U.S. Housing Market Foreclosure Filings Jump as Investors Eye Exits

Housing-Market / US Housing Feb 17, 2014 - 03:39 AM GMTBy: Mike_Whitney

“Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.” -John Maynard Keynes, The General Theory of Employment, Interest and Money

It’s too bad Keynes isn’t around today to see how the toxic combo of financial engineering, central bank liquidity and fraud have transformed the world’s biggest economy into a hobbled, crisis-prone invalid that’s unable to grow without giant doses of zero-rate heroin and mega-leverage crack-cocaine. This is exactly what the British economist warned about more than half a century ago in his magnum opus, “The General Theory…”, that you can’t build a vital, prosperous economy on the ripoff, Ponzi scams of Wall Street charlatans, mountebanks and swindlers. It can’t be done. And, yet– here we are again– in the middle of another historic asset-price bubble conceived and engineered by the bubbleheaded crackpots at the Federal Reserve. Go figure?

Just take a look at housing, which is at the end of an astonishing 18-month run that was entirely precipitated by what?

Higher wages?

Nope.

Lower unemployment?

Wrong again.

Consumer confidence, bigger incomes, credit expansion, growing revenues, pent-up demand?

No, no, no, no and no. Economic fundamentals played no part in the so called housing rebound. In fact–as everyone knows–the economy stinks as bad today as it did 4 years ago when the government number-crunchers announced the end of the recession. The reason prices have been rising is because of the Fed’s loosy-goosey monetary policy (fake rates and QE), inventory suppression, bogus gov mortgage modification programs, and unprecedented speculation. (mainly Private Equity and investors groups) Those are the four legs of the stool propping up housing. Only now it looks like a couple of those legs are in the process of being sawed off which is going to put downward pressure on sales and prices. Take a look at this from DS News:

“A majority of experts surveyed by Zillow and Pulsenomics expect large-scale investors will pull out of the housing market in the next few years…

Out of 110 economists, real estate experts, and investment strategists surveyed in Zillow’s latest Home Value Index, 57 percent said they think institutional investors will work to sell the majority of homes in their portfolios “in the next three to five years.” These investors are largely credited with propping up housing during its recession, helping to keep sales volumes from plummeting too far.

While their withdrawal will most certainly affect today’s still-fragile market—79 percent of those surveyed said the impact would be “significant or somewhat significant” should investor activity curtail this year.” Experts Predict Level Playing Field as Investors Withdraw, DS News

This is what we were afraid of from the very beginning, that the big PE firms would pack-it-in and move on once they’d made a killing, which they have, since prices soared 12 percent in one year. Now they want to get out while they getting is good, which means that–in some of the hotter markets where investors represented upwards of 50 percent of all purchases–there will have to be a new source of demand. Unfortunately, the demand for housing has never been weaker.

Sales are down, purchase applications are down, and the country’s homeownership rate has slipped to levels not seen since 1995, 18 years ago. The Fed’s $1 trillion purchase of mortgage backed securities (MBS) and zero rates have done nothing to stimulate “organic” consumer demand. Zilch. No “trickle down” at all. All the policy has done is generate a temporary surge of speculation that’s distorted prices and created conditions for another big bust. Get a load of this article from Housing Perspectives:

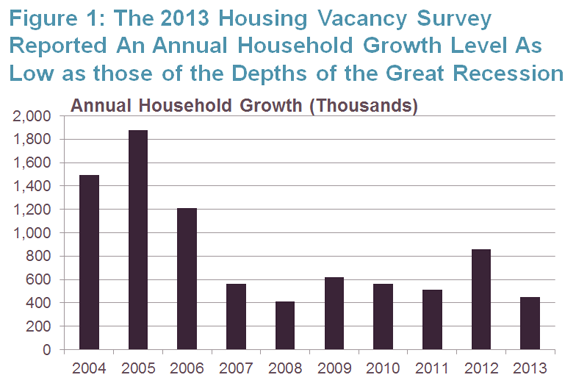

“Although household growth is the major driver of housing demand, getting an accurate picture of recent trends in this measure is difficult…In its recent release, the HVS reported annual household growth of just 448,800 in 2013. This represents a 48 percent drop in household growth relative to that from 2012 and marked the lowest annual household growth measure since 2008, in the depths of the Great Recession (Figure 1).

Source: US Census Bureau, Housing Vacancy Survey

Repeat: “…a 48 percent drop in household growth relative to that from 2012 and marked the lowest annual household growth measure since 2008, in the depths of the Great Recession.”

Do you really think there are enough firsttime homebuyers in out there in Mortgageland to fill that gap?

In your dreams! Keep in mind, that a lot of firsttime homebuyers are collage grads who want to start a family and put down roots. Regrettably, nearly half of those potential buyers have been scrubbed from the list due to their burgeoning student loans which now exceed $1 trillion. These kids will probably never own a home, let-alone have a positive impact on sales in 2014. Ain’t gonna happen.

Maybe this is why the banks are suddenly speeding up their foreclosure filings, because they want to offload more of their distressed inventory before prices fall. Is that it? Check out this article on Housingwire:

“Monthly foreclosure filings — including default notices, scheduled auctions and bank repossessions — reversed course and increased 8% to 124,419 in January from December, according to the latest report from RealtyTrac.

This marks the 40th consecutive month where foreclosure activity declined on an annual basis, with filings down 18% from January…

As a whole, 57,259 U.S. properties started the foreclosure process for the first time in January, rising 10% from December…

…this month’s foreclosure starts increased from a year ago in 22 states, including Maryland (up 126%), Connecticut (up 82%), New Jersey (up 79%), California (up 57%), and Pennsylvania (up 39%).

Scheduled foreclosure auctions jumped 13% in January compared to the previous month.” RealtyTrac: Monthly foreclosure filings reverse course, rise 8%, Housingwire

Like most articles on housing, you have to sift through the bullshit to figure out what’s really going on, but it’s worth the effort. The banks have been dragging their feet for 40 months now, slowing down the foreclosure process (and adding to the shadow supply of distressed homes.) in order to push up prices hoping to ignite another boom. Now–after 3 and a half years of blatant collusion–they’ve done a 180 and started speeding up foreclosures. Why?

It’s because they agree with the above-mentioned “110 economists, real estate experts, and investment strategists” who think that “institutional investors” are going to call-it-quits and move on to greener pastures. That’s going to push down prices, which means they’re going to lose money. So they want to get ahead of the curve and dump more houses on the market before the stampede. That way, they lose less money.

Keep in mind, the banks are up-to-their-eyeballs in distressed inventory. Even conservative estimates of shadow backlog puts the figure of 90-day delinquent or worse, above 3 million homes. But if you review the gloomier prognostications, the sum could easily exceed 6 million homes, enough to suck the entire bleeding banking system into a black hole of insolvency. There was an interesting article on the topic in Bloomberg last week. It seems that, “bond king” Jeffrey Gundlach has been warning mortgage-backed security purchasers that they should to pay more attention to underlying collateral in MBSs (vacant homes, that is) which have been “rotting away” for “six years” or more. Here’s a clip from the article:

“The housing market is softer than people think,” Mr. Gundlach said, pointing to a slowdown in mortgage refinancing, shares of homebuilders that have dropped 13% since reaching a high in May, and the time it’s taking to liquidate defaulted loans…

About 32% of seriously delinquent borrowers, those at least 90 days late, haven’t made a payment in more than four years, up 7% from the beginning of 2012, according to Fitch analyst Sean Nelson.

“These timelines could still increase for another year or so,” Mr. Nelson said, leading to even higher losses because of added legal and tax costs, and a greater potential for properties to deteriorate.” Gundlach Counting Rotting Homes Makes Subprime Bear, Bloomberg

Let me get this straight: The number of “seriously delinquent borrowers” has actually gone up in the last year? Not only that, but many of these people “haven’t made a payment in more than four years”?

That’s a mighty fine recovery you got there, Mr. Bernanke. Sheesh.

Keep in mind, the backlog of unwanted homes could be a lot bigger than most people think. Way bigger. I was reading an article by Keith Jurow the other day, (“The Coming Mortgage Delinquency Disaster”, Keith Jurow, dshort.com) that paints a pretty grim picture of what is really going on behind the faux inventory numbers. Jurow–who has done extensive research on pre-foreclosure notice filings in New York state– says: “The number of monthly foreclosure filings in Suffolk County on Long Island …(were) more than 180,000 (while) fewer than 1,000 foreclosure filings had been served each month in (the last 4 years). By this calculation, Jurow figures that there should have been 1,192,000 foreclosures in New York state while the actual percentage of homes that have been repossessed remains in the single digits. (Read the whole article here.)

Chew on that for a minute. So, that’s a total of 180,000 homeowners who would have faced foreclosure under normal conditions, while less than 48,000 have actually been foreclosed. That’s 132,000 fewer foreclosures than there should have been IN JUST ONE COUNTY IN ONE STATE ALONE.”

The reason the prodigious shadow stockpile continues to balloon is quite simple, as Jurow points out in his piece: “Servicers do not foreclose on seriously delinquent borrowers throughout the entire NYC metro area. Completed foreclosures have actually declined rather dramatically throughout the nation in the past two years. The difference is that in the NYC metro, the servicers have not been foreclosing since the spring of 2009.”

So, there you have it; the banks haven’t been foreclosing because it hasn’t been in their interest to foreclose. Foreclosure sales push down prices which batters balance sheets and scares shareholders. Who wants that? So the game goes on. Only now, the dynamic is changing. Skittish investors are eyeing the exits, QE is winding down, and housing prices have peaked. The recovery has reached its zenith, which is why the bankers want get off on the top floor before the elevator begins its bumpy descent.

People who are thinking about buying a house in the near future, should watch developments in the market closely and proceed with extreme caution. No one wants to get burned in another bank swindle.

By Mike Whitney

Email: fergiewhitney@msn.com

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. Whitney’s story on declining wages for working class Americans appears in the June issue of CounterPunch magazine. He can be reached at fergiewhitney@msn.com.

© 2013 Copyright Mike Whitney - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.