Is Gold Price Pullback Another Buying Opportunity?

Commodities / Gold and Silver 2015 Feb 13, 2015 - 06:21 PM GMTBy: Sy_Harding

There are reasons in the technical charts, in the fundamentals, and in investor sentiment, to believe gold is ready for at least a tradable bear market rally.

There are reasons in the technical charts, in the fundamentals, and in investor sentiment, to believe gold is ready for at least a tradable bear market rally.

In a January column, I noted that gold plunged 48% from its record high above $1,900 an ounce in 2011, to its low late last year, and was one of last year’s worst performers, down 15% for the year.

Not surprisingly, that had investors very bearish on gold’s prospects. BullionVault tracks online investor buying and selling of gold via its Gold Investor Index. It reports, “Gold investing sentiment fell to a five-year low among private individuals as 2014 ended”.

We all know the history of investor sentiment, excessive bullishness and confidence at market tops, and excessive bearishness and fear at market lows.

The problem is that extremes of sentiment only indicate there is potential for a change in market direction. There is no way of knowing what will constitute the ultimate level of either bullishness or bearishness in each cycle.

So we look elsewhere for clues.

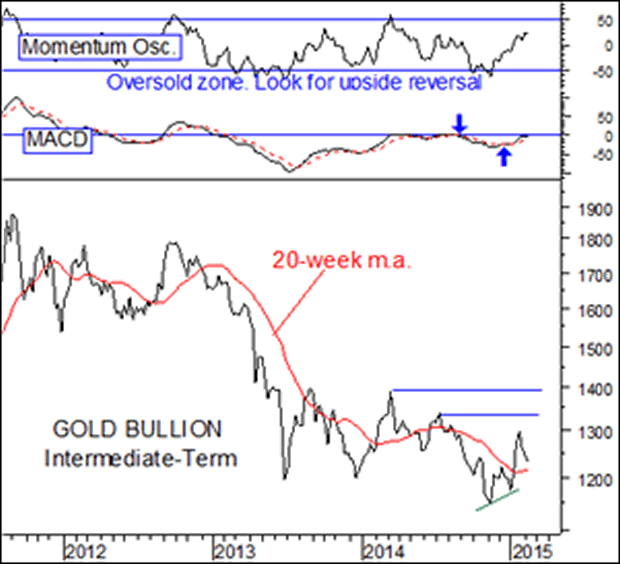

On the charts, our technical indicators remain on an intermediate-term buy signal for gold. Gold itself is rallying from a rising double-bottom (a higher low on its last decline), and has broken out above its 20-week moving average again. First levels of potential overhead resistance are at $1,340 and $1,400 an ounce.

Shorter-term, gold became somewhat over-extended above both its intermediate-term 20-week moving average, and its short-term 50-day m.a., making a short-term pullback likely.

That pullback has been underway. The jury is still out on whether it marks the end of another failed rally attempt, or is a normal pullback to retest support before resuming its rally.

However, this time around, in addition to the bearish investor sentiment and technical buy signal, gold has a few things going for it in the fundamentals.

For instance, India, the world’s largest user and importer of gold, imposed a tax on gold imports in 2013, which added to gold’s problems. The intent was to slow gold purchases in an effort to bring India’s current account deficit under control. The tax was successful in doing that, but at considerable cost to India’s important jewelry industry and its exports.

With the current account problem now under control, helped also by the decline in oil prices, India’s Trade Ministry is recommending that the government dramatically cut the gold import tax from the current 10% level to only 2%. Its objective is to revitalize India’s exports by lowering the raw material costs for India’s jewelry industry. Jewelry exports account for 13% of India’s total exports.

Additional positive news comes from the World Gold Council, which reports that gold purchases by global central banks surged last year to their second highest level in 50 years, and projects 2015 will see more of the same given the heightened global economic and financial uncertainties.

That said, in its short-term pullback from the overbought condition above its 50-day m.a., gold has broken fractionally beneath the m.a.

Before initiating new positions, it may be wise to wait and make sure gold does not break out of its encouraging rising trading band to the downside.

In the interest of full disclosure, my subscribers and I have positions in gold bullion via the SPDR Trust Gold etf, symbol GLD, and in gold mining stocks.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2015 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.