Gold And Silver - Western World Is Upside Down

Commodities / Gold and Silver 2014 Jun 22, 2014 - 12:37 PM GMTBy: Michael_Noonan

In a break from a thematic undertone to link to gold and silver, here are some ramblings that are more underpinnings to the core problems that have left people unfocused and dealing with symptoms, no matter how they may seemingly appear to be core issues.

In a break from a thematic undertone to link to gold and silver, here are some ramblings that are more underpinnings to the core problems that have left people unfocused and dealing with symptoms, no matter how they may seemingly appear to be core issues.

What makes sense any more? In the United States, all one hears in the news is lies, deceit, and propaganda. In the EU, Mario Draghi "dictates" what is [un]real, backed by a host of unelected, non-representative NWO bureaucrats. In the UK, do not know if anyone is really in charge. Regardless, there is no truth being told, in fact, the truth is actively being hidden and/or suppressed. Governments are circling the wagons against people. Banks are being protected, at all costs, literally.

We live in an Alice In Wonderland, circa Orwell's 1984 world. Everything is upside down, and that includes the price for gold and silver. In the United States, if you do not like what you hear from the inept central planners, or if you choose to criticise what you hear, you run risk of being branded a "terrorist," certainly one who is a threat to the existing regime.

The leader of the corporate federal government. Barack "Yes We Can!" Obama, apparently referring to the NWO, is like a Forrest Gump box of chocolates. When he opens his mouth you can never be sure of what he will say. From CNN, Friday 13 June: "OBAMA SAYS NO COMBAT TROOPS TO IRAQ." From AP, Monday 16 June: "OBAMA ANNOUNCES 275 TROOPS DEPLOYED TO IRAQ." Now, there are going to be about 300 or so military "advisors." That was a term LBJ used when he was sending "troops" to Viet Nam, back in the 1960s.

Western governments are openly pushing the elite's agenda onto a mostly unsuspecting population, too dumbed down and too compliant to think for themselves. Most people ignorantly believe the NWO myth of "spreading democracy" [and for the part of the US, it is at the point of a gun barrel, tank, drone, or, just as worse, a central bank taking over control of a nation's currency.] A democracy is the worst form of government, but most people simply believe in a notion of what democracy means instead of knowing what it is.

We first heard then ex-president George Herbert Walker Bush, formerly in charge of the CIA, announce that he wanted to see installed, "A NEW WORLD ORDER!" Emphasis added because he shouted out that part of his speech in 1990. It was somewhat shocking to hear a then-previous president openly endorsing the most insidious of secretive rulers whose interests were totally against a free United States population.

Interestingly, Putin's past as head of the KGB is often mentioned to cast aspersions on him as President of Russia, but nothing is mentioned about Bush being ex-CIA, the US counterpart to the KGB.

For clarity, the corporate federal government serves against the interests of the people who live within the United States. It is a huge mistake for anyone to think the federal government is "their government," for it is not. This is a concept most will find hard to accept, but the clues are everywhere when one finally chooses to look for them and then think for themselves.

Biden, another NWO lap dog, openly announced Biden Challenges Air Force Academy Grads to Shape a "New World Order" on 30 May 2014. How brazen sycophant- politicians have become in the service of foreign interests ahead of their own supposed national interests. Most Americans simply do not get it. It is not an isolated event, either. Vice President Biden: "The affirmative task we have now, is uh, is to actually um, create uh, uh, a New World Order..." back in late April.

The Council on Foreign Relations is the NWO's primary leader group in this country, a fact of which even fewer Americans are aware, or even care. The crass Kardashians are much more well-known, along with American Idol, The Voice, Dancing With The Stars, along with an unending host of similar programs that garner more attention than how one's own government functions in direct opposition to its people.

Ignorance and an inattentive population is what allows the NWO to breed and take total control...Master Parasites, and still winning. How? By drowning the Western World in fiat debt.

Debt has been growing exponentially, while the ability to repay it has been in an unabated decline. Debts can be refinanced ad infinitum, and interest rates close to zero. The secret of the elite's is that there is never enough money to pay off both principal and interest because only the debt was loaned into existence. From where does the interest come?

Imagine a world of three people: One has a printing press and creates $1,000. The other two need to borrow $500 each. The money man lends the money to each for one year and charges 10% interest. At the end of one year, the money man is owed $1,100. With only $1,000 in existence, from where will the interest come? Just like the Fed prints all the fiat debt, it never prints the interest to pay it. This is why debt can never be repaid. Not only do the elites know this, it has been part of their plan from over 200 years ago.

Another not so minor fact of their not being enough "money" to repay the existing debt is, there is no money. All that exists in circulation is fiat paper debt. As we have said before, debt is not and can never be money. The only lawful money in the United States is gold and silver. This remains true to this day, but since the questionable passage of the Federal Reserve Act of 1913, the Federal Reserve has destroyed all US issued Notes that were specie-backed, and gold and silver coin no longer circulate.

How did the Federal Reserve Act of 1913 pass, and how did the elites take over control of this nation's money issuance?

"The two enemies of the people are criminals and government, so let us tie the second down with the chains of the Constitution so the second will not become the legalized version of the first." Thomas Jefferson

As a nation, the people lost their government to the money changers, and it is now only criminals that are in control, and so successfully that almost all the people still do not know.

With the NWO/elites, nothing is as it seems, especially what almost all think is money

"History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and it's issuance." James Madison

To avoid the debt trap, owning physical gold and silver is the best way to preserve and even grow purchasing power. Keep on buying when and as much as possible, even cashing in retirement funds. Better to pay any tax/penalty for getting out early, for if there is one thing certain in the not too distant future, the corporate federal government will confiscate all retirement plans, exchanging them for government bonds that can no longer be sold to foreigners who refuse to buy them.

It is a choice, at least until the government says otherwise, which it will.

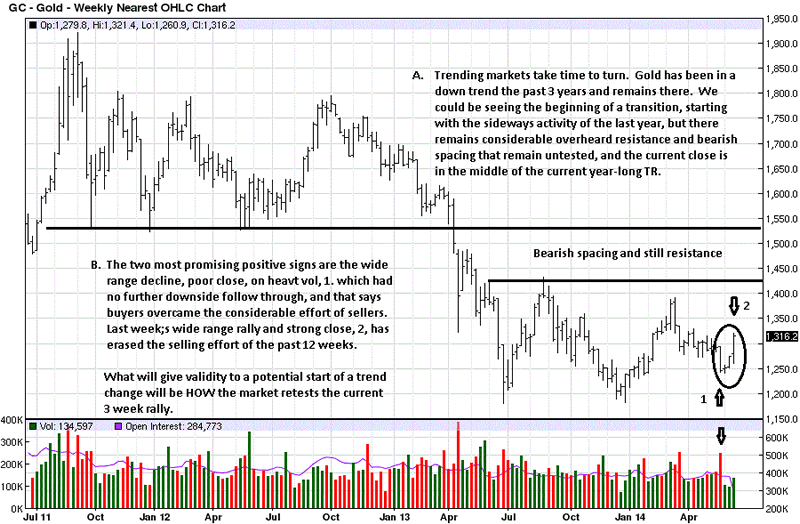

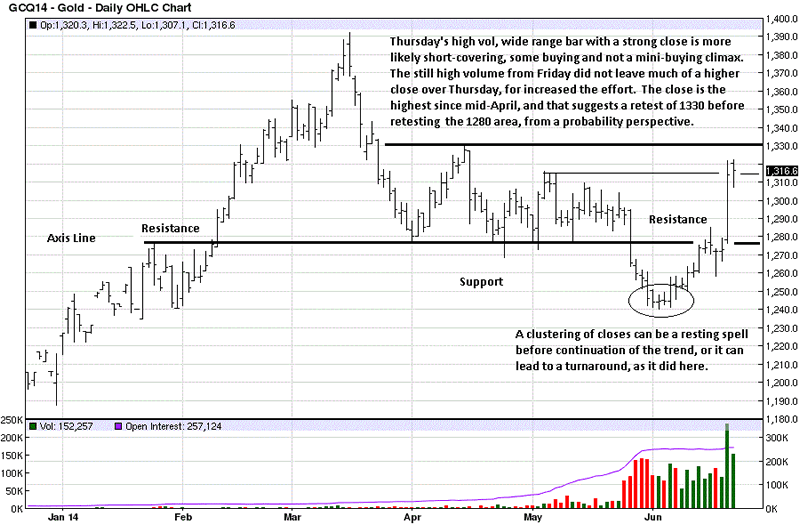

For the present, gold has stopped declining. Whether this will lead to a change in trend remains to be seen. It takes time and a lot more volume effort to change a trend. Last week's close puts gold about in the middle of its TR, [Trading Range]. In the middle of any TR is where the level of knowledge it at its lowest, for price can go in either direction and still not change the trend within the established bounds.

While the numbers for potential events that can keep gold in a sustained rally remain high, none appear to be in play, at the moment, even with the threat of war in Ukraine, and the US is pushing Putin hard to provoke him into war, so far to no avail.

What is most reliable in defining the character of any trend is the retest after a move of any degree. If 1330 is retested next week, it will be a continuation of recent relative strength. What will be important is HOW the next retest develops, be it from 1330 or last week's rally high.

If the trend is to turn upward, the next correction should show smaller ranges down, and volume should decrease, indicating less selling pressure. A correction should also be less in duration, lasting 3-4 TDs lower, for a relatively stronger trend, to 5 -8 TDs, which would be more typical in a weaker environment, which is where gold is now. [TD = Trading Days]

By reading how the market develops, it eliminates having to guess in advance...guessing can be expensive. Combined with some rules for initiating a position can reduce risk, as well.

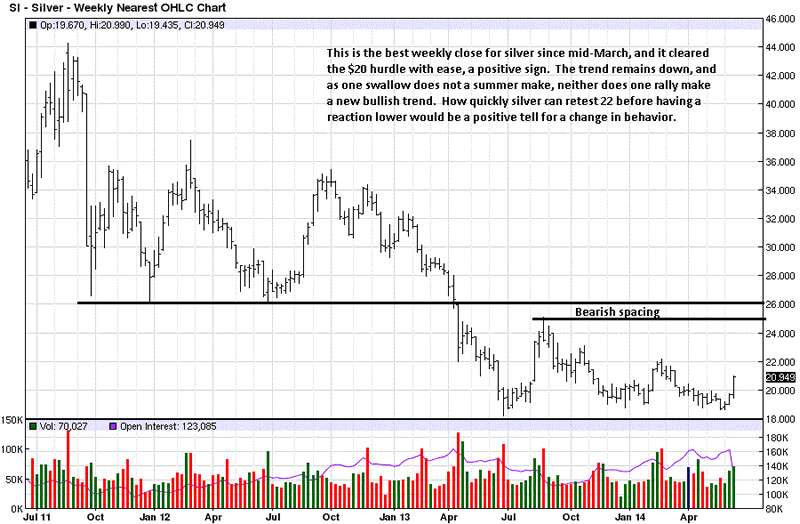

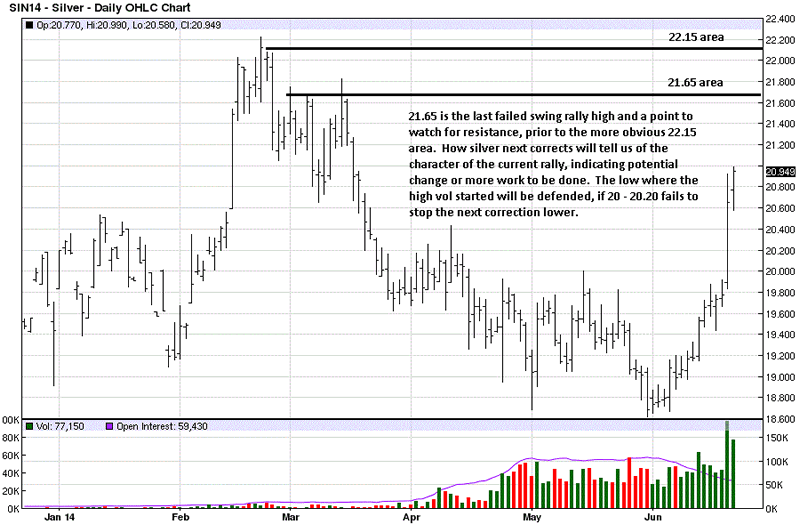

Silver has been more depressed than gold, but it could turn into a more important metal to watch if price approaches its resistance/support levels ahead of gold. The down trend is far from turning, so a look at the daily can be more instructive for change.

Silver would have to rally over 22.90 to about equal the last failed rally which began at the end of January. In fact, that last failed rally is sufficient reason to not get overly enthused about the current rally. There needs to be some kind of confirming indicator that a trend change has occurred, and none is apparent, yet.

When the next correction is marked by smaller ranges, without the larger numbers of down days since the February high, and not last as long in duration, these will be more reliable signs of change.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.