Gold 2014 - U.S. Dollar 30 Year Slide May Be Gold's New Life

Commodities / Gold and Silver 2014 Nov 22, 2013 - 01:57 PM GMTBy: GoldCore

Today’s AM fix was USD 1,241.75, EUR 918.59 and GBP 766.75 per ounce.

Today’s AM fix was USD 1,241.75, EUR 918.59 and GBP 766.75 per ounce.

Yesterday’s AM fix was USD 1,248.50, EUR 929.64 and GBP 775.76 per ounce.

Gold fell $1.50 or 0.12% yesterday, closing at $1,243.20/oz. Silver climbed $0.14 or 0.71% closing at $19.99/oz. Platinum rose $4.60 or 033% to $1,389.50/oz, while palladium climbed $3.78 or 0.53% to $714.75/oz.

Many traders and investors are still scratching their heads at the peculiar gold trading Wednesday which pushed gold below the important technical level of $1,250/oz. Support at $1,250/oz has been breached and gold is vulnerable of a fall to test support at $1,200/oz and the June 28th low of $1,180/oz (see charts below).

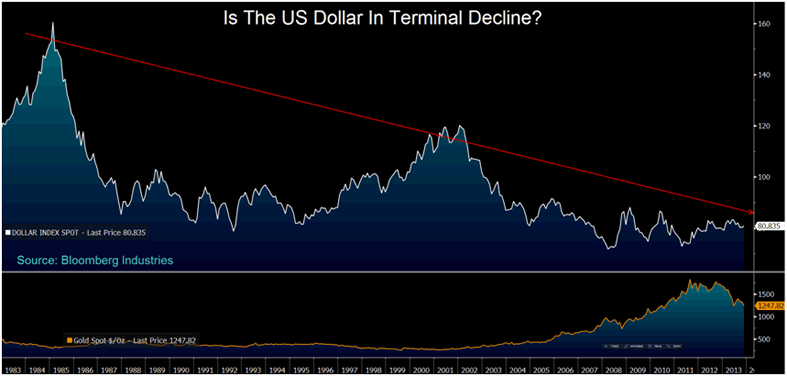

US Dollar Index - 1983 to Today (Bloomberg Industries)

And yet gold still seems to be stuck in a downtrend. This week's sell off may have been due to trading shenanigans on the COMEX and many, including the UK Financial Regulator are asking questions as to whether gold price rigging is taking place.

Gold’s falls come despite there being many compelling reasons for gold to rally. These include uber dove Yellen at the Fed's helm, the near certainty that the Eurozone debt crisis will erupt early in the New Year, signs ETF outflows are stabilizing and China picking up the slack with regard to physical demand, after India’s demand fell from near record levels.

Gold in U.S. Dollars, 5 Days - (Bloomberg)

THE U.S. DOLLAR has been on a 30 year slide versus other competing paper currencies, in particular the Chinese yuan. If the dollar's decline, as measured by the DXY Index continues, gold may be the main beneficiary.

The dollar may be printed in unlimited quantities, though the global stock of gold increases by just 2% to 2.5% annually. Irrespective, of the huge increase in money supplies globally today. Indeed, should gold prices fall more, gold production is likely to begin falling.

This is seemingly lost on Janet Yellen and central banks, who continue to print money at record rates.

The smart money who understand gold’s importance as a diversification continue to accumulate gold.

The very poor state of the U.S. economy bodes badly for the U.S. dollar in 2014 which should help gold resume its multi year bull market.

Gold in U.S. Dollars, 1 Year - (Bloomberg)

DATA FROM THE INTERNATIONAL MONETARY FUND today shows that central banks continued to diversify into gold in October.

Turkey's holdings rose the most, with the central bank adding a large 12.994 tonnes - 16.18 million oz vs. 15.762 million oz. Kazakhstan’s gold reserves rose 2.4 tons and Azerbaijan’s gold reserves increased 2 tonnes last month.

Germany, the world's second biggest holder of gold reserves, cut its bullion holdings by a tiny amount in October for the second time in five months. Germany's gold holdings dropped to 108.9 million ounces from 109.01 million ounces in September. The reduction was likely for domestic gold coin sales.

Gold in U.S. Dollars and Suspensions Of COMEX Gold Trading - 3 Month (Bloomberg)

GOLDMAN SACHS Inc. has come out with another of their widely covered market predictions.

Gold, iron ore, soybeans and copper will probably drop at least 15% next year as commodities face increased downside risks even as economic growth in the U.S. accelerates, according to Goldman.

As we noted before, Goldman’s gold calls and crystal gazing have been poor at best. Indeed, some suspect that while Goldman is advising clients to sell, they may be on the other side of the the trade going long.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.