The New Normal of Healthcare Spending

Companies / Healthcare Sector Jul 01, 2014 - 10:21 AM GMTBy: John_Mauldin

A rather interesting shockwave came across the newsfeeds this week. I was actually doing a TV interview when the host announced that GDP was down 2.9% for the first quarter. There was not much else I could do but note that that was a really bad, ugly, terrible, not very good number. But I had no real basis, without any facts in front of me, by which to understand why the revision was so extreme. Sure, we were all expecting a pretty large revision, but what we got was the worst decline in five years and the largest downward revision since recordkeeping began. Later, a quick perusal of the data on the BLS website revealed the culprits: exports and healthcare spending.

A rather interesting shockwave came across the newsfeeds this week. I was actually doing a TV interview when the host announced that GDP was down 2.9% for the first quarter. There was not much else I could do but note that that was a really bad, ugly, terrible, not very good number. But I had no real basis, without any facts in front of me, by which to understand why the revision was so extreme. Sure, we were all expecting a pretty large revision, but what we got was the worst decline in five years and the largest downward revision since recordkeeping began. Later, a quick perusal of the data on the BLS website revealed the culprits: exports and healthcare spending.

Last year I was one of the very few who suggested that the implementation of Obamacare could cause a recession (see more below). Such a suggestion was universally dismissed by all right-thinking economists, and for very good reasons based in sound economic theory, I might add. But sometimes the real world neglects to adhere to our models and theories, and that was my concern.

While I doubt we’ll see a recession – classically understood as two quarters in a row of negative GDP – this rather large bump in the road offers a number of teaching opportunities. This week’s letter will look at the actual numbers; and then, rather than try to spin the numbers to fit some preconceived political agenda, we will examine what actually happened in the spending data and why. And while it may surprise some of you, I actually think a few good things did happen, things I find encouraging.

Anytime I write about healthcare it’s controversial, and I expect this letter will be received that way as well. However, as I (and many others) haveclearly established, the healthcare system in the United States is massively dysfunctional. We are simply spending too much money on healthcare and are on a path to spending an unsustainable amount of money by the end of the decade. Things are going to change no matter what. The Affordable Care Act (ACA or Obamacare) was one way to try to address the problem. The majority of the country now feels this might not have been the best way, but that really doesn’t make any difference. It is going to be the basic law for another three to four years. My job, at least in this letter, is not to discuss policy but rather the economic effects of the policies we have chosen to implement, and what those effects may mean for our investment portfolios.

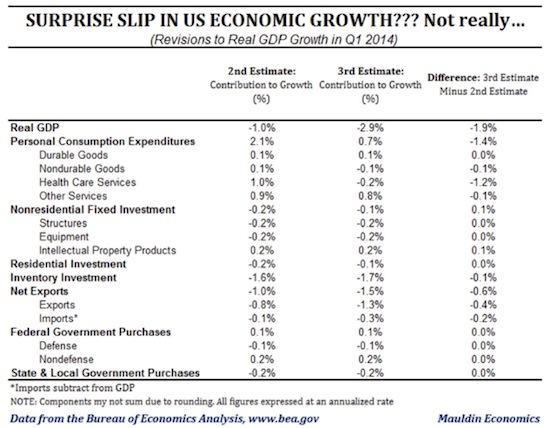

First, let’s look just at the facts as given to us by the BLS. US Q1 GDP Q/Q was revised much lower, to -2.9% on an annualized basis, down from the -1.0% previously reported (which itself was revised lower from the +0.1% initially reported) and well below the expected decline of -1.8%. How did we go from barely positive to down 2.9%?

When the BLS gives us its first estimate of previous-quarter GDP, it is forced to use models based on previous trends until the actual data comes in. This is why we get two monthly revisions and in future years will get even further revisions. (Sidebar: don’t you wish the US Bureau of Labor Statistics could be as good as their Chinese counterparts? The Chinese never have to revise their numbers. Obviously they are very good at this type of thing.)

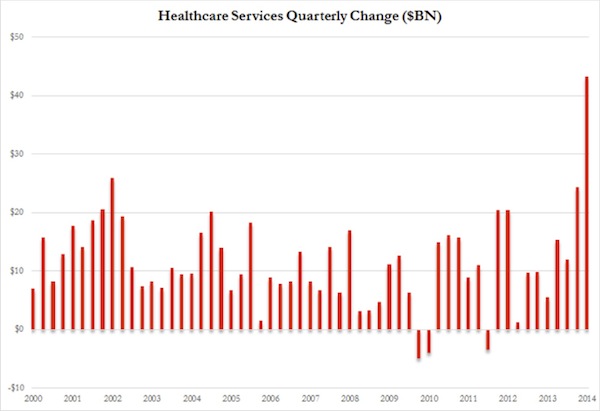

And we all know that assumptions will sometimes bite you in the derrière. Look at this chart of projected healthcare spending from the original release of first-quarter GDP data in April. Notice that the projected spending was almost double what it had been just the previous quarter and over four times the previous year’s average. I’m not quite certain how trend models got to that number, but then I’m not a mathematician. In any event, here’s the chart, courtesy of Zero Hedge:

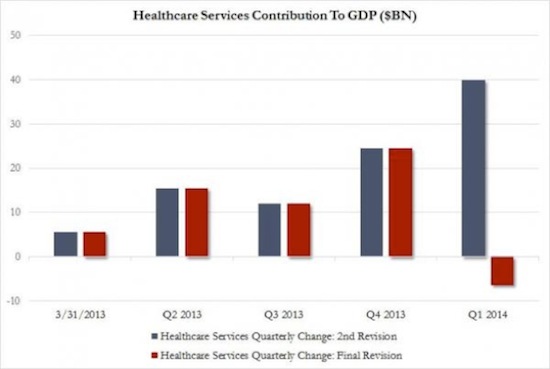

Now fast-forward to last week’s revision and notice that the healthcare spending number has dropped from the previous quarter, not doubled. In fact, it dropped an enormous 6.4%. Rather than contributing 0.62% to GDP is it did in the fourth quarter of 2013, in Q1 2014 it subtracted 0.16% from GDP growth.

Just for the record, here are the actual numbers from the BLS data. Roughly 2/3 of the negative revision in Q1 GDP was from healthcare spending, and the rest was from falling exports and rising imports (from an accounting standpoint, imports are a negative in figuring GDP).

I want us to look quickly at two charts to get some historical perspective on growth in the US. The first is GDP quarter by quarter for the last seven years. Notice that only two quarters ago we had a 4.1% positive quarter. During the 19 quarters since the current expansion began in June 2009, the economy has grown at an annual rate of 2.1%, compared to the 4.1% average in every other expansion since 1960.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.