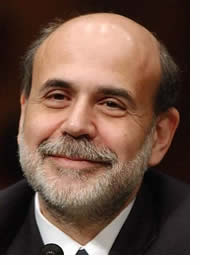

How Ben Bernanke Is Destroying Your Retiremen

Politics / Pensions & Retirement May 23, 2013 - 12:41 PM GMTBy: Money_Morning

Martin Hutchinson writes:

Uncle Sam has an unfunded pension liability of $800 billion.

Martin Hutchinson writes:

Uncle Sam has an unfunded pension liability of $800 billion.

Corporate pension funds have an unfunded liability around $400 billion.

State and local pension funds have an unfunded liability in the tony neighborhood of $3 trillion.

That's over $4 TRILLION in UNFUNDED pension funds.

That's over $4 TRILLION in UNFUNDED pension funds.

And if you're not lucky enough to be in a "defined benefit" pension plan (which fewer and fewer people are these days) there's undoubtedly an "unfunded liability" in your own savings - in other words, you haven't saved enough to retire.

It's a huge problem and it's getting worse. And there's one individual to blame for all that $4.2-plus trillion of money we need to find - Ben Bernanke.

The Killer of Nest Eggs

Bernankeism exerts a double whammy on pension funds, because of the accounting.

To determine the cost of all the pensions that must be paid, the actuary makes assumptions about people's lifespans (another problem - they're lengthening), gets a future stream of cash flows, then discounts the cash flows back to the present at an assumed rate, based on what he thinks the fund can earn on its money.

If the discounted amount is less than the current value of the fund, the fund has a surplus; if it's more, the fund has a deficit.

Still awake?

Here's the kicker: When interest rates are held at very low levels year after year, they make it more difficult for pension funds to achieve their desired returns, and they move the goalposts farther and farther away from the ball.

Unlike the Peanuts strip where Lucy removes the football just as Charlie Brown is about to kick it, in this case the Bernanke Fed playing Lucy lets Charlie Brown (us) kick it but moves the goalposts into the far distance, so that Charlie has no chance of reaching them however hard he kicks.

Look Back to Look Ahead

In the 1990s, even though interest rates were too low from 1995 on, all was well with pension funds. The U.S. stock market zoomed upwards, so many funds' value soared far above their actuarial liabilities.

Many companies stopped contributing to their funds, and General Electric (NYSE: GE) even found a way to make profits on its pension funds goose the company's reported profits - thus siphoning more bonuses and stock option gains into management's pockets.

After 2000, the profits went into reverse. Pension funds then responded foolishly; they transferred a huge percentage of their money into "alternative investments" such as farmland, forests, private equity funds and hedge funds.

Essentially, they bought a lot of assets at inflated prices - like, well, anything to do with real estate in 2004-07 - and paid inflated fees for mediocre performance.

However, apart from the losses from the market crashes of 2000 and 2008, the real problems for pension funds came from the steady decline in interest rates engineered by Alan Greenspan and Ben Bernanke.

For example, even though stock prices are at record levels, and the asset sides of the pension funds ought to be doing fine, Bernanke's low interest rates have swelled the liabilities sides to enormous heights, so pension funds' funding deficit is at levels more typical of the bottom of bear markets than several years into a recovery.

What's more, the problem won't go away when interest rates rise again. That will make stock and bond prices decline, reducing the asset side of the funds' balance sheets. It will also push leveraged hedge funds and private equity funds into bankruptcy, wreaking further havoc.

No One Is Exempt

The problem of pension funds also extends to baby boomers' own retirement savings. You see, what may look good on your statements isn't usually put through the same actuarial calculations that pension funds build.

That means what looks like a fairly decent pile of money when looked at in cash, translates into an absolutely pathetic annual sum if you try to turn it into an annuity (because annuity calculations are based on the same arithmetic as pension fund accounting).

The fact is, most retiring baby boomers keep their IRAs and 401(k)s in cash, withdrawing the amounts of money they need to live on.

What needs to shouted from the rooftops is, more likely than not, the withdrawals they make are too large, and will exhaust the available funds long before the unfortunate owners expire.

Baby boom retirements are destined to be thoroughly miserable, mostly thanks to Bernanke; those with funded pension plans will find their plans in bankruptcy, while those without pensions - the IRA and 401(k) majority - will simply find the bankruptcy transferred to their own finances.

The solutions are simple, but not easy: save every penny you can, pray QE ends quickly and just in case, work till you drop.

In all seriousness, to the extent you invest, buy into emerging markets with good growth rates and no Ben Bernanke. They may have risks, but at least they avoid the Bernanke risk you have to live with in the rest of your life.

Source :http://moneymorning.com/2013/05/23/how-ben-bernanke-is-destroying-your-retirement/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.