Draghi Speaks the Truth; ECB Will ‘Do What it Must’

Interest-Rates / Quantitative Easing Nov 21, 2014 - 03:27 PM GMTBy: Gary_Tanashian

Words are important. This is not just a headline, it is a reality…

Words are important. This is not just a headline, it is a reality…

Draghi says ECB will ‘do what it must’ on asset buying to lift inflation

Not ‘do what it thinks would be the best course for the European economy’, not ‘choose the path of least resistance in guiding the financial system to recovery’… the ECB will DO WHAT IT MUST.

As I have written til I’m blue in the face for the last 10 years, we are in the age of ‘Inflation onDemand‘©, 24/7 and 365. “…do what it must”… let that sink in for a moment.

Japan is trying to kill the Yen, China is dropping interest rates and the world over we have a rolling inflationary operation that is little more than a game of Whack-a-Mole. BoJ popped up a couple weeks ago and now this one…

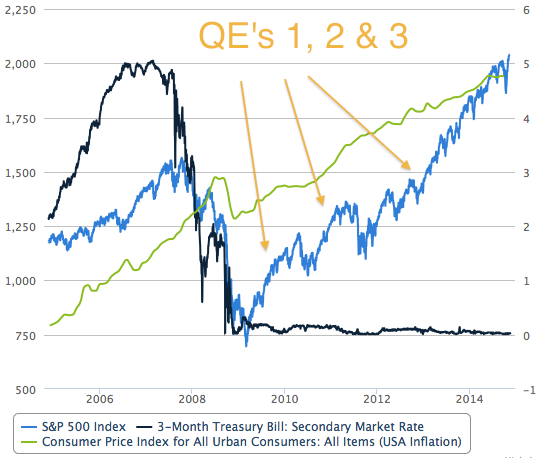

Transitioning to the country and policy making establishment that has truly shown ‘em how it’s done over the last 6 years, we view the S&P 500 with its eternal attendant, ZIRP and add a view of the CPI as well. One message that can be interpreted from this chart is that stock markets have been used (controlled) as a mechanism for asset owners to keep up with the reported effects of inflation (CPI). Saving has been disallowed, legislated by policy right out of the equation. Everybody into the pool, if you’ve got the bankroll to play.

We have maintained since the post 2012 lift off of the most intense phase of the inflated stock bull market that there is and has been no bubble in stocks (though they have become over valued* even by traditional metrics) but rather, a massive and ongoing bubble in global policy making.

First Alan Greenspan laid the groundwork and the initial blueprint (asset inflation), then his inflation operation was liquidated with extreme decisiveness and now, from the ashes we have a new global asset inflationary operation born not of good intention or rationally sound strategy. It is pure and simple desperation. The ECB will “do what it must”. The US Federal Reserve has done “what it must” since instituting ZIRP nearly 6 full years ago and through QE’s 1-3.

Straw Man

It sure looks like the whole debate about 2015’s coming interest rate hikes are another Straw Man stood up to manage market expectations (see Deflationary Straw Man), to give the impression that Policy Central is still in control and that they have decisions to make. There is no decision folks. The inflationary operation, now gone global, is an all-in, all-or-nothing’ proposition.

Greenspan’s inflation ended up being less than nothing. It was resolved in a sea of debits that assigned negative value to the system. The ongoing effects of inflation feel good to some people now (especially those who get to lap up the silver spoon’s gifts that keep on giving first and foremost as opposed to those savers and paycheck-to-paycheckers who just get to suck on ZIRP-eternity) but inflation is never a lasting benefactor. It is a subtractor over the years and decades as savings and productivity are replaced by money printing.

We will clip this post here and go on managing the market as always, taking what it gives, managing against what it is one day going to take and keep the big picture view in place at all times. That view very simply is that 6 years on from the US financial crisis (ongoing, though that is an unpopular notion at this time) a global cadre of policy makers are playing a transparent game of Whack-a-Mole trying to one-up each other until the whole thing flushes once again.

* Although it is worth asking the question ‘what is value today, anyway?’ when considering the constant inputs and distortions inflicted by policy makers. Anyone care to take a guess on that one?

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.