Gold And Silver Prospects From A Russian Point of View

Commodities / Gold and Silver 2014 Apr 27, 2014 - 05:51 PM GMTBy: Michael_Noonan

One of the biggest problems for the West, the US in particular, is its increasingly parochial perspective from the narrowest of lenses, fully colored by the elite's use of its main propaganda machine, the Maintstream Media. It will not work for people to expect more from their government, rather, people have to demand and expect more from themselves, for in the end, people will discover all they really had to rely upon was themselves and failed to do so.

One of the biggest problems for the West, the US in particular, is its increasingly parochial perspective from the narrowest of lenses, fully colored by the elite's use of its main propaganda machine, the Maintstream Media. It will not work for people to expect more from their government, rather, people have to demand and expect more from themselves, for in the end, people will discover all they really had to rely upon was themselves and failed to do so.

All of the information one needs to make more enlightened decisions is out there. One has to change their broken habits of spoon-fed expectations from local news and take a more active role in seeking the truth. In a nation that relies upon a police state, increased militarization, and NSA [STASI] spying on its docile population, one cannot expect to hear truth, only lies, and the Obama administration is certainly delivering them.

Ask yourself, what is your impression of Russia, of Putin? Then, consider the following information about both. Never in the history of the world have [mostly] Western central bankers issued anything but worthless paper currency, backed by nothing, controlled by unelected bureaucrats, and none beholding to nor responsible for citizens of a nation, your neighbors and everyone you may know. This is the world in which most of you live without challenging it. Others, outside of the Western sphere of central banks, with a firm grip on their respective governments, refuse to remain a victim of the West's inflationary degradation via fiat currencies and the rot-from-within they generates.

Who has been the champion prodder of the Ukrainian situation? The United States, led by its teleprompter-reading corporate president, Barack Obama. What has he done? Threatened economic sanctions, provided neo-Nazi thugs to continue to stir unrest, steal, or remove, if you prefer, all the Ukrainian gold in the middle of the night, and drain the country of billions of dollars, transferred to Swiss banks. Are any of these moves in the least bit constructive, let alone justifiable?

Putin's response? Aggression to match aggression? No. Just patience, waiting as events that are doomed to fail play out. While Obama does what he can to stir up a hornets nest in an area of the world the US has no business in interfering, Putin is allowing Obama to take as much political rope as he needs to hang himself. In the meantime, Putin is busy putting together deals with other countries, and its natural gas deal with China in the works will be a game-changer for Russia. All of the deals made and those in process will bring income to Russia as a nation. What kind of income?

More rubles, some yuan, maybe even some gold. Totally absent is the use of the dollar as the disappearing world reserve currency. Putin is taking his job of running a country seriously and responsibly.

Putin spurns Western central banks and continues to strengthen the ruble. He makes deals with other natural resource-rich countries. Obama invades oil-rich countries. While Obama pushes for war on the other side of the world with Syria and Ukraine, Putin is busy making deals on the other side of his world with Obama's ignored neighbors, Mexico and Latin America. While Obama allows the Fed and Wall Street to continually suppress and disparage the gold market, Putin is building Russia's gold reserves. No fiat ruble over there.

What has Obama done to help strengthen the US financially? Nil, and to the contrary, he has increased government spending, with no means of ever repaying it, and he has worsened the plight of millions and millions of Americans through his enrich-insurance- companies scheme at the expense of leaving people without affordable insurance coverage.

Most Americans have never heard of Russia's Gazprom, yet it dwarfs Exxon and Mobil in size. In anticipation of Western sanctions, Gazprom secured natural gas deals with China. If Gazprom never sold another energy unit of natural gas to the West, its bottom line will continue thrive with its natural gas sold to the East. Further, Gazprom will now only sell their product using rubles, yuan, and gold, no petrodollars allowed.

The Russian banking system has responded to the West's petty and of no-effect sanctions by raising a one-finger salute to the West. Russian banks have stopped using the dollar and have adapted total reliance upon its own ruble, intent on having the ruble become a part of any new global currency. US banks continue to entrap citizens with debt-forever fiat. Russia has the second largest gold reserve in the world. US is the highest debtor nation in the entire world. The US has always had a fondness for being number 1 in everything.

The fact that Russia has rejected the dollar in every way, coupled with another fact that it will only transact its gas and oil trade in the ruble will have an impact on the US and the West more than any sanctions Obama can ever hope to [under]achieve. As a consequence of pushing Russia away from the [totally failed] Western banking system, the US stands to lose trillions of fiat $ in return. It is not just Russia. All of the other BRICS nations are following suit. The US and the central banking system is committing seppuku, [hari kari], financial [self-imposed] disembowelment.

Still think of Russia as an "evil empire?" Here is a quote from one of Russia's members of Parliament on the US and its fiat:

"The dollar is evil. It is a dirty green paper stained with blood of hundreds of thousands of civilian citizens of Japan, Serbia, Afghanistan, Iraq, Syria, Libya, Korea, and Vietnam. Our national industrial giants will not suffer any losses if they choose to make contracts in Rubles or other alternative currencies. Russia will benefit from that. We should act paradoxically when we deal with the West. We will sell Rubles to consumers of our oil & gas, and later we will exchange Rubles for Gold. If they do not like this, let them not do this and freeze to death. Before they adjust, and this will take them three of four years, we will collect tremendous quantities of Gold. Russian companies will at last become nationally oriented and stop crediting the economy of the United States that is openly hostile to Russia." Source: Izvestia newspaper

What of he US ally Germany? Guess where Germany will turn when push comes to shove? East! It has vastly important financial ties with Russia. Germany's ties to the US? Mostly fiat and highly objectionable NSA tentacles covering the country.

Israel. Surely the staunchest US ally? Well, it turns out that the US worsening of events in Ukraine are a threat to Israeli security. Israel has its own floating Tamar natural gas platform, and it has made a deal with Gazprom to export the liquified natural gas.

How much of any of this has anyone read or heard about from government-controlled mainstream media? Not a peep, not a sentence. The elites want US citizens to remain dumbed down, and US citizens are complying in utter ignorance and steadfast refusal to consider any alternative news sources. Reliance upon the total control over the corporate and bankrupt federal government's newspeak is the elite's goal.

At the outset, we said people need to expect more from themselves and take more responsibility for their own lives. Reliance upon any government is a trap from which there is no escape.

We have not even covered all that can be covered re Russia and Putin, or Obama and the federal government, for that matter. We have not even touched China, India, the growing BRICS nations as a power unto themselves, totally outside of and separate from the self- toppling United Sates.

The acronym BRICS brings to mind the story of the Three Little Pigs, making houses of straw and twigs that failed, [fiat], with the safest being the one built of brick. The BRICS are using a lot of gold in building their financial ties together.

None of this addresses timing, but the message is clear: financial integrity and strength is relying upon gold, in some large degree, as a standard, at least indirectly. The message should be the same for us all who endeavor to withstand the inevitable fall-out from fiat currencies destroying the Western financial system. The East, parts of the Middle East, and even Central and South American countries are accumulating gold. There is no concern about gold going lower or even not going higher, for now. The end-game is not the short-term price, it is for where gold will seek its natural price level once freed from Western central bankers and to not be caught holding nothing but value-lost paper.

On a side note, the elites are not stupid. It is likely that they may even be orchestrating the demise of the Federal Reserve Note "dollar." The direction may have been intended to replace the "dollar" with another fiat issue, like an SDR, [Special Drawing Rights], to be issued by an all-controlling, non-elected or representative government, like the BIS, [Bank for International Settlements], or some similar elite organization. What was not anticipated, during all the decades of planning, was the rise of the East and the use of gold as a measure of currency control.

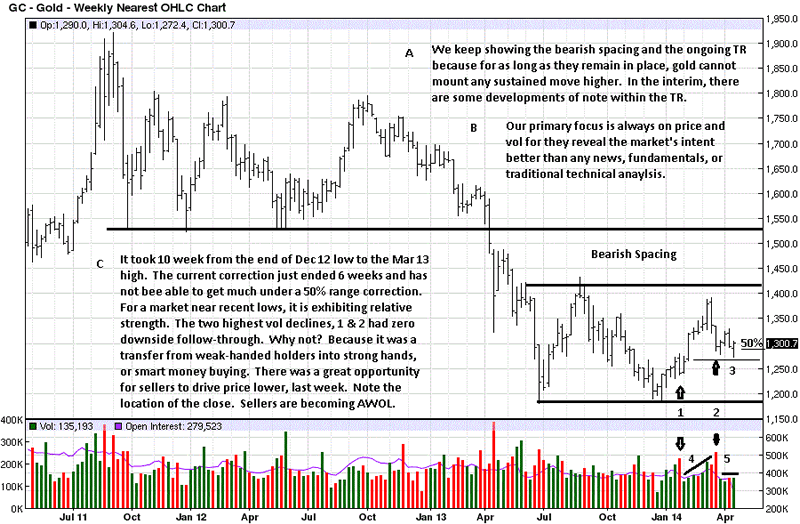

Last week could have been an important anchor for a turning point in gold and silver. The comments on the weekly chart cover a lot of ground. What can be added are the observations labeled 4 and 5. Both are directed at the level of volume. The area marked 4 shows increased volume as price rallied. On the current correction, volume has dropped off. This tells us that the selling pressure is not there, as it used to be.

The gold price is also respecting, albeit loosely, the half-way correction area between the recent swing low and swing high. In somewhat of a down market condition, that is a good showing. Gold's failure to decline to the lower channel line is an indication of strength.

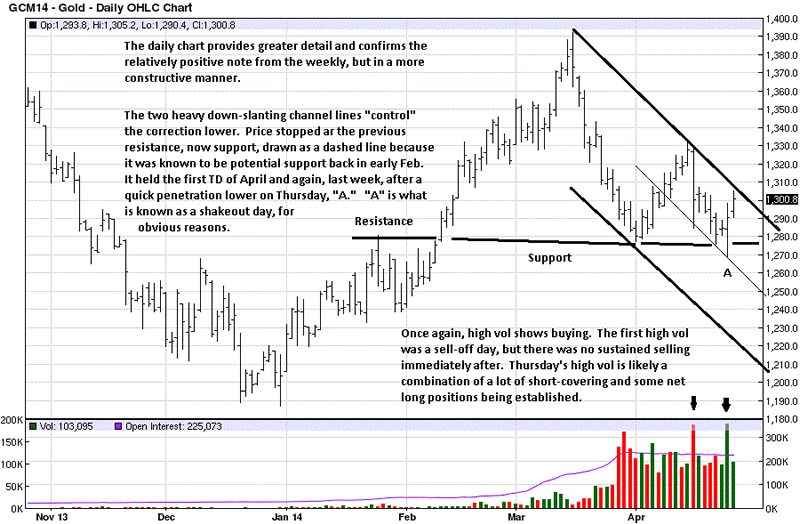

The daily gold chart is confirming observation made on the weekly, but with more detail. What was not covered in the chart comments was the thin line at the half-way measure of the down sloping channel. Whenever price can hold the half-way point of anything, it is taken as a relative measure of strength

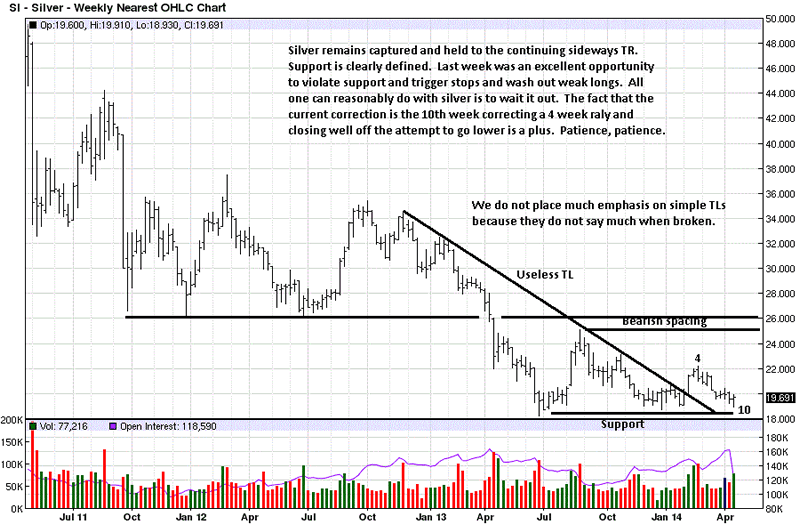

Silver is a test of one's patience. All purchases made at current, even slightly higher, prices will be viewed as gifts and wise moves sometime in the future, be it later this year or into 2015/2016. When silver finally does rally away from its [very constructive] support zone, purchases made at any higher price in the past few years will look like bargains.

The way the charts are setting up, even purchases in the paper futures market now have a diminished downside. What cannot be known is when a move to the upside will make any such buys worthwhile from a profit perspective.

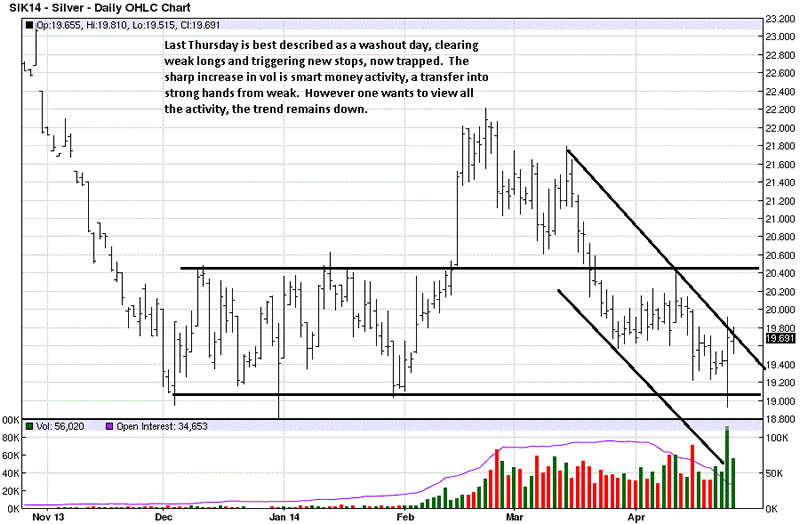

That high volume spike should loom as important, moving forward. As with gold, it may be an anchor for establishing the low point for silver, too. Similar to gold, silver has kept just above the half-way area in its down channel. In this last correction, silver did not even come close to reaching the lower channel live, as it did in late March. Last week's close has it bumping up against the upper channel line very soon after the last challenge just two weeks ago. This is a positive development within a negative down trend.

On an ending note, last week, mention was made of Gann and the Cardinal Grand Cross, an astrological significant time frame. It all ends with a solar eclipse on the 29th. [See Gann, Cardinal Grand Cross, A Mousetrap And Wrong Expectations, if you did not read it.] It is just interesting to see how both gold and silver can be potentially bottoming at the same time. From our unwavering point of view, price and volume remain the most reliable guides and source of market information.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.