Sharp Fall in Consumer Spending

Economics / US Economy Apr 30, 2008 - 06:19 PM GMTBy: Mick_Phoenix

Does the consumer truly believe?

Does the consumer truly believe?

The past three Occasional Letters have been quite an in-depth discussion about the path taken by the Federal Reserve and recently by the Bank of England in their attempts to deal with the deflationary forces unleashed by the credit crash. Since those discussions we have seen evidence that supports my view as seen recently in the Weekly Reports.

This Occasional Letter will further expand upon that evidence and show why the plan, which I dubbed Eggertsson Theory, may already be showing signs of failure.

Firstly a little recap to refresh readers memories. GB Eggertsson wrote a paper for the Federal Reserve in which he supported the Monetarist view that deflation could be avoided by a combination of fiscal and monetary expansion combined with a credible expectation that the polices were inflationary. This would lead the private sector (business and consumer) to act in a manner that reflected such expectations and to respond to them accordingly.

It is the expectations of inflation that were of importance to Eggertsson, without it the plan to reflate would fail, as seen in Japan over the past 2 decades. Indeed, Eggertsson goes as far as to say (along with Bernanke) that the failure of the Bank of Japan to adopt an inflation target, either actual or implicit led to the current malaise affecting their economy.

As I mentioned in the previous articles, the Ben Bernanke Fed along with the US Govt and Treasury have adopted the measures espoused by Eggertsson and have implemented them. We have ample proof of the stimulus, tax rebates and new Fed Facilities, all designed to add liquidity in the form of cash and credit enabling structures to stave off a slowdown. During this period we have had constant reiteration of a hawkish view on inflation and the possible decoupling of inflation expectations to the upside.

Importantly then, have we seen an increase in inflation expectations in the people and the private sector? April Consumer Confidence as measured by The Conference Board dropped to 62.3 from 65.9 showing that the economy has yet to bottom. Within the report were 2 interesting figures:

- 1 year inflation expectations were 6.8% up from 6.1% in March.

Does this mean consumers expect to spend more? No it does not and as we shall see later, it would appear that rather than consumers stepping up to higher prices, they are buying less.

Here are a couple of snippets from the Consumer Confidence report that show more evidence of a lack of spending power and an increasing fear:

- Jobs Hard to Get 27.9% up from 24.5% in March, and Jobs Plentiful 16.6% down from 19.2% in March.

The number of respondents planning holidays (vacations) are at a 10 year low.

Now expectations are one thing, actual changes in habits are another. We can see that the public perception of inflation is growing and by some measures could be viewed as having decoupled from the Fed expressed inflation expectations. This could only be seen by most as highly inflationary and that rises in workers compensation would have to go up to maintain equilibrium.

A self fulfilling prophesy, engendered by Fed/US Govt policies, that causes a rise in compensation and prices and a move away from deflation seems to be in the throws of creation. If we take the consumer inflation expectation at 6.8% and compare it to Fed Fund Rates at 2.25% then real rates are a negative 4.55%.

Yet the consumer does not seem to be interested in grasping this opportunity, even to fund a holiday.

- GDP +0.6%, but real final sales -0.2% (1st drop since -0.5% in Q4:2005). Consumption slowed on dip in durables & nondurables spending (only services were up), & investment fell except for inventories.

More from Thompson financial:

- (Thomson Financial) - The U.S. economy continued to sputter in the first three months of the year as consumers cut back on spending to their slowest pace since the mild recession of 2001, the Commerce Department said today.

Consumer spending grew at 1% yet reported Personal Consumption Expenditures rose 3.5%. Core PCE rose 2.2%. Now we have a dilemma for the Fed, in that although inflation expectations have risen, PCE and core PCE have not. In fact it they slipped back by 0.2% and 0.1% from Q4. (core excludes food and energy)

So by the Feds own measures, (it prefers core PCE) inflation is moderating. Now before I get a bunch of emails about using Fed data let me explain one thing. The Fed use Fed data. If you want to know what the Fed are thinking don't impose statistics that the Fed doesn't use.

So what does this tell us about consumers? It tells us they have stopped spending. Goods might cost more but they are not being bought in the same quantity. Remember, you can put whatever price you want onto an asset, it doesn't mean someone will be willing (or able) to pay it.

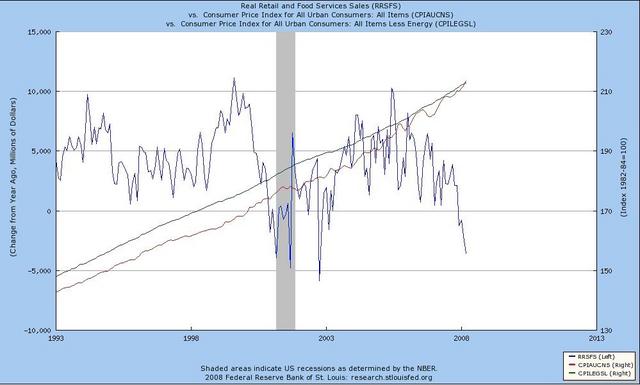

Blue = Real retail and food services sales. Red = CPI all urban consumers, all items. Green = CPI all urban consumers less energy.

What about business, did it continue to view the economy as it did in Q4?

To read the rest of this article go to An Occasional Letter from the Collection Agency and sign up for the 14 day free trial.

By Mick Phoenix

www.caletters.com

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.