Gold New Bull Beginning?

Commodities / Gold and Silver 2015 Jan 23, 2015 - 01:01 PM GMTBy: Aden_Forecast

Gold ended 2014 essentially breakeven, being slightly down (1½%). It was a choppy year for gold and a bad year for gold shares.

Gold ended 2014 essentially breakeven, being slightly down (1½%). It was a choppy year for gold and a bad year for gold shares.

But it looks like the bear market may now be coming to an end. In fact, it could happen at any time.

The seemingly never ending fall in the oil price, the plunging euro and petro currencies, and weaker stocks all pushed safe haven buying to bonds and gold as the new year got started.

It's interesting to note that the soaring U.S. dollar ceased to keep downward pressure on gold.

We already started seeing this last month. And essentially the strength in the dollar has not affected gold since November.

This alone shows that a subtle but positive change has started.

Demand is Solid

In addition, gold demand has been up, and it continues to grow.

Hedge funds became the most bullish on gold since August.

And while fears that Russia will sell their gold prevailed, the contrary happened. Russia has been buying more gold.

We've been seeing the physical demand for gold increase around the world as central banks add to their gold reserves, with China leading the way.

And, according to our dear friend Chuck Butler, the NY Fed had a huge drop in physical gold last month.... down by 42 tonnes, leaving the Fed with the lowest amount of physical gold since the turn of the century!

It seems the Fed is giving gold back to several European countries who had their gold stored there.

Global Inflation?

It's certainly no secret that many central banks have been on an unprecedented stimulus program, like Japan. China is joining in too and so is Europe.

This rekindles concerns that global inflation could rise, in spite of ongoing low inflation around the world. But either way, the global situation is bullish for gold.

The big question on all gold investors' minds is, are the lows in the bear market behind us?

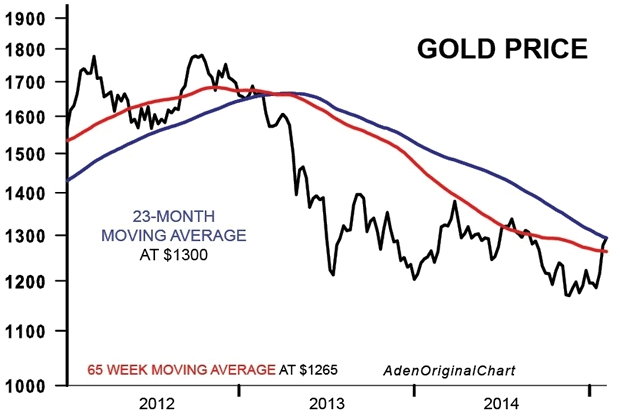

Only time will tell, but the strong start this year gives us the feeling that the lows are in (see Chart).

What To Watch

For now, if gold's firmness since November continues, and gold stays above $1200, it'll be doing fine. But if it stays above $1265 (the 65 week moving average), it'll be turning bullish, reinforcing that a further decline is unlikely.

Gold would then turn super bullish if it can manage to rise and stay above $1300, its mega moving average.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.