Is Inflation the Legacy of the Federal Reserve?

Economics / Inflation Feb 28, 2013 - 12:51 PM GMTBy: Mike_Shedlock

In testimony to Congress on February 27, Bernanke bragged that inflation under his and Greenspan's watch was a mere 2% a year.

In testimony to Congress on February 27, Bernanke bragged that inflation under his and Greenspan's watch was a mere 2% a year.

Of course Bernanke ignored a housing boom and bust. He also ignored a a dotcom boon and bust, a global financial crisis, numerous bank bailouts, and a policy of "too big to fail" that is now "even bigger".

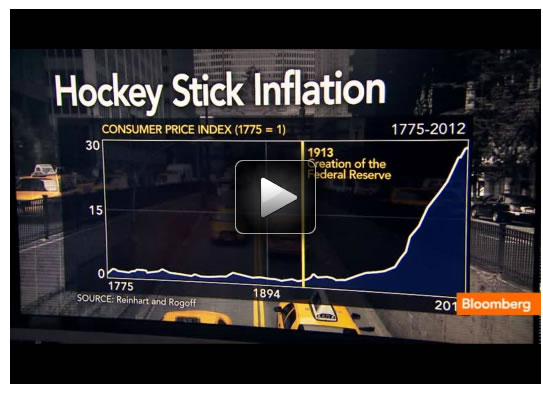

Fed Inflation

A Bloomberg video exposes Bernanke as nothing but a charlatan. Please consider Hockey Stick Inflation.

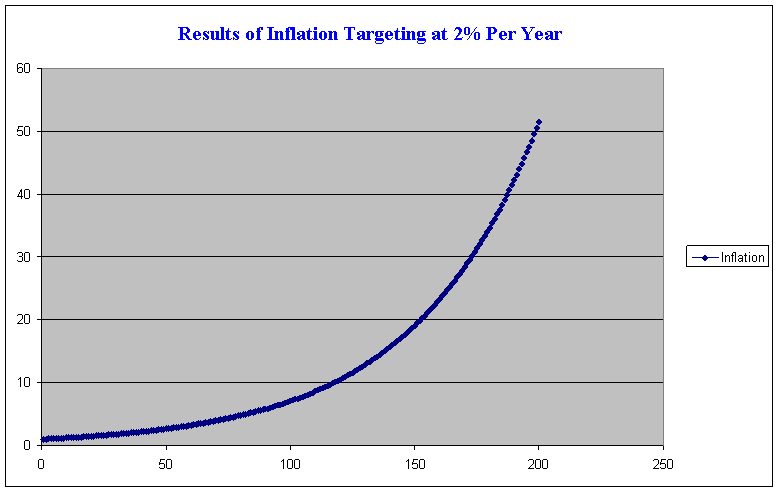

Inflation Targeting at 2% Per Year

Bernanke brags about a 2% inflation rate as if it is something to brag about. It's not. This is what it looks like over time.

Inflation Targeting at 2% a Year

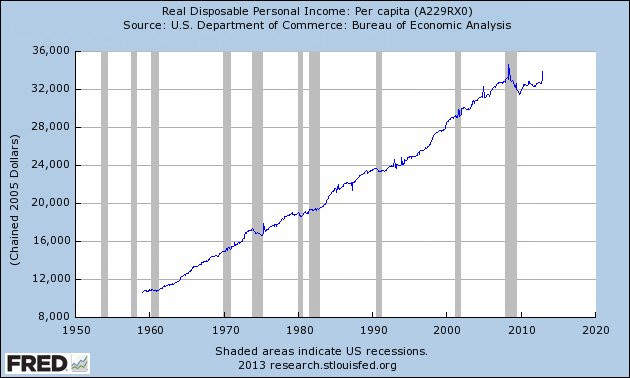

Real Disposable Personal Income Per Capita

See the Problem?

Hopefully so, because it's obvious. The moment (for any reason) wages stop rising at the rate of inflation, the system is in stress. Why might wages stop rising? Global wage arbitrage is certainly one reason.

Even if that did not happen, income skew comes into play. Wages of the top 10% rise far faster than the wages of everyone else. As proof, I present Top 1% Received 121% of Income Gains During the Recovery, Bottom 99% Lose .4%; How, Why, Solutions

Also consider "Too Big To Fail" and other inept government policies as noted in Obama's Infrastructure Mania; Why It's Not Justifiable (And What To Do About It)

The Source of Inflation

If you are looking for "THE" source of inflation, look no further than the Fed, fractional reserve lending, and government policies that benefit those with first access to money (namely the banks and the already wealthy).

Bernanke has the gall to brag about his 2% inflation fighting "achievement", ignoring numerous boom-bust cycles, bank bailouts, and income skew.

The ultimate irony is the Fed and its inflationary policies is the primary reason inflation exists at all

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.