Unprecedented Stocks Bear Market Formation Since 2000

Stock-Markets / Stocks Bear Market Jun 26, 2014 - 07:11 PM GMTBy: EWI

Think the current conditions in the stock market are normal? Think again. Here are 3 characteristics you should expect to see in wave b.

Think the current conditions in the stock market are normal? Think again. Here are 3 characteristics you should expect to see in wave b.

Editor's Note: Below you will find a sneak peek from the just-published issue of Robert Prechter's Theorist. It provides you an opportunity to see some of the research, analysis and forecasts that Elliott Wave International's subscribers are enjoying inside their latest issue.

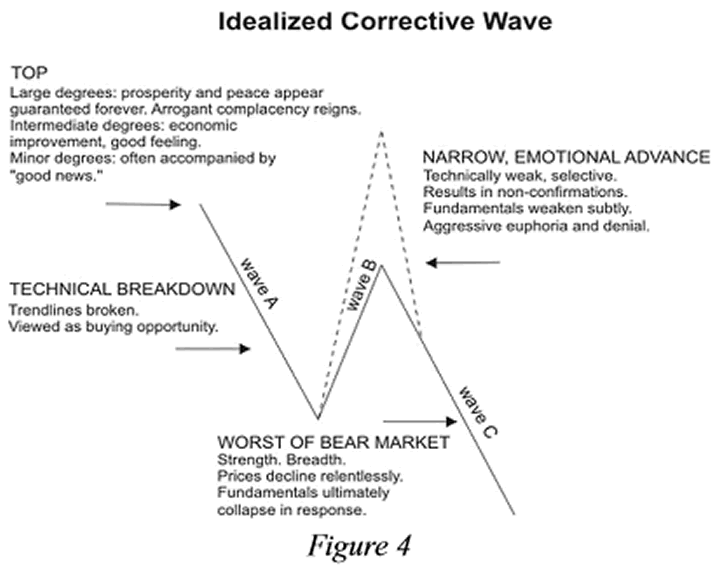

Figure 4 (below) is a diagram from Chapter 2 of Elliott Wave Principle. It displays a typical progression of prices and psychology in a bear market. We can apply this picture to the stock market since 2000. The real-life pattern is a bit more complex than this picture, because wave a itself was a flat correction, which ended in 2009. The dashed line in Figure 4 represents what the market has been doing since then: rallying to a new high in a b-wave. The entire formation has been tracing out an "expanded flat" correction (see text, p.47) of Supercycle degree.

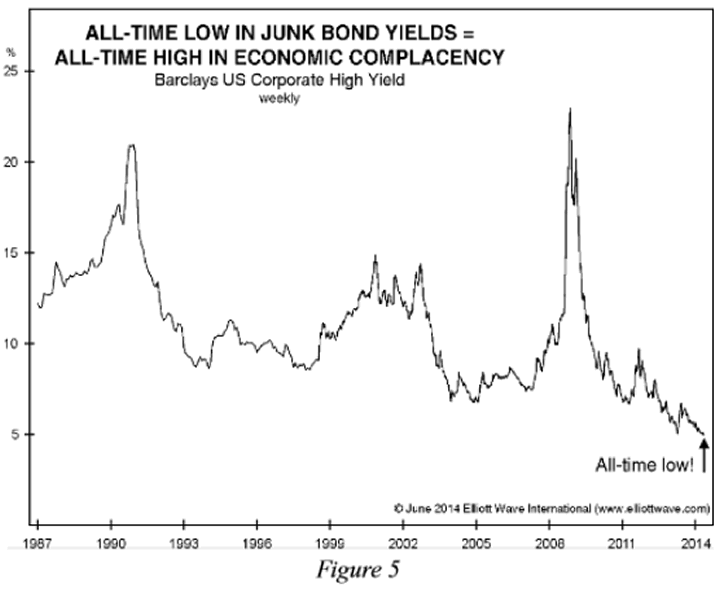

Per Figure 4, among the characteristics we should expect to see in wave b are: "Technically weak," "Aggressive euphoria and denial" and "Fundamentals weaken subtly." The volume contraction in the stock market has now lasted over five years, which is extreme technical weakness, albeit only in that indicator. The 30+ charts we have shown of market sentiment reveal historically high levels of optimism regarding stocks. No doubt bulls would dismiss the idea that investors today exhibit "aggressive euphoria and denial." But look at Figure 5.

It shows that the yield on junk bonds has just reached its lowest level ever. Junk bonds did not even exist prior to 1989. In 2009, investors were deathly afraid of them. Now they cannot get enough of them. They are thinking only about yield; they are ignoring risk to principal. That's denial. Finally, fundamentals have not just weakened a bit but rather are awful. The economy is flat, the amount of debt is at a record high, and as shown in the June issue of The Elliott Wave Financial Forecast the quality of debt is at a record low.

There has never been an expanded flat pattern as large as Supercycle degree in recorded stock market history, going back 300 years. It's a first. So, we are getting commensurate expressions of stupendous optimism, which will prove worthy of the record books. People think today's market conditions are normal, because a benign present is always considered normal. But it's not normal. It's unprecedented.

Would you like to see the rest of the issue for free? For more details, the complete wave count, and EWI's forecast for how they believe it will all play out, continue reading Prechter's 10-page June Theorist now, completely risk-free. Learn more here.

This article was syndicated by Elliott Wave International and was originally published under the headline Inside Look: Check out this Unprecedented Bear Market Formation Since 2000. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.