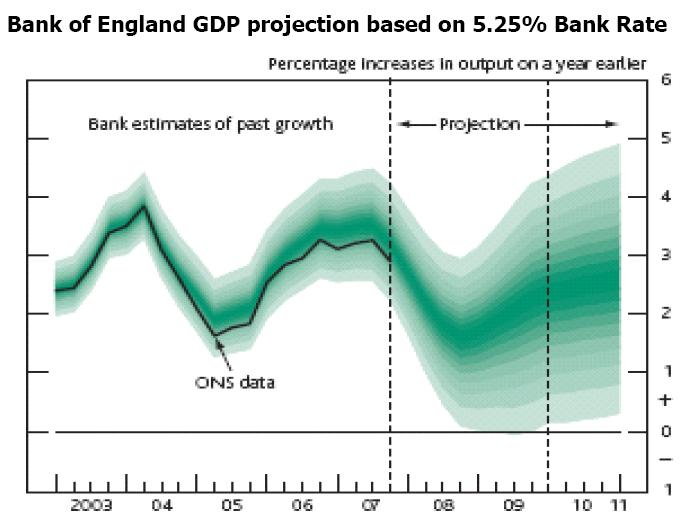

“As expected the Monetary Policy Committee (MPC) voted to cut interest rates by 0.25% in February and this was quickly followed by the Inflation Report setting out the Bank of England’s latest view on the economy. The tone of the report was fairly hawkish. Energy and food price inflation are threatening the MPC’s 2% CPI inflation target and seem likely to lead to another formal letter to the Chancellor later this year. The tone of the Governor’s remarks seemed to rule out the likelihood of aggressive rate cuts, at least for now, especially as the MPC is concerned about consumers’ inflation expectations. This is a particularly difficult time for the Committee as very little is known about how inflation expectations are formed. Consumers may trust the MPC’s ability to keep inflation in check and so moderate wage demands, but on the other hand, their future inflation expectations could be more sensitive to their own recent experience, which makes the outlook more fragile. The MPC will be watching developments in this area very closely.

…but recession “a remote risk for the UK economy”

MPC members have been vocal since the publication of the Inflation Report, and the common message is that the outlook for the economy is much weaker than it was a year ago. Even without the recent shocks to the financial markets, after a decade of growth averaging almost 3%, it should not be surprising that we are entering a slower phase. It is encouraging that the outlook is one of just that, slower economic growth rather than recession. Economic growth is expected to fall below trend this year, but the Bank of England’s analysis suggests a recession is very unlikely, even with more hawkish interest rate assumptions than those held by the market. Indeed, MPC member Andrew Sentance put his view more forcefully in a speech last week by saying that “an outright recession…is a remote risk for the UK economy”.

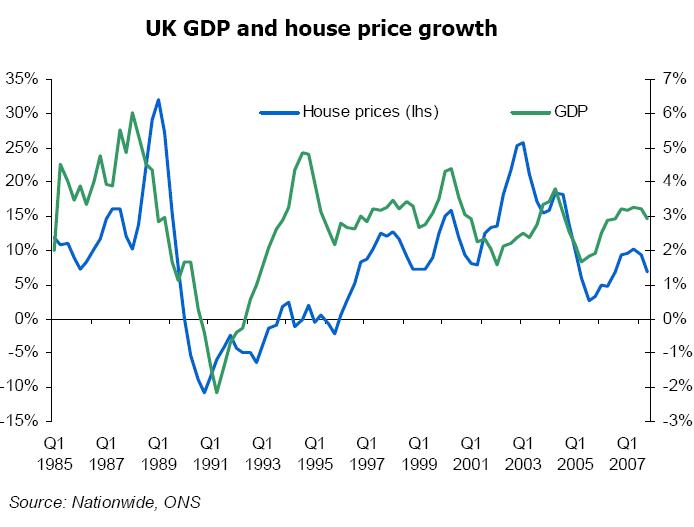

“The performance of the economy is highly relevant for the fortunes of the housing market. A brief glance at the relationship over the last twenty or so years makes this abundantly clear. So while there are several factors which are slowing housing market demand, from poor affordability to weakening house price growth expectations to tighter credit conditions, the fact that an economic recession in the UK seems unlikely provides some support for the overall health of the housing market.

Housing demand conditions are weaker, but supply matters too

“The softening in UK house prices in February is not unexpected given the weakening trend in other housing market demand indicators. House purchase approvals have been falling back sharply since the autumn and the upturn in interest from new home buyers at estate agents seen in the final two months of 2007 fell back again in January. This reluctance on the part of buyers is not surprising given current uncertainties in the market and it is unlikely that we will see levels of activity returning to trend levels for some time. However, the behaviour of sellers is also important to the overall movement in house prices.

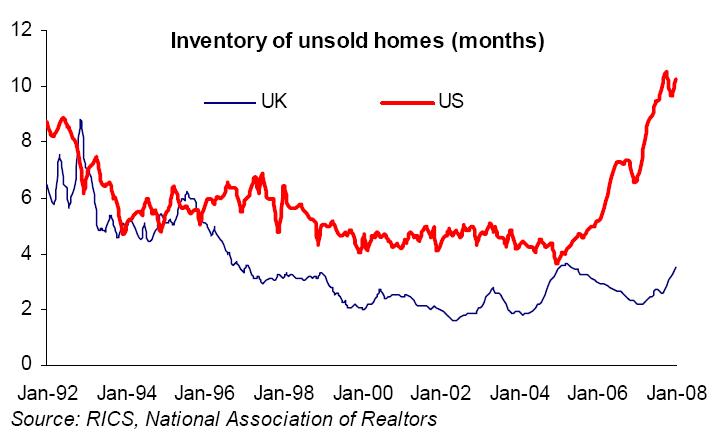

Indeed, comparison with the US market, where house prices are falling rapidly, is instructive. Taking the average stock per surveyor figure and dividing by the average sales per surveyor should give a rough measure of the number of months required to clear the existing stock of property at the existing rate of sales. A similar measure in the US leapt in the last two years and is consistent with the 10% annual house price fall in the US in 2007. In the UK, it has been edging up but is not at levels that have been consistent with systematic falls in prices in the past. Even if demand remains at current low levels, if fewer new sellers decide to market their properties in the UK, as was the case in January, the upturn in the UK measure should also slow.

Overall, it seems clear that we will not see recent rates of growth, in either the UK economy or housing market, repeated for some time. There is currently an unprecedented amount of uncertainty about future economic conditions, but if the Bank of England’s central projection that the economy continues to grow is correct, conditions for the UK housing market are perhaps less gloomy than some would have us believe.

| Fionnuala Earley Chief Economist Tel: 01793 656370 Mobile: 07985 928029 fionnuala.earley@nationwide.co.uk |

Kate Cremin Press Officer Tel: 01793 656517 kate.cremin@nationwide.co.uk |

Notes: Indices and average prices are produced using Nationwide's updated mix adjusted House Price Methodology which was introduced with effect from the first quarter of 1995. Price indices are seasonally adjusted using the US Bureau of the Census X12 method. Currently the calculations are based on a monthly data series starting from January 1991. Figures are recalculated each month which may result in revisions to historical data. The Nationwide Monthly House Price Index is prepared from information which we believe is collated with care, but no representation is made as to its accuracy or completeness. We reserve the right to vary our methodology and to edit or discontinue the whole or any part of the Index at any time, for regulatory or other reasons. Persons seeking to place reliance on the Index for their own or third party commercial purposes do so entirely at their own risk. All changes are nominal and do not allow for inflation. More information on the house price index methodology along with time series data and archives of housing research can be found at www.nationwide.co.uk/hpi

Nationwide Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.