World Financial InStability - Stock Market Wealthbuilder Report

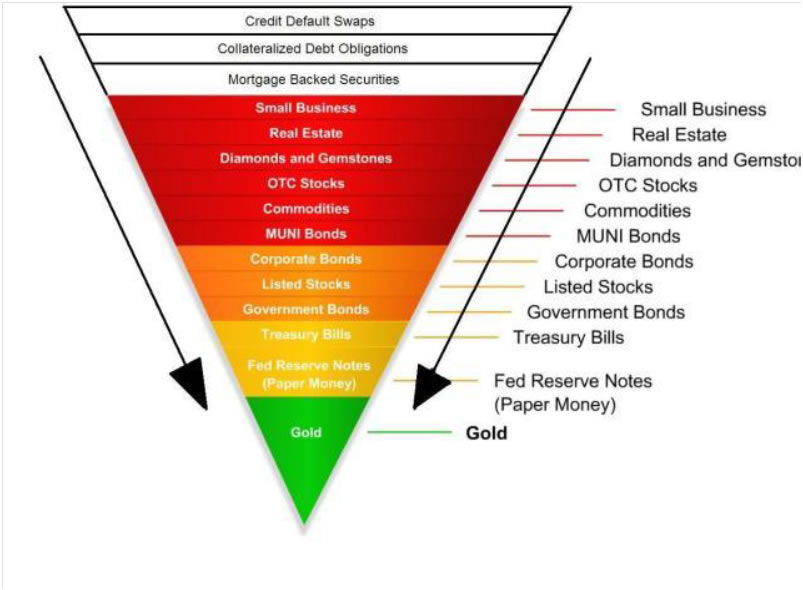

Stock-Markets / Financial Markets 2014 Apr 01, 2014 - 06:17 PM GMT I came across the inverted pyramid below last year which outlines the “asset backing configuration” between gold, cash and all other financial instruments.

I came across the inverted pyramid below last year which outlines the “asset backing configuration” between gold, cash and all other financial instruments.

I decided to try to put some real figures behind this graphic. What I discovered is summarized below.

When you review this summary you begin to understand why many are beginning to believe the current “fiat” (Fiat = let it be) money system is becoming increasingly unstable and cannot continue in its present “arrangement”.

The one statistic that I discovered which really worries me is the fact that in 18 years total currency in circulation (item 2.) has grown from 1 trillion dollars to the current level of 4 trillion dollars.

This has all the hallmarks of hyper-inflation to me and explains the explosion in food, commodity and equity prices world –wide despite lackluster economic performance.

World Financial Summary:

9. Total Value of Derivatives (Notional): 1,200 Trillion

8. Total Debt. (Owned By Banks): 160 Trillion

7. Total Value of Assets In The World: 120 Trillion (Managed).

6. Total Personal Debt. (Owned By Banks): 100 Trillion

5. Total Gov. Debt. (Owned By Banks): 60 Trillion

4. World GDP: 70 Trillion

3. Total Value of Derivatives (Cash): 20 Trillion

2. Total Value of Circulating Currency (Cash): 4 Trillion

1. Total Value of Gold Reserves: 1.5 Trillion

(US Dollars: Approx. 2013).

Source:World Gold Council

Technical Bullish Breakout Signals.

On the Dow Industrials, the Dow Transports, the McClennan Oscillator Index, the McClennan Summation Index, the Advance-Decline Line, the market is giving “buy” signals this Tuesday.

I attach charts of the fore-mentioned for your review.

Dow Industrials: Daily

Dow Transports: Daily

McClennan Summation Index: Daily

McClennan Oscillator: Daily

Advance/Decline Line: Daily

Technically speaking this augurs well for the up-coming earnings season.

Even consumer staples, which have been in a short term bear, gave a gentle bullish break-out signal.

Consumer Staples ETF: XLP: Daily

As you can see from the chart above, for nearly 20 trading days (4 calendar weeks) the Consumer Staples ETF: XLP had been caught in a tight trading range (a line).

I told all my students to closely observe where the “break-out” would occur on this ETF. I pointed out that, on probability, the break-out direction would indicate April’s earning season trend.

Charts Courtesy Worden Bros.

By Christopher M. Quigley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2014 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.