Bitcoin Price Reaction or Lack of Reaction to News from China?

Currencies / Bitcoin May 06, 2014 - 04:37 PM GMTBy: Mike_McAra

In short: we don’t support any short-term positions in the Bitcoin market at the moment.

In short: we don’t support any short-term positions in the Bitcoin market at the moment.

More news from China coming our way. BTC China, a prominent Bitcoin exchange, announced today it would stop taking yuan-denominated deposits from the Bank of China as of today:

Dear users,

Due to regulations, we have suspended CNY deposits from Bank of China. (…)

Not a long message and no elaboration on what “regulations” actually means here but it is most probably the Chinese central bank going even more aggressive towards Bitcoin exchanges. We’ve previously written about the attitude of Chinese authorities and why they might perceive Bitcoin as a threat. For instance, in our Bitcoin analysis on Apr. 10, we wrote:

The Chinese central bank has moved more aggressively to make it difficult for Bitcoin users to get served by local Bitcoin exchanges. Chinese exchanges BTC100 and BTCTrade were ordered by the Chinese authorities to close accounts used for reception of incoming Bitcoin deposits. This is one in a long string of attempts to limit the use of Bitcoin in the country. The main concern of the Chinese government is that Bitcoin might be used to pull money out of China, which falls under capital controls imposed by the Chinese authorities.

It’s not clear if the Chinese bank took any specific steps to “discourage” BTC China at this time or the exchange decided to halt the deposits on previously-known information about the behavior of the Chinese government but, either way, this is simply an extension of the previous policy of the authorities to make it hard for Chinese individuals to use Bitcoin to transfer money abroad.

Let’s take a look at what happened in the market.

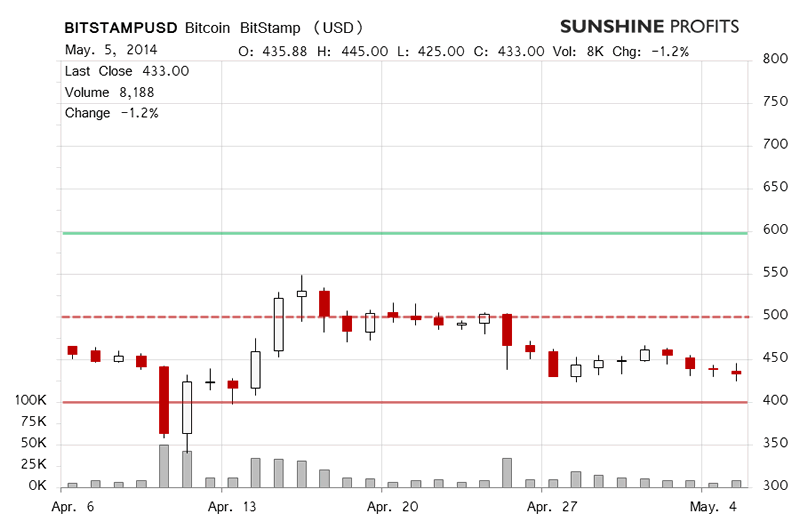

Bitcoin went 1.2% down yesterday on BitStamp on increased volume. The volume made the short-term situation more bearish than it had been before but not enough to justify shorting. Bitcoin stayed below $450 but didn’t move visibly towards $400 (solid red line in the chart).

If one were to believe the stories that bad news for Bitcoin from China swings the whole market, one would have expected serious depreciation today. This is generally not what has happened so far (this is written at 9:25 a.m. EDT). The market has gone 0.3% down but this is the kind of action that is considered noise.

On the other hand, one might speculate if there is upside potential in the market since Bitcoin hasn’t gone down in light of bad news from China. This approach would consider that Bitcoin “should have gone down” but “it hadn’t” which would lead to the conclusion that there might be a move up.

Our take is that it is an extremely tough call to make whether Bitcoin “should’ve moved” following news from China. We wouldn’t bet on a move up just because the currency hasn’t depreciated yet. But taking into account that Bitcoin has been going down for some time now, down but without a significant move, we would expect to see some kind of pause in the next day or days. This is very much in line with what we wrote yesterday in our alert:

Today, we’ve seen more depreciation and Bitcoin fell to around $430 (this is written past 11:00 a.m. EDT). The volume is not decisively strong but stronger than yesterday which makes the short-term outlook more bearish than it was yesterday. Is the bearish outlook strong enough to go short?

We think no, at least not just yet. We’ve seen three days of depreciation and the overall volume levels are falling. If we don’t see an increase in volume today, we might as well expect a short move up in the next days, followed by more declines.

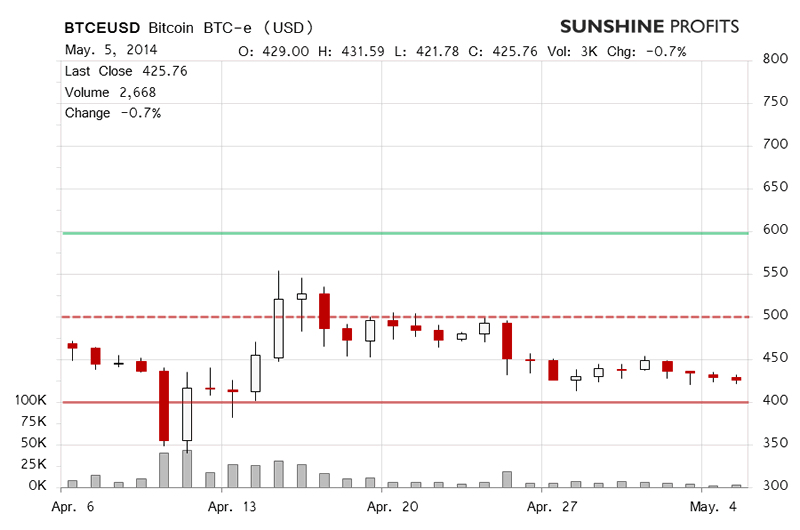

The one thing that might make you more concerned is the possible increase in volume today, particularly visible on BTC-e.

Yesterday, the move down on BTC-e was weaker than on BitStamp and so was the trading volume. The short-term situation looked leas bearish on BTC-e than on BitStamp.

Today, the tables have turned and the depreciation on BTC-e is stronger, 0.5% at the moment of writing. The most important factor, however, is the volume which is almost twice as heavy as yesterday. This could make you concerned as it makes the short-term situation decidedly more bearish. In our opinion, this is still not enough to go short as the move down has been relatively weak and we could see a period of appreciation up ahead in the following day or days.

Summing up, in our opinion no short-term positions should be kept in the market now.

Trading position (short-term, our opinion): no positions. We expect to see a move up followed by more declines.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.