Ebola and Global Recession Risks Send Stocks Sliding

Commodities / Gold and Silver 2014 Oct 08, 2014 - 04:36 PM GMTBy: GoldCore

Hardly a day goes by without a headline on the spread of the deadly Ebola virus in West Africa and now in Spain and in the U.S. With more than 3,500 deaths and about 8,000 reported cases, it is one of the most severe disease outbreaks in recent years.

Hardly a day goes by without a headline on the spread of the deadly Ebola virus in West Africa and now in Spain and in the U.S. With more than 3,500 deaths and about 8,000 reported cases, it is one of the most severe disease outbreaks in recent years.

All the focus has rightly been on the medical implications of the disease and the tragic human consequences. So far, there has been little attention on the financial and economic consequences of a pandemic.

Global economic growth remains weak and vulnerable and the global financial system remains very fragile. The ebola virus has the potential to be the straw that breaks the proverbial camel’s back.

Stocks and commodities fell globally today due to concerns about the spread of Ebola and declining economic growth. Precious metals bounced from near multi month lows.

The Stoxx Europe 600 Index declined another 0.6% today after the benchmark gauge had slumped 1.5% yesterday as the International Monetary Fund cut its forecasts for global growth and German industrial production contracted the most in more than five years as sanctions on Russia took their toll.

S&P 500 - Jan 1985 to Oct 8, 2014 (Thomson Reuters)

Airlines led the sector lower, having come under pressure from the spread of the Ebola virus to Europe. Shares in travel companies including budget carrier Easyjet, Iberia owner International Airlines Group and cruise company Carnival are down for a second day after a Spanish nurse in Madrid became the first person outside Africa to contract the deadly Ebola virus.

Fears that this could put people off travelling or that travel restrictions could be imposed hit travel companies. EasyJet shares lost nearly 3% this morning, Carnival was down almost 2% while IAG and Tui Travel shed 1.9%.

The DAX Index fell 1% and extended its slump from a record reached in July to a 10% decline. The volume of shares changing hands in Stoxx 600-listed companies was 37% higher than the 30-day average for this time of the day, according to data compiled by Bloomberg.

U.S. stocks fell again yesterday, pressured by a second straight day of weak data out of Germany, the euro zone's largest economy. German industrial output figures for August plunged a whopping 4%, the biggest fall in 5-1/2 years, a day after industrial orders saw their biggest monthly drop since 2009.

Industrial production in Spain also slowed in August, disappointing economists. Output rose just 0.6% compared with a revised 0.9% gain in July. Production of consumer goods remained flat in August while capital goods and energy fell 4% and 1.4% respectively.

The emergence of Ebola in Madrid, the Spanish capital, will do little for consumer confidence in the struggling Spanish economy.

Similarly, the emergence of Ebola in Texas and Washington risks impacting on the fragile U.S. recovery. The Obama administration is developing additional screening protocols for airline passengers both overseas and in the United States to control infectious diseases like Ebola, the president said Monday.

After meeting with his senior health, homeland security and national security advisors, President Obama told reporters that in the wake of the first Ebola case diagnosed in the U.S., officials would study increasing screening plans. “I consider this a top national security priority,” Obama said.

The White House said a ban on travel from West African countries would slow the fight against the virus.

The International Monetary Fund and World Bank are handing out free thermometers as a precaution against the Ebola virus for people attending their annual meetings in Washington this week.

Thousands of finance officials, economists, bankers and representatives of nonprofit groups from nearly every nation are gathering in the U.S. capital to discuss the darkening economic outlook. That includes officials from the West African nations struggling to contain the deadly outbreak.

Ebola has overshadowed the Middle East respiratory syndrome (Mers). Discovered in 2012, Mers has so far killed around 330 people in Saudi Arabia primarily. More than 850 people worldwide are thought to be infected, with new cases being reported from as far as the U.S. and Europe.

Pandemics can severely affect supply chains, including food supplies, business operations and key government services such as the provision of water, electricity, education and of course health care. Travel restrictions and “stay at home” policies bordering on curfew would greatly curtail economic activity.

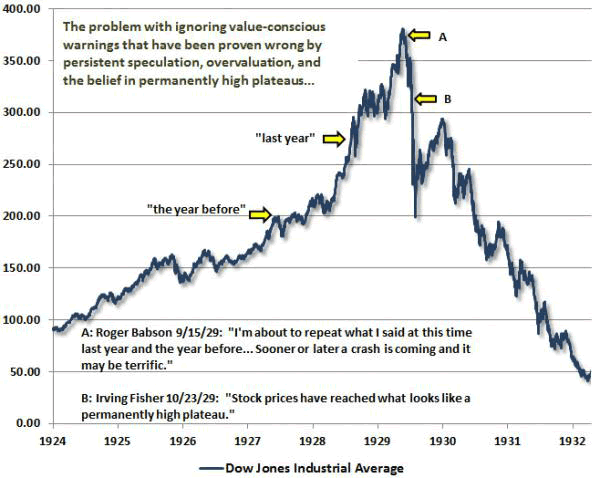

Hussman

There is also an element of the “boy who cried wolf” regarding the ebola virus. There have been numerous alarmist campaigns and scaremongering regarding many viruses - bird flu, swine flu, H1N1 et cetera, et cetera. There have been so many false alarms that when an actual pandemic commences, people may ignore the threat for longer than is wise.

Therefore, the public in many western countries will remain skeptical of the risk of ebola virus until it has been shown to be a real threat. This in itself poses risks as it means that people do not act in a precautionary manner thereby exposing themselves to potentially contracting the virus.

Is Ebola another virus scare story or a real pandemic?

It is too early to tell. However, it looks like it is already impacting stock markets and market sentiment. Unless it is contained in the U.S. and Europe, it will likely soon impact consumer confidence and already fragile economic growth.

The outbreak and spread of Ebola is a worrying development and should remind people and companies, the world over, to be aware of the risks and be prepared.

RECEIVE GOLDCORE’S AWARD WINNING RESEARCH HERE

GOLDCORE MARKET UPDATE

Today’s AM fix was USD 1,220.00, EUR 963.51 and GBP 758.38 per ounce.

Yesterday’s AM fix was USD 1,207.50, EUR 957.27 and GBP 751.49 per ounce.

Gold in U.S. Dollars, 1 Year (Thomson Reuters)

Gold rose $3.60 or 0.3% to $1,210.60 per ounce and silver fell $0.12 or 0.69% to $17.19 per ounce yesterday.

Gold in Singapore climbed from $1,209.00/oz to almost $1,220/oz. Further slight gains were seen in London, prior to gold falling to $1,217/oz.

Gold was boosted by negative economic data from Germany and Europe and the IMF's third cut this year to its global growth forecast.

Gold in GBP, 1 Year (Thomson Reuters)

China returned from their Golden Week holiday today and the market had high hopes of a physical related bounce for both gold and silver.

Growth in China's retail sales during the long "Golden Week" holiday slowed to 12.1% from a 13.6 % rise in the same period last year, data from the Ministry of Commerce showed on Wednesday.

Gold in Euros, 1 Year (Thomson Reuters)

However, Chinese bullion investors are back after their week-long National Day holiday and initial signs are that Chinese demand remains robust.

Gold jewellery sales rose 106% at Hangzhou Department Store, at Tianjin stores gold and silver jewellery sales rose more than 40% according to data from the commerce ministry reported by Reuters. However, there are no overall jewellery sales figures available.

The bounce higher in gold and silver in recent days is encouraging from a technical perspective. Gold may have seen a triple bottom which is a strong technical signal which often signals the reversal of a recent downtrend and can often occur prior to a resumption of a bull market.

It is too early to call the bottom. Prudent buyers will continue to accumulate through dollar cost averaging into bullion.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.