What to Expect From Janet Yellen

Politics / US Federal Reserve Bank Apr 03, 2014 - 06:56 AM GMTBy: MISES

Patrick Barron writes: No change.

Patrick Barron writes: No change.

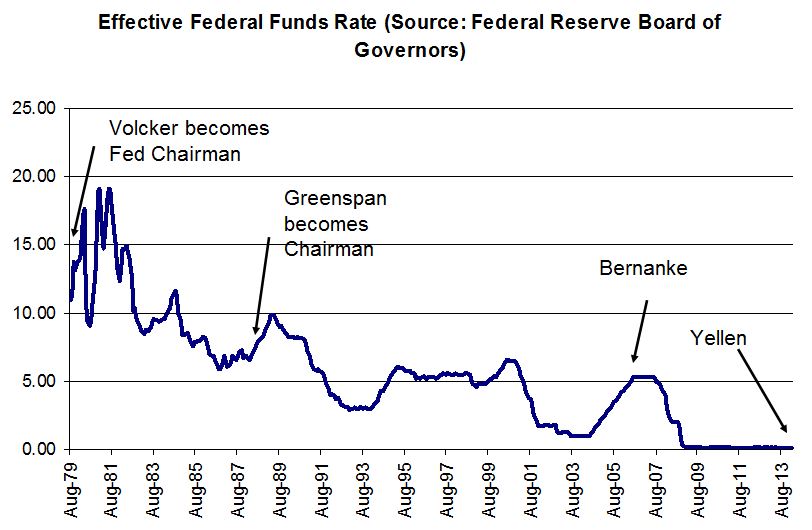

Oh, you want more? Groucho Marx used to tell a joke on himself that “I wouldn’t want to belong to any club that would admit me as a member.” That pretty much sums up why we shouldn’t expect much from the new chairman of the Federal Reserve System. This administration and this Congress will never admit anyone that is not of the Keynesian-School-of-economics persuasion. As long as this mentality resides in the political halls of power, our nation will not get another Paul Volcker.

That means that we should anticipate a continuation of policies that assume that monetary expansion can spur economic growth. It cannot. Monetary expansion can spur phony economic growth; i.e., fooling entrepreneurs to invest capital in projects that will not return a profit. GDP may go up — temporarily. Employment may go up — temporarily. Janet Yellen and her fellow Keynesians believe that the Fed, through money creation, can create software engineers, doctors, nurses, and steel mills. In other words, they think they’re creating real resources. It’s nonsense, yet they seem to be true believers. They may couch this error in highfalutin terms, but that is what they mean on a fundamental level. In the end capital will be destroyed, resulting in an economic bust, and the nation will have wasted years and resources that it can never recover.

Now, Yellen may preside over a gradual “tapering” of the unprecedented “quantitative easing” program begun under Bernanke. But this does not mean that she is different. Remember, that program was unprecedented; everyone knew at its beginning that it could not continue forever. Whoever occupies the Fed chairmanship would have to end that program at some point — we hope. There is no guarantee, however. If rates start to rise, unemployment rises, and businesses start to go bust, the Fed could jump right back into the program, because that is all it knows how to do — print money. The real question is whether Yellen and her fellow travelers will accept a recession that most likely will occur as QE ends. The Fed likes to think of QE as a jump start, a one-time boost, a helping hand, etc. But these are false analogies. QE funds projects that cannot exist in its absence; therefore, when QE ends or even slows down, these projects will be revealed to be unprofitable. No amount of cost cutting will make them profitable. They were born of QE and they will die when QE ends. The only question is whether the Fed will accept the necessary recession or will jump right back into money printing. If it does the latter, we can expect an even greater bust in the future.

The Fed has painted itself into a corner. There is no way that the nation can avoid either a recession or the collapse of the value of the dollar. We should prefer the recession, then insist on an end to monetary expansion, regardless of the howls from the politicians that the government cannot continue its many programs otherwise. At the core this is a political problem. Only a radical change in the mindset of government can end the monetary madness.

Patrick Barron is a private consultant in the banking industry. He teaches in the Graduate School of Banking at the University of Wisconsin, Madison, and teaches Austrian economics at the University of Iowa, in Iowa City, where he lives with his wife of 40 years. Read his blog. Send him mail. See Patrick Barron's article archives.![]()

This article is an address delivered by Patrick Barron at the European Parliament in Brussels on March 16, 2011.

© 2014 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.