The Swiss Gold Initiative and Why it May Affect Gold Prices

Commodities / Gold and Silver 2014 Nov 06, 2014 - 10:15 AM GMTBy: Bob_Kirtley

The people of Switzerland go to the polls on 30th November to vote on the gold initiative. The proposal requires the Swiss National Bank to hold gold reserves of at least 20% of the value of the assets of the Swiss National Bank. The initiative also wants no further gold sales by the SNB and all Swiss Gold to be stored in Switzerland.

The people of Switzerland go to the polls on 30th November to vote on the gold initiative. The proposal requires the Swiss National Bank to hold gold reserves of at least 20% of the value of the assets of the Swiss National Bank. The initiative also wants no further gold sales by the SNB and all Swiss Gold to be stored in Switzerland.

If the yes vote is successful then they would be required to buy 1500 tons of gold over a period of five years, in order to achieve the 20% target. This acquisition would then be held indefinitely as they would not be allowed to sell it. However, in the case of a yes vote, the referendum would still have to run the gauntlet in the Swiss parliament in order to gain ratification.

Latest News on Poling

As far as we can gather the polls have been mixed with some reporting that 38% of voters would support the Swiss gold initiative and 47% would be against it and others showing 45% in support and 38% against this initiative.

A yes vote would also have ramifications for the current peg between the EUR/CHF, it’s hard to see just how this could be maintained with a currency backed by so much gold. A re-priced Swiss Franc at a much higher value increases the buying power of the people, but makes exporting goods and services that bit more difficult. Should the bank decide to stick with its current monetary policy and maintain the floor that is there at the moment then for every euro that it buys a purchase of gold will be required in order to maintain its gold ratio at 20% of its holdings.

Both houses of Parliament are already urging voters to reject the motion as it is something they don’t want as it limits their powers regarding future policy. These referendums, as we understand it, have to be approved by a majority of the Swiss Cantons or member states, of which there are 26 of them and they are apparently not in favour of this change.

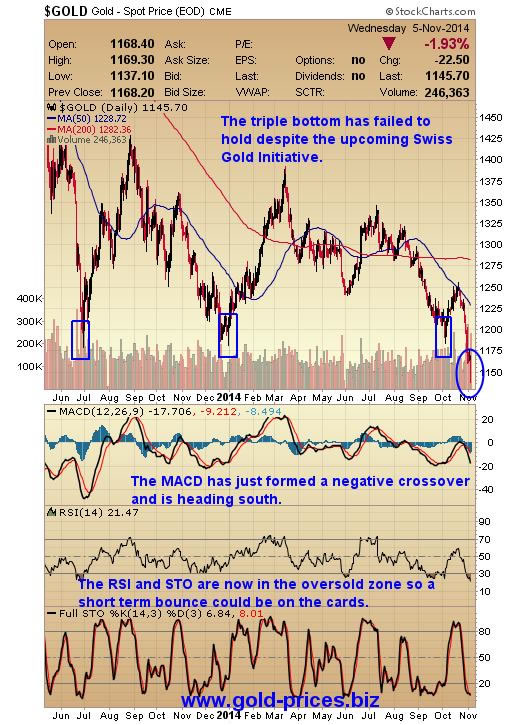

Chart of gold’s recent performance

The triple bottom has failed to hold despite the upcoming Swiss Gold Initiative, but there are still a few weeks to go and a week can be a long time in the precious metals arena.

Conclusion

The Swiss Federal Council and both houses of Parliament have already recommended voters to reject the motion and even in case of a yes vote, the proposal would have to be approved by a majority of Swiss Cantons and they have already indicated that they are against the motion.

Should it all go through then the amount of gold purchases that they have to make would effectively put a floor under the price, especially as the buyer doesn’t have a choice but to buy.

No doubt traders will be analyzing this situation and positioning themselves according in order to benefit from the outcome.

Our very humble opinion is that it is too early to tell which way this vote will go and even if the Yes camp win we don’t know what other powers may be invoked by the central planners in order to retain the status quo. The only certainty is that they won’t give up without a decent fight which could years to resolve.

Either way we expect more volatility in both directions in the precious metals market with the oscillations becoming more extreme in this tug of war over the power to govern.

This initiative is an important part of gold’s fortunes, but we would suggest that monetary policy, and the US dollar are more important and for that reason we will continue to short the weaker stocks, buy puts and retain the lion’s share of our funds in cash until gold completes its final capitulation process.

Got a comment, fire it in, especially if you disagree, the more opinions that we have, the more we share, the more enlightened we become and hopefully the more profitable our trades will be.

These are the key themes we are focused on at present, to find out more about what trades we are executing and how we are allocating capital in our model portfolio please visit www.skoptiontrading.com to subscribe.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.