Urbanization and Demographics Could Skew China's Economic Rebalancing

Economics / China Economy Sep 04, 2014 - 12:31 PM GMTBy: STRATFOR

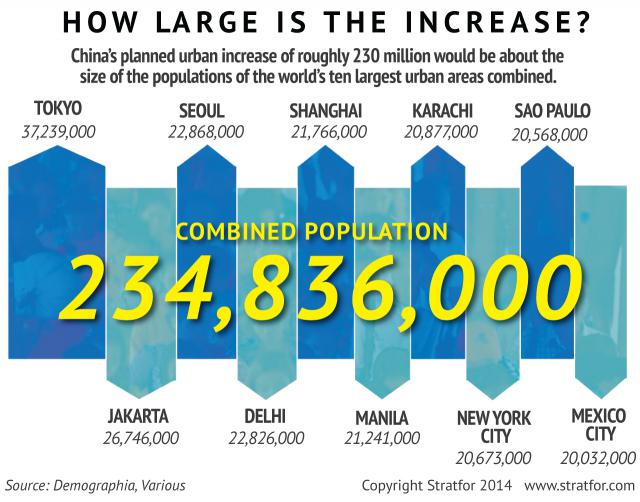

China's urban population may grow by as many as 230 million people in the next 15 years. But most growth will take place not in metropolises like Beijing, Shanghai and Chongqing but in the myriad small- and medium-sized satellite cities around them. And as residents flock to these cities, China's working-age population will begin to decline, and its elderly population will grow dramatically.

China's urban population may grow by as many as 230 million people in the next 15 years. But most growth will take place not in metropolises like Beijing, Shanghai and Chongqing but in the myriad small- and medium-sized satellite cities around them. And as residents flock to these cities, China's working-age population will begin to decline, and its elderly population will grow dramatically.

Together, these processes will underpin major changes not only in China's overall economic structure, but also in the financial, fiscal and political relationship between central and local government. The added burdens facing small- and medium-sized cities, especially those located deep inside China that are sequestered from mainstream global trade, will be substantial and perhaps socially and politically destabilizing.

Together, these processes will underpin major changes not only in China's overall economic structure, but also in the financial, fiscal and political relationship between central and local government. The added burdens facing small- and medium-sized cities, especially those located deep inside China that are sequestered from mainstream global trade, will be substantial and perhaps socially and politically destabilizing.

Analysis

In July, the Chinese government announced that a revision to the one-child policy had been implemented throughout the country's provinces and regions. The announcement of the revision, which allows couples in which either partner is an only child to have up to two children, heralded the end of the controversial policy. More relaxed family planning measures have long been in place for rural and ethnic minority communities, and most urban Chinese of childbearing age now were the only children in their families, so the revision dramatically narrows the portion of China's population to which the original one-child policy still applies.

The purpose of the one-child policy -- limiting the population shaping demographic trends -- was superseded many years ago by the far more fundamental forces of industrialization and urbanization. Two decades ago, China's fertility rate fell below 2.1, the generally accepted population replacement rate. Since then, it has dropped to roughly 1.5 or, by some measures, as low as 1.4. These are comparable to fertility rates in Russia and Italy but well below those of the United States, Australia, the Netherlands and many other more advanced economies.

It is a coincidence, but a symbolically loaded one, that China's fertility rate fell below the population replacement rate in the same year that the Chinese government enacted new fiscal policies and other measures that would necessitate and drive the housing construction booms of the 1990s, early 2000s and post-global financial crisis era. The almost continuous two-decade property boom cycle underpinned rapid growth in the portion of China's population living in cities -- from less than 30 percent in the early 1990s to the current 54 percent. In doing so, it introduced hundreds of millions more Chinese to urban life, with all its associated costs. Far more than the one-child policy, these costs have shaped family planning practices in China in recent years, as have rising education levels and the transition from an agriculture-based economy to one based on manufacturing and construction.

The urbanization of the past two decades has altered the country's demographic balance rapidly and profoundly. The change has hastened the decline in fertility and population growth rates, particularly those of China's working-age population, as the size of the country's elderly population has risen.

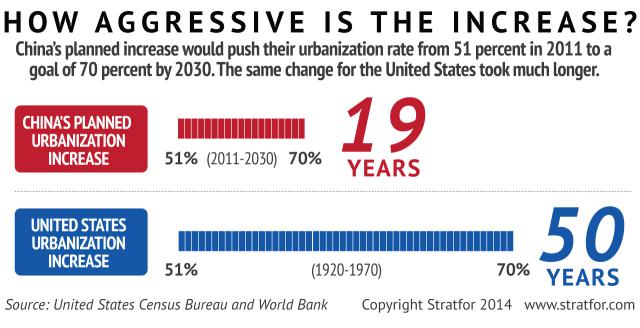

In the next two decades, these trends will only grow as the Chinese government attempts to push the country's urbanization rate above 70 percent, thus bringing the proportion of China's rural and urban populations more in line with those of advanced industrial economies with robust domestic consumer bases. If the government achieves its target, China's urban population will grow by more than 230 million between now and 2030, reaching approximately 975 million.

One-Way Street

For China's leaders, further urbanization on a significant scale is not optional: It is imperative. China is in the early stages of an effort to rebalance toward an economic model grounded in robust domestic consumption and characterized by greater economic integration between, and equality across, its diverse regions. Because of its large population, China has one of the world's largest domestic consumer markets, but relative to the country's economy as a whole, private consumption remains weak. In 2013, China's household consumption was equivalent to only 34 percent of its gross domestic product, compared with 70 percent in the United States, 61 percent in Japan, 57 percent in Germany and 52 percent in South Korea. Even if private consumption is somewhat stronger than official statistics show, it is nonetheless far from enough to support China's current rates of growth. As a result, too rapid a drop-off in housing construction activity before domestic consumption has had time to grow would likely cause a dramatic decline in China's overall economic activity and employment.

Moreover, private consumption is highly concentrated geographically and socially in more heavily urbanized coastal provinces and in a handful of major inland urban centers. Much of China's population, not only in rural regions but also in the hundreds of small cities that dot China's interior, does not participate meaningfully in the country's consumer economy.

The Chinese government wants to change this. It is experimenting with several reforms and tools to boost domestic consumption, including financial liberalization, expansion and modernization of the country's logistics industry (to more efficiently transport goods from the coast to the interior and back), and expansion of social security and health insurance programs. These measures are intimately tied to urbanization: Their success will depend on the progress Beijing makes with efforts to urbanize and integrate the country's interior, along with less developed parts of coastal provinces, into its more developed and largely coastal urban industrial economy.

Whatever form it takes, continued urbanization will have important implications for China's overall demographic balance and its political and economic structure for the next two decades. But how it affects Chinese demography, and how this in turn plays into major underlying issues in Chinese political economy, will depend very much on how China urbanizes.

After three decades of focusing on coastal urban development to suit the needs of China's heavily export-oriented economy, Beijing has redirected its attention to the interior in the past five to seven years. Now, with major inland metropolises like Chengdu, Chongqing and Wuhan approaching levels of development and population comparable with top-tier coastal cities, the government's attention appears to be shifting once again, this time to smaller cities in the interior and, to a lesser extent, along the coast. These cities are satellites of larger metropolises, once-forgotten river towns along the Yangtze and its tributaries, and other minor outposts on the rail and highway trunk lines that connect China's north and south and its coastal and interior regions.

It is these smaller cities that Beijing expects to drive future urbanization in China -- to house, employ, care for and educate most of the new urbanites China hopes to create by 2030. In the government's vision, these cities will serve not only as manufacturing bases and lower-end service providers for consumers in China's wealthier top-tier cities, but also as sources of marginal but rising consumer demand.

The government has made clear its intent to limit immigration into top-tier coastal cities, and it will continue to use tools like the household registration (hukou) system to make it harder for all but the most established non-resident workers to live and raise families in these cities. Meanwhile, it will use those same tools -- relaxed hukou restrictions, programs to bring rural laborers into small- and medium-sized inland cities, greater job availability and other social and economic incentives -- to encourage laborers from the interior to migrate or re-migrate to these cities.

Small-Town Demographics

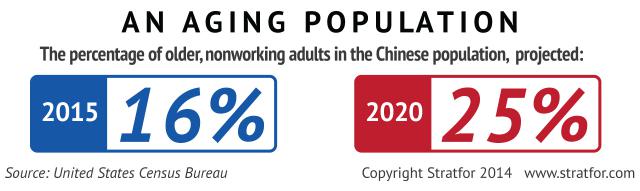

In under a decade more than a quarter of China's population will be over the age of 60, compared with slightly less than 15 percent today. In that time, the portion of China's population too young or too old to work will rise from approximately 38 percent to 46 percent, with the balance of China's dependent population shifting substantially from young to old.

At the same time, with China's working-age population (defined here as ages 20-59) set to decline by as much as 80 million people between 2015 and 2030, China will need to increase worker productivity significantly to sustain growth rates even remotely close to present levels. For example, for China to sustain 5 percent average annual growth between now and 2020 and then 2 percent between 2020 and 2030, worker productivity must almost double. Given China's low productivity levels, some gains will come naturally as Chinese industry gradually moves up the value chain and incorporates more advanced machinery. But those gains will also require less tangible improvements in education levels and skills, increased market competition, greater freedom of movement for labor and increased financial support to small businesses, which account for most of the employment and manufacturing output in China.

As China's workforce shrinks and its elderly population grows, pressure will mount to raise wages and expand the social services necessary to help that workforce manage the social and financial pressures of caring for the elderly while continuing to spend more. This pressure will translate to significantly higher fiscal expenditures for local governments, which are responsible for almost 90 percent of total government spending, and in turn will necessitate significant expansion of local governments' ability to raise capital by means other than land sales.

All of this will take place against a backdrop of massive and, except for the past two decades in China, unprecedented urbanization. Urban growth will not be primarily in the major cities with the greatest concentrations of wealth and greatest capacity to raise capital through municipal bonds or hefty taxes on high value-added manufacturing and high-end services industries. Rather, it will be borne by the small- and medium-sized satellite cities or even very small rural townships. Most of these cities and towns are in the interior and separated by distance and often unforgiving geography from overseas markets. Their prospects as manufacturing hubs are questionable at best, and their avenues for raising capital, whether through taxes or bond sales, are more limited.

Known Unknowns

A number of variables will further shape this process. Some, such as the progress and direction of agricultural modernization, could aggravate the challenges and constraints facing China's plan to urbanize small- and medium-sized cities. For example, if the Chinese government's vision for agricultural modernization involves clearing large tracts of land for use in industrial-scale agriculture in existing agricultural basins, the local governments that absorb the farming populations could find themselves caring for the parents and children of migrant laborers previously left behind to tend the now-defunct family farm. (With the exception of Jiangsu, the provinces with the top five dependent-to-working population ratios are inland.) Urbanization that results in the transfer of unproductive demographic groups to small- and medium-sized cities will only add to those local governments' financial, fiscal and social burdens.

Other factors could mitigate the financial and fiscal constraints on local governments in small- and medium-sized cities. A notable example is rural land reform, which aims to strengthen rural land ownership rights, thus giving rural landholders means to generate capital while giving local governments a new market with which to trade and generate revenues. However, rural land reform faces numerous complications, not least of which is the potential tension between expanding rural land markets and the government's imperative to maintain a base level of arable land. How exactly rural land reform plays out in context of broader urbanization and agricultural modernization efforts without infringing on Beijing's goals for either is unclear.

There is the more distant problem that rapid urbanization over the next 15 years will most likely exacerbate current demographic trends. As more people move from the countryside to cities, China's fertility rate will likely decline further, leaving future generations of Chinese urbanites even more constrained in their efforts to care for elderly and child populations and remain active consumers than those coming of age in the 2020s.

Finally, there is the question of how the Chinese government will manage the social stresses created by decades of uneven demographic growth between male and female populations driven at least in part by the one-child policy in its early years. In the next decade, this imbalance will come to a head as tens of millions of Chinese men, especially from rural regions where male children have traditionally been prized above female, come of age with little to no prospect for finding partners and forming families. This demographic will be of particular concern for Beijing as the low value-added manufacturing and construction industries best suited to absorb it decline further.

"Urbanization and Demographics Could Skew China's Economic Rebalancing is republished with permission of Stratfor."

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2014 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.