Hedge Funds Move From Gold GLD To Other ETFs

Commodities / Gold and Silver 2013 Feb 15, 2013 - 01:56 PM GMTBy: GoldCore

Today’s AM fix was USD 1,629.25, EUR 1,221.42 and GBP 1,052.01 per ounce.

Today’s AM fix was USD 1,629.25, EUR 1,221.42 and GBP 1,052.01 per ounce.

Yesterday’s AM fix was USD 1,644.00, EUR 1,233.22 and GBP 1,060.37 per ounce.

Silver is trading at $30.26/oz, €22.80/oz and £19.61/oz. Platinum is trading at $1,692.50/oz, palladium at $759.00/oz and rhodium at $1,225/oz.

Gold in USD (1 Year)

Gold dropped $7.40 or 0.45% yesterday and closed at $1,635.60/oz. Silver finished with a loss of 1.04% at $30.45/oz. Gold’s decline was again a function of dollar strength as gold eked out gains in some currencies. The euro fell sharply yesterday as investors digested weaker Eurozone growth data which created a shadow of gloom ahead of the G20 meetings taking place in Moscow.

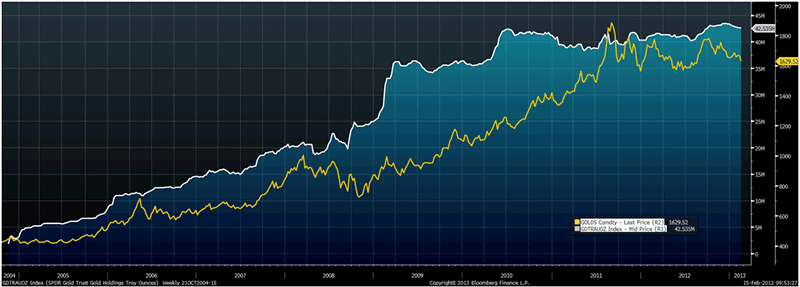

Gold in USD and SPDR Gold Holdings (2003 to Today)

Gold dropped to a 6 week low today and has broken below support at $1,650/oz and now looks vulnerable of a fall to support at the $1,600/oz level. Gold will be supported next week by physical buying when Asia has returned from the week long New Year’s holiday.

Palladium and platinum have outperformed gold so far this year on mining disruptions, supply constraints, reduced supply from Russia, jewellery demand, increasing auto sales and currency debasement.

The largest silver ETF climbed 0.26% from Wednesday to Thursday while SPDR gold fell 0.23% for the same period.

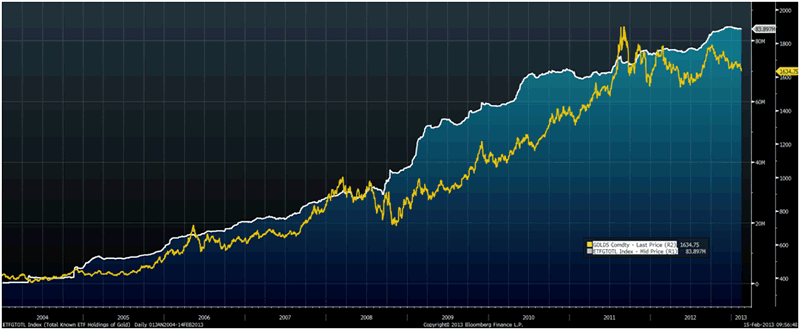

Gold in USD and Total Gold ETF Holdings ( 2003 to Today)

Prominent hedge fund manager John Paulson continued to hold significant gold investments in the fourth quarter of 2012, even as other investors reduced their SPDR gold ETF (GLD) positions.

Paulson & Co owned 21.8 million shares in the world's largest gold-backed exchange-traded fund, SPDR Gold Trust , at the end of December, unchanged from September 30, a filing with the U.S. Securities & Exchange Commission showed yesterday.

Paulson is by far the biggest shareholder of the SPDR gold ETF. He has often advocated gold to offset risks related to currency exposure, U.S. dollar depreciation and inflation.

Notable institutional investors, including George Soros and Julian Robertson reduced their allocations to the U.S. SPDR gold ETF during the quarter.

Soros’ gold ETF sale is again garnering much media coverage. It is worth noting that his position was quite small especially when compared to levels of demand coming from consumers in Asia and central banks internationally.

An assumption is again being made, in some quarters, that the reduced allocations to the Gold ETF by Soros and others are negative for the gold price.

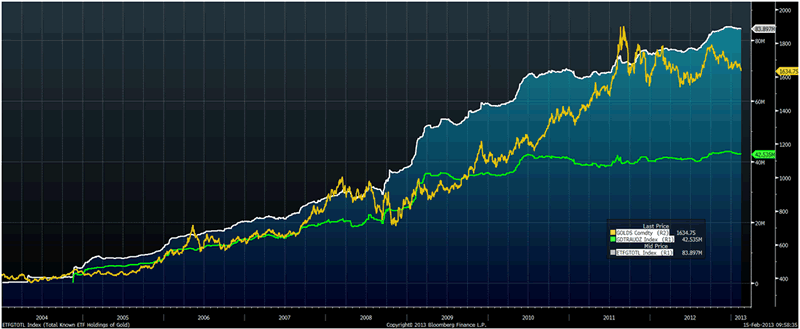

This is not necessarily the case as it is quite possible that many Ultra High Net Worth (UHNW) and hedge fund gold buyers are reducing allocations or selling completely their holdings in the SPDR gold ETF in order to own gold in other ETFs which are perceived to be less risky - ETFs that have less counter party risk.

Since 2009, investors internationally have been showing a preference for international gold ETFs over the SPDR gold ETF whose holdings have flat lined in recent years (see chart below).

There is also the fact that some have already opted to own gold bullion in allocated storage outside of the banking and financial system.

Gold in USD, SPDR Gold Holdings <green> and Total Gold ETF Holdings <white> (2003 to Today)

It is worth noting that some hedge funds and institutions are on record as having sold their GLD holdings in order to own gold bars in allocated accounts.

This was done in order to avoid the transparency and scrutiny that comes from owning the GLD in the quarterly SEC filings reported yesterday.

Other highly respected hedge fund managers such as Kyle Bass and David Einhorn have bought gold bars in allocated accounts due to concerns about the significant counter party risk in the world today.

We have long pointed out that looking solely at SEC SPDR or GLD data as a guide to sentiment towards gold is deceptive.

It is increasingly likely that gold ownership is being transferred to other less-visible channels as investors, large and small, increasingly opt for the safety of allocated bullion over paper gold.

This is due to the fact that in many gold ETFs, one is an unsecured creditor and has exposure to an array of different banks who act as custodians and sub custodians.

In the event of financial, systemic and or monetary contagion, prudent gold owners do not wish to be left facing lengthy and costly legal battles to secure their gold. There is also the concern that in the event of a monetary or systemic crisis, embattled governments might opt to expropriate large gold holdings

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.