Are All G20 Bank Depositors Exposed to a Cyprus Style Seizure of Deposits for a 'Bail-in?'

Politics / Credit Crisis 2013 Apr 04, 2013 - 02:49 AM GMTBy: Jesse

Dave from Golden Truth has let me know of an interesting quote from an article by Eric Sprott titled Caveat Depositor which *could* explain why countries like New Zealand and Canada are quietly tilting towards seizing bank deposits to recapitalize failed banks.

Dave from Golden Truth has let me know of an interesting quote from an article by Eric Sprott titled Caveat Depositor which *could* explain why countries like New Zealand and Canada are quietly tilting towards seizing bank deposits to recapitalize failed banks.

"If there is a risk in a bank, our first question should be: ‘Ok, what are you the bank going to do about that? What can you do to recapitalise yourself?’ If the bank can’t do it, then we’ll talk to the shareholders and the bondholders. We’ll ask them to contribute in recapitalising the bank. And if necessary the uninsured deposit holders: ‘What can you do in order to save your own banks?’”Apparently this template has already been agreed to by the G20 according to Dave.

Jeroen Dijsselbloem, March 26, 2013

"Because the use of taxpayer-funded bailouts would likely no longer be tolerated by the public, a new bank rescue plan was needed. As it turns out, this new "bail-in" model is based on an agreement that was the result of a bank bail-out model that was drafted by a sub-committee of the BIS (Bank for International Settlement) and endorsed at a G20 summit in 2011.

For those of you who don't know, the BIS is the global "Central Bank" of Central Banks. As such it is the world's most powerful financial institution. I sourced a copy of this Agreement here: LINK...

...the agreement references specifically avoiding more taxpayer bailouts. It also refers to bank deposits in excess of Government insured amounts as "uninsured creditors." This is essentially the standard legal bankruptcy model which uses creditor hierarchy (secured lenders, unsecured lenders, preferred equity, equity) and applies to the rescuing of banks.

This is very important to know about and understand because what is commonly referred to as a "bail-in" in Cyprus is actually a global bank rescue model that was derived and ratified nearly two years ago. It also means that bank deposits in excess of Government insured amounts in any bank in any country will be treated like unsecured debt if the bank goes belly-up and is restructured in some form.

Because this is a legal Central Banking agreement that will be applied globally, it also means that U.S. bank depositors will not be immune to this rescue mechanism. It means that no one should keep any amount in any bank that exceeds the FDIC guarantee. In fact, I would recommend only keeping enough money in the bank to fund your monthly or quarterly bill paying requirements. Any amount in excess of FDIC deposit insurance will be exposed to the risk bankruptcy."You may read the entire article at Dave's blog Golden Truth.

I would assume that if Dave's reading of this document is correct, unless there is a specific and unequivocal denial by your local government Administration, then this is the operative plan for another series of bank failures in the G20 countries, including the US, Germany, France, Italy, and the UK. This would explain how these stealthy depositor seizure plans have been bubbling up from diverse countries.

I would not be satisfied if there was merely a dismissal of the possibility, that Cyprus was somehow a 'special case' because of the way in which their banks were capitalized, and so heavy with deposits. In the event of a global derivatives meltdown, no capital structure will stand, and no bank can maintain a so-called 'fortress balance sheet.'

I do not wish to seem to be an alarmist, but this additional information and some of the other events which are occurring has created a rather significant shift in my thinking. Cash is not cash and deposits are no longer deposits as we once thought of them in this non-transparent, post-Glass Steagall financial world of ours.

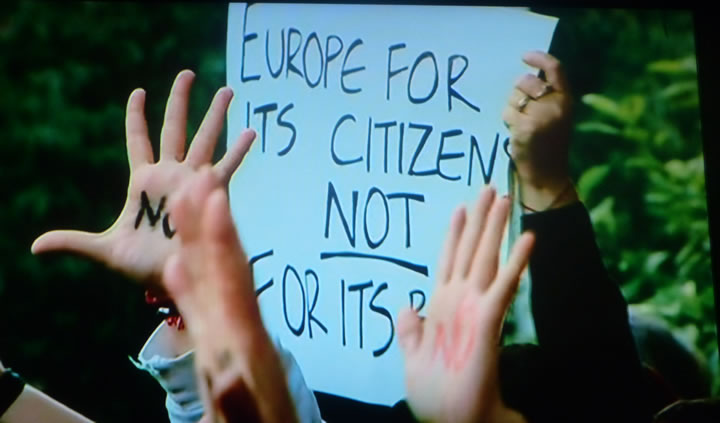

Nothing is more irritating than when the public's concerns are treated disparagingly by the enablers of the financial system, who are defending a private system cloaked in secrecy, mutually beneficial financial relationships, and insider dealings. I see this all the time, and most people feel embarrassed and walk away. Well, they are wrong to do so. They do not need to accept that sort of treatment by statists and crony capitalists of both the left and the right.

Congratulations. You may now be an unsecured creditor of your local TBTF bank if your and yours have any money on deposit there, either directly or indirectly. You say you have money in a pension fund and an IRA at XYZ bank? Oops, it is really on deposit in you-know-who's bank. You say you have money in a brokerage account? Oops, it is really being held overnight in their TBTF bank. Remember MF Global?

Who can say how far the entanglements go? The current financial system and market structure is crazy with hidden risk and subtle dangers. No wonder people are so edgy.

To my readers who say they have spoken to their elected representatives about this and received assurances, I would not assume that they are aware of this international agreement which the US has presumably signed. I was not.

And if you think they will stand up against any plans to take your deposits during a banking emergency, against a vociferous and overwhelming flood of objections from their constituents, remember how quickly the Congress caved on TARP and Cyprus' Parliament gave way to the EU and ECB.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.