Mortgage Providers Fail to Pass on Interest Rate Cuts to Borrowers

Housing-Market / Credit Crisis 2008 May 16, 2008 - 01:09 AM GMTBy: MoneyFacts

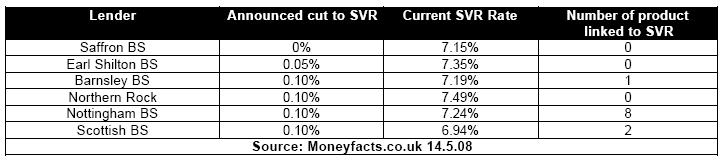

“It is now five weeks since the last base rate cut and still 24 lenders (25%) have not announced their intentions with regards to their standard variable rate (SVR). Of those lenders that have done so, 20 (28%) have announced a cut of less than 0.25%. Even more disappointingly is the fact that those lenders which have passed on the smallest cuts offer some of the highest SVR rates.

“It is now five weeks since the last base rate cut and still 24 lenders (25%) have not announced their intentions with regards to their standard variable rate (SVR). Of those lenders that have done so, 20 (28%) have announced a cut of less than 0.25%. Even more disappointingly is the fact that those lenders which have passed on the smallest cuts offer some of the highest SVR rates.

“The majority of institutions that so far haven’t passed on the cut or have passed on less than the 0.25% cut are building societies. Of the 51 building societies that offer mortgages, 18 (38%) have so far not announced their intentions and another 18 (38%) have announced cuts of less than 0.25%.

“Two lenders, Catholic BS and Chorley & District BS, did not pass on the February cut and so far have not announced that they will be passing on the April cut. Chorley & District BS has the most products linked to SVR in the market, so both new and existing customers are being penalised.

“Anyone wishing to go onto an SVR is likely not to be charged a product fee. With some lenders’ SVR rates now running at similar levels to the rest of their mortgage range, the SVR is becoming part of lenders’ standard product range.

“In some cases, rates being offered are at levels higher than SVR and a few lenders have stopped offering their SVR rate to new customers. These include ING Direct, Halifax, Lloyds TSB and Nationwide BS (not available via intermediaries).

“With falling house prices and borrowers finding it harder and harder to get a new deal, the lenders’ SVRs are becoming a more attractive option, but these lenders do not want to take on the more risky borrowers who do not have enough equity in their home to get a good deal.

“More and more lenders are now requiring a bigger deposit than ever before. Just prior to the credit crunch in August 2007, 47% of deals required a deposit of 5% or less. Today only 12% of the deals on the market will accept deposit that small. 53% of the market now requires a deposit of more than 10%, compared with 27% in August 2007. This is most concerning for first time buyers or anyone with limited equity in their home.

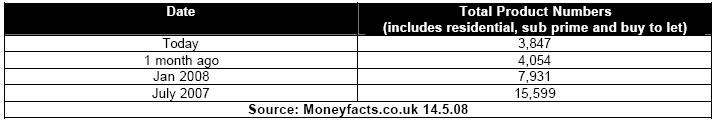

“The total number of mortgages available has been reasonably constant over the last few weeks, but recent product withdrawals by the likes of Northern Rock have seen the number drop to the lowest level we have seen in quite some time.”

www.moneyfacts.co.uk - The Money Search Engine

Moneyfacts.co.uk is the UK's leading independent provider of personal finance information. For the last 20 years, Moneyfacts' information has been the key driver behind many personal finance decisions, from the Treasury to the high street.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.