Dollarize Argentina Now

Currencies / Fiat Currency May 10, 2013 - 02:48 PM GMTBy: Steve_H_Hanke

Argentina is once again wrestling with its long-time enemy, inflation. Now, it appears history may soon repeat itself, as Argentina teeters on the verge of another currency crisis.

Argentina is once again wrestling with its long-time enemy, inflation. Now, it appears history may soon repeat itself, as Argentina teeters on the verge of another currency crisis.

As of Tuesday morning, the black-market exchange rate for Argentine pesos (ARS) to the U.S. dollas (USD) hit 9.87, meaning the peso’s value now sits 47.3% below the official exchange rate. This yields an implied annual inflation rate of 98.3%.

For now, the effects of this elevated inflation rate are being subdued somewhat by Argentina’s massive price control regime. But these price controls are not sustainable in the long term. Indeed, the short-term “lying prices” they create only distort the economic reality, ultimately leading to scarcity.

There is, however, a simple solution to Argentina’s monetary problems: dollarization. I have advocated dollarization in Argentina for over two decades, well before the blow up of their so-called “currency board.” To put the record straight, Argentina did not have a true currency board from 1991 to 2002. Rather, as I anticipated in 1991, the “convertibility system” acted more like a central bank than a currency board. This pegged exchange rate system was bound to fail—and fail, it did.

The 2001-02 Argentine Crisis could have easily been avoided if the country had simply dollarized. Argentina had more than sufficient foreign assets to dollarize their economy even late into 2001. But the Argentine government, through a series of policy blunders, ended up “floating” the currency.

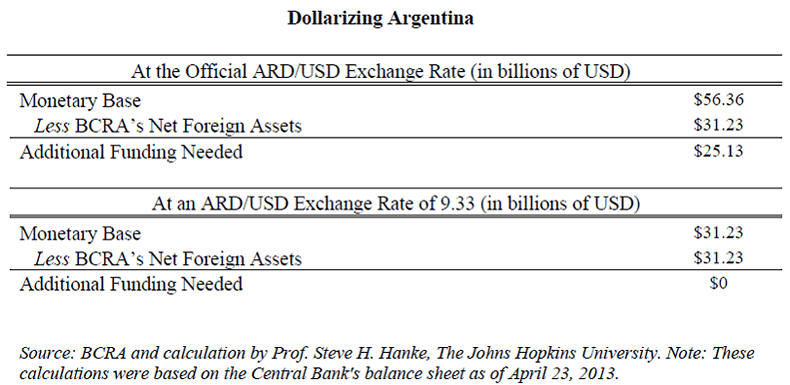

Not surprisingly, Argentina is now back to where it was in the late 1980s. So, how can Argentina dollarize? In short, the Banco Central de la Republica Argentina (BRCA) would take all of the assets and liabilities on its balance sheet denominated in foreign currency and convert them to U.S. dollars. The Central Bank would then exchange these dollars for all the pesos in circulation (monetary base), at a fixed exchange rate. By my calculation, the BRCA would need at least $56.36 billion to dollarize at the official exchange rate (as of April 23, 2013).

As of April 23, the BRCA had net foreign assets equivalent to $31.23 billion. If Argentina were to dollarize at the official ARS/USD exchange rate of 5.17, it would fall $25.13 billion short of the $56.36 billion needed to cover the monetary base. That said, if the BRCA were to use an exchange rate closer to the black-market (read:free-market) exchange rate, this could be more easily accomplished. For example, if Argentina decided to dollarize at an ARS/USD exchange rate of 9.33 pesos to the dollar (5.5% lower than the black-market ARS/USD exchange rate as of Tuesday), only $31.23 billion would be required to cover its monetary base and dollarize the economy. This is the exact amount of net foreign assets held by the BCRA (see the accompanying table).

The end result would be an Argentine economy free of the inflation that has plagued it for decades. Indeed, Argentina could finally experience those benefits enjoyed by other dollarized countries, like Ecuador.

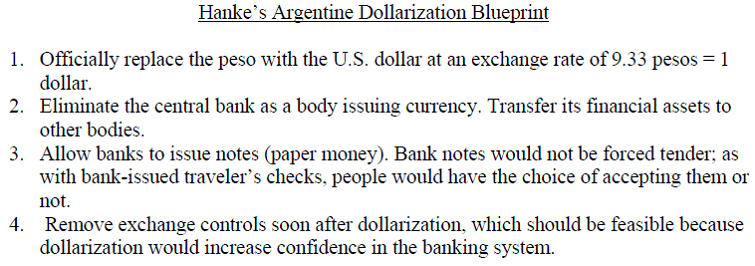

Below, I present (with only one minor change) my blueprint for Argentina’s dollarization, which I first presented over a decade ago.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2013 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.