Spoiling the Great U.S. Employment News

Politics / Employment Mar 09, 2013 - 01:26 PM GMTBy: Mike_Shedlock

This article originally appeared on MarketWatch under the title Jobs numbers are far worse than they look.

This article originally appeared on MarketWatch under the title Jobs numbers are far worse than they look.

I selected my title from a humorous comment on MarketWatch by reader "Homer Price" who writes "Mike, What are you doing ? Trying to spoil the GREAT EMPLOYMENT news. Just wait until next year when the Unaffordable Care Act kicks in. THE BEST IS YET TO COME ............................. "

There are other interesting comments as well. Inquiring minds may wish to take a look. Now for my article ...

Economists were surprised by the massive "beat" in today's reported job numbers. The unemployment rate dropped .2 to 7.7% and the economy allegedly added 236,000 jobs.

Is that what really happened? No not really.

According to the household survey (on which the unemployment rate is based) the economy added a healthy 170,000 jobs. However, a whopping 446,000 of those jobs were part-time jobs. Simply put, the economy shed 276,000 full-time jobs.

The BLS labeled those 446,000 part-time jobs as "voluntary". I am not so sure.

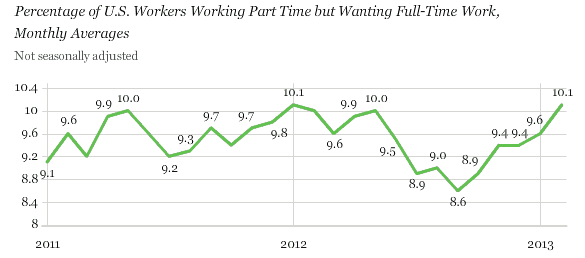

A Gallup Survey yesterday on Jobs show the percentage of workers working part time but wanting full-time work was 10.1% in February, an increase from 9.6% in January, and the highest rate measured since January 2012.

Gallup notes "Although fewer people are unemployed now than a year ago, they are not migrating to full-time jobs for an employer. In fact, fewer Americans are working full-time for an employer than were doing so a year ago, and more Americans are working part time. Although part-time work is clearly better than no work at all, these are not the types of good jobs that millions of Americans are still searching for."

Obamacare Effect

Obamacare is in play. Recall that under Obamacare, the definition of full-time employment is 30 hours. The BLS cutoff is 34 hours. At 30 hours, companies have to pay medical benefits so they have been slashing the number of hours people work. This reduced the number of hours people worked and provided an incentive for many to take on an extra job.

We can see the effect in actual BLS data.

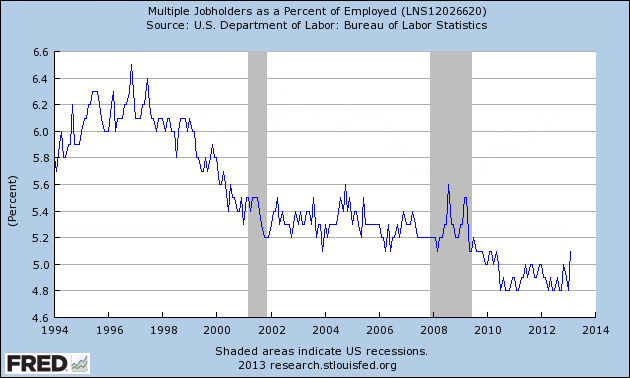

Multiple Jobholders as a Percent of Employed

After declining for years, the percent of those working two or more jobs is again on the rise.

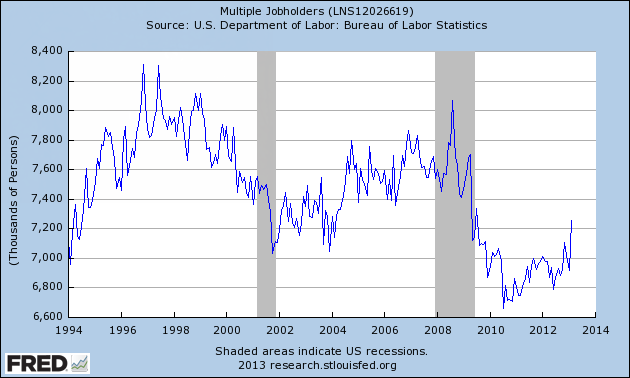

Multiple Jobholders

In the past month there was a surge of 679,000 in the number of people working multiple jobs. The seasonally-adjusted increase, as shown above, was 340,000.

One can look at the data two ways.

- The economy is getting better and more jobs are available

- People are working more jobs because their hours were cut and they need a second job

Evidence suggests more of the latter than the former.

Expect Downward Revision in Establishment Survey

The reported 236,000 surge in the establishment survey is not real. It will be revised away.

This is why: In the household survey one is either working or not, thus multiple jobs do not distort the reported unemployment rate (although there are many other distortions such as the participation rate and declining labor force).

The establishment survey, however, is distorted by people working multiple jobs. A surge in multiple-job workers would artificially hike the baseline number. I expect revisions later, probably huge downward revisions.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.