China’s Stock Market Mania; How High can Red-chips Fly?

Stock-Markets / China Stocks Apr 02, 2015 - 06:06 PM GMTBy: Gary_Dorsch

Recognized as the world’s single biggest attraction for high rollers at the gambling tables, Macau is the only location in the People’s Republic of China where betting on the Roll of the dice is legal. Macau is a just short ferry ride from Hong Kong, through which many mainlanders travel to get to the casinos. As such, the former Portuguese colony saw its annual casino and entertainment revenues soar to a combined $44-billion in 2014; or 7-times that of the Las Vegas Strip. For Macau, the boom times began in 2010 when casino revenues increased +58% and was followed by a +42% gain in 2011.

Recognized as the world’s single biggest attraction for high rollers at the gambling tables, Macau is the only location in the People’s Republic of China where betting on the Roll of the dice is legal. Macau is a just short ferry ride from Hong Kong, through which many mainlanders travel to get to the casinos. As such, the former Portuguese colony saw its annual casino and entertainment revenues soar to a combined $44-billion in 2014; or 7-times that of the Las Vegas Strip. For Macau, the boom times began in 2010 when casino revenues increased +58% and was followed by a +42% gain in 2011.

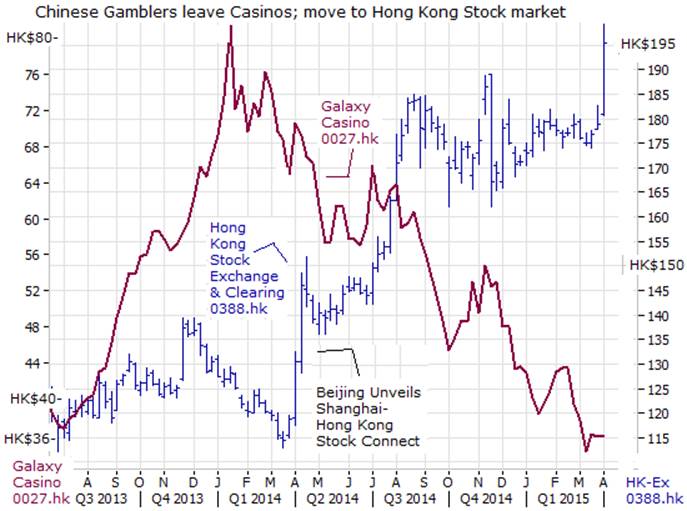

However, the share prices of the biggest gaming operators in Macau suffered their worst year ever in 2014, as Beijing launched a major crackdown on corruption and money laundering in the colony. Chinese President Xi Jinping’s bid to catch the mobsters scared off many of the high rollers, - the so-called “VIP segment” that accounts for about two-thirds of Macau’s casino receipts. Operators such as Macau Legend Development<1680.hk>, owners of The Landmark, MGM China Holdings <2282.hk>, Galaxy Entertainment <0027.hk>, which is building Galaxy I, Galaxy II and Galaxy III casinos on the Cotai strip, and multi-national casino operators, Wynn China <1128.hk> and Sands China <1928.hk>, lost a combined $73-billion of market value last year.

Macau is dependent on big spenders from the mainland, and in the month of December ‘14, the results of the crackdown were starting to show up on the casinos’ top line; revenues had fallen to $2.9-billion, posting a stunning -30% year-on-year decline. It was the seventh consecutive month of decline and the biggest drop since Macau began recording monthly revenues 10-years earlier. Casino operators had plans to expand their operations on the Cotai Strip, and transform it into a mass market of resorts. However, the VIP heyday in Macau appears to be over. Instead, much of the “hot money” that used to flow through Macau began sweeping through Hong Kong and into the Chinese stock markets.

While Beijing was busy cracking down on money laundering in Macau, it was also sanctioning its securities regulators, stock brokerage firms, overseers of the stock exchanges, and hundreds of high-tech engineers, to begin working night and day to launch the world’s third biggest casino, - dubbed “Shanghai - Hong Kong -Stock Connect.” It would allow global investors to trade Chinese Shanghai “A-shares” for the first time, through brokers located in Hong Kong, and mainland Chinese investors could trade Hong Kong’s ”H-shares” index via the Shanghai Stock Exchange, subject to quotas both ways. The combined size of the Chinese and Hong Kong markets is roughly $10.5-trillion today, behind only the combined $27-trillion size of New York Stock Exchange and Nasdaq.

Since April ’14, when the HK-Shanghai “Connect” was first announced to the public, there’s been an unprecedented level of coordination between multiple parties – including 100 banks and brokers, asset managers, the two exchanges, their clearing and settlement providers, data providers, technology firms and several regulators. The trading link has been hailed as a milestone in the opening up of China’s capital markets, allowing foreign investors to trade in and out of Chinese stocks in real time.

The HK/Shanghai stock-connect has added 855-companies with $1-billion+ (market cap) to the global investable universe, and has created the world’s 3rd largest equity market global by market-cap & turnover, only behind the NYSE and the Nasdaq. The southbound link of “Stock Connect” allows Chinese investors to trade 266 stocks of companies listed in the Hang Seng Composite Large-Cap and Mid-Cap Indexes that includes some “H-share” companies. Foreign investors with brokerage accounts in Hong Kong can now trade 568 Shanghai “A-shares,” through the northbound link.

By chasing the high rollers out of Macau and steering them into the Chinese stock markets, the fortunes of shareholders in Chinese casino and brokerage stocks was turned upside down. The share price of HK- Hong Kong Exchanges and Clearing (HK-Ex) <0388.HK> has soared by +63% compared with a year ago to HK$195 /share. HK-Ex is the sole operator of the stock market and futures market in Hong Kong, and also provide integrated clearing, settlement, and depository services. Its OTC Clear provides interest rate derivatives and non-deliverable forwards clearing and settlement services to its members. HKEx provides market data through its data dissemination entity, and also owns the London Metal Exchange. Stock Connect has boosted the average daily value of trading on the HKEx by +38% to HK$93-billion and its Empire has a total market capitalization of around $30.5-billion today.

On the flip side, the share price of Galaxy Entertainment <0027.hk> has lost more than half of its peak value to $20-billion today. Galaxy owns and operates the Star World Hotel and Casino – a luxury 5-star property on the Macau peninsula, and operates four City Club casinos in Macau. On March 23rd, the Macau government forecasted gaming revenue would fall -32% this year, compared with 2014. Worse yet, Macau’s Chief executive Fernando Chui, warned of a “New Normal” in which government regulation of the gaming sector would only increase. A full smoking ban in 2016 could weigh on VIP revenues.

Retail Investors Stampede into Shanghai Red-chips; According to the Chinese Zodiac, the year 2015 is called the “Year of the Goat.” People born in a Year of the Goat are generally believed to be gentle mild-mannered, shy, stable, sympathetic, amicable, and brimming with a strong sense of kindheartedness and justice. Although they look gentle on the surface, they are tough on the inside, always insisting on their own opinions. They have strong inner resilience and excellent defensive instincts. Though they prefer to be in groups, they do not want to be the center of attention. They are reserved and quiet, most likely because they like spending much time in their thoughts.

However, the share of good fortune for those born in a “Year of the Goat,” is not be very good. Instead, they often get involved in financial difficulties. Therefore, it’s advised that they should adopt conservative strategies when dealing with investments. They should try their best to increase their income, decrease their expenditure, and live within their means. They are advised to restrain themselves from gambling too much in order to avoid big losses.

However, the vast majority of traders that are operating in the Chinese markets these days, have no such inhibitions about gambling. Instead, they are feverishly bidding up red-chip shares on the China-300 Index, which has nearly doubled in value since the start of July ‘14. Chinese retail investors are flocking to the stock market, and they’re using margin loans to amplify (ie; leverage) the size of their investments. Buying on margin accounts for a fifth of daily turnover. Retail participation in Shanghai was always high. Over the last five years, retail investors accounted for 80% of A-share market turnover. This ratio hit 90% this year. About 4-million new account were opened in March, bringing the total to 182-million. Two-thirds of new investors have never attended or graduated from high school.

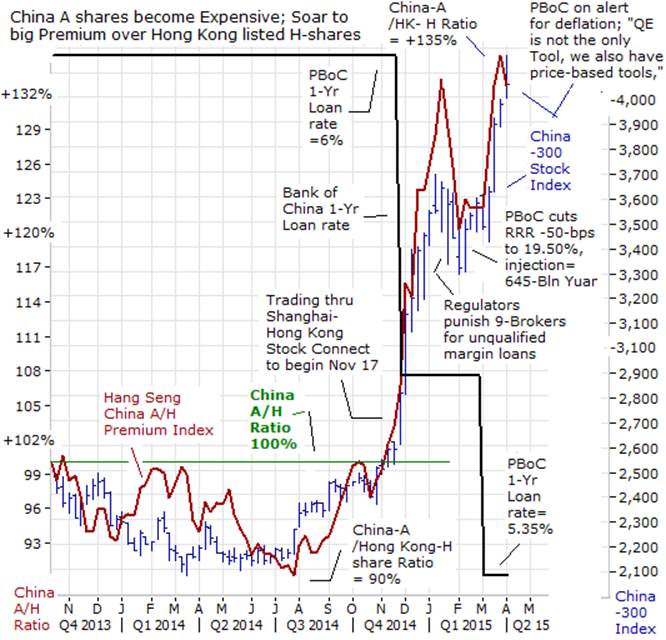

Many Chinese companies have dually listed shares in Shanghai (A-shares) and in Hong Kong (H-shares). Today, the A-shares are trading at a premium of +32%, on average, above their H-share counterparts (and above ETF’s on the US-exchanges). This indicates that arbitrageurs are not yet able to buy the cheaper shares in Hong Kong and sell those shares into the more expensive Shanghai market, thereby driving the premium to zero. One company’s A-shares and H-shares, while representing the same underlying assets and cash flows, are not yet interchangeable. To track this, the Hang Seng China A/H Premium Index measures the price spread between the Top-57 companies domiciled in Mainland China, and with A-shares listed in Shanghai and H-shares in the Hang Seng China Enterprises Index.

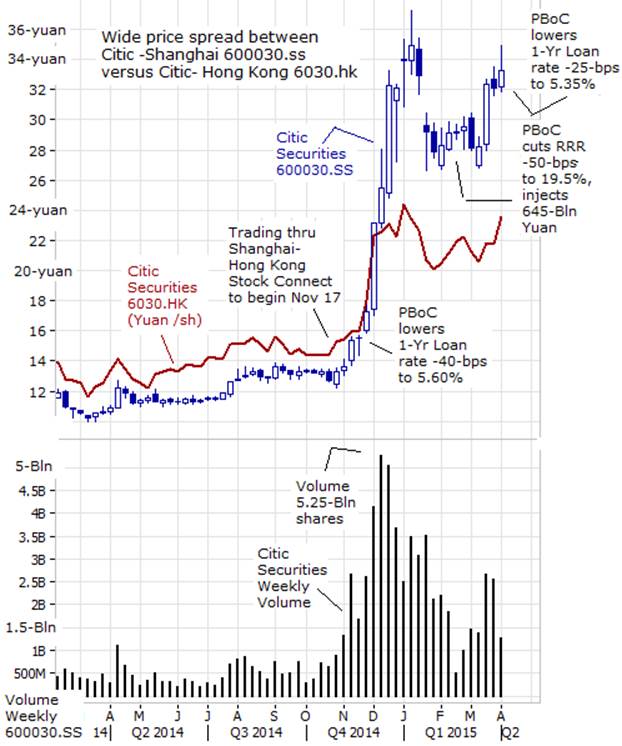

The superior performance of A-shares over H-shares since the launch of Stock Connect on Nov 17th, can also be seen by the price differential between the shares of China’s biggest stock broker, Citic Securities, traded in Shanghai under ticker symbol; <600030.ss,> and in Hong Kong, traded under symbol <6030.hk>. When converting Citic Securities H-shares into the yuan, - it’s easy to see the Shanghai price is nearly 10-yuan /share higher (ie about +50% higher). Trying to level the playing field, China’s Securities Regulatory Commission agreed on March 26th to allow mainland-based mutual funds to use “Stock Connect” to invest in the Hong Kong market. The Bullish news spurred risk loving traders to scoop up Hong Kong-listed H-shares, driving the index to its highest level in four years.

On Dec 29th, Citic Securities said it would issue of up to 1.5-billion of Hong Kong-listed H-shares to raise capital and help expand its businesses including margin trading in Shanghai. Haitong Securities, China’s second-biggest listed broker, has also announced a plan to raise HK$30-billion in a private share placement in Hong Kong, also mainly to expand margin loans. Citic says up to 70% of proceeds will be used for margin loans. On the Shanghai Stock Exchange alone, the amount of margin loans reached 684-billion yuan ($110-billion) more than double July’s 284-billion yuan.

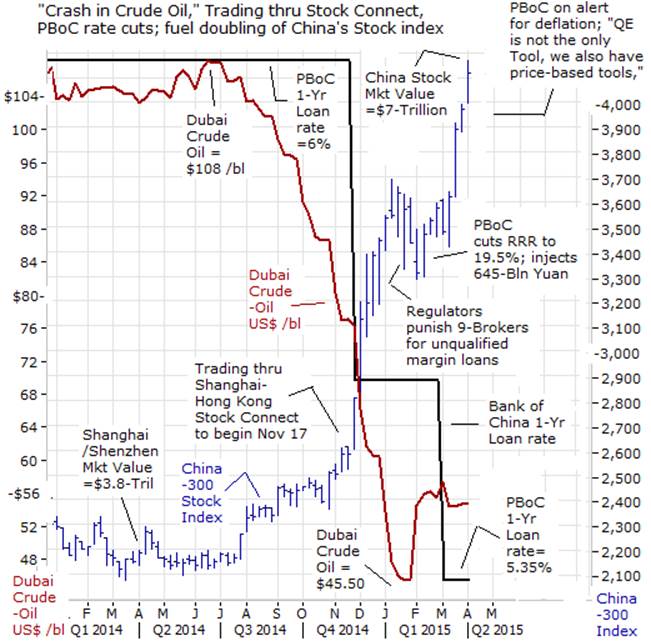

No Replay of Shanghai Stock Bubble of 2006-07; It seems like déjà vu all over again, with memories of the Jan-2006-- October 2007 Shanghai Bubble, still fresh in many traders’ minds. However, one dynamic that is very different this time around, - the PBoC is not trying to burst the Shanghai rally in 2015 with a tighter monetary policy. In fact, - it’s doing just the opposite, - it’s inflating the 2014-15 bubble with an easier money policy. It’s for this basic reason that many Chinese traders believe the recent doubling of the China-300 Index is sustainable over the longer term. That’s because the PBoC is currently fighting deflation, or steadily declining prices at the producer level, (-4.8% from a year ago), and can afford to inject more liquidity into the markets. The near doubling of the China-300 stock index is also the mirror image of the -50% “Crash in Crude Oil’ prices that began at the start of July ’14. Sharply lower prices for crude oil, petrol, grains, industrial metals, and other commodities are delivering a huge windfall to China’s economy, - the world’s biggest importer of natural resources, and Chinese households are enjoying the benefits of increased purchasing power.

By some estimates, Beijing will save as much as $200-billion this year on imports, even while it steps-up purchases of crude oil, copper, soybeans, rubber, and iron ore, --much of it piling up at the northeastern Dalian port and other trade gateways. China is saving over $600-million per day on its oil import bill, following the -50% plunge in crude oil prices since last summer. The windfall comes on top of China’s steady trade surpluses and $4.2-trillion in foreign currency reserves, that makes it easy for Beijing to spend $25-billion this year building up its reserves of grains, edible oils, and “other materials, ” a +33% rise over 2014 when stockpile-spending rose +22%.

The Commerce Ministry confirmed in a recent briefing that Beijing is boosting commodity imports to take advantage of lower global prices. Ramped-up purchases of oil are helping China reach its goal of a 90-day supply in its strategic petroleum reserve. Imports of iron ore rose +14% last year over 2013 levels, while prices plummeted -50%, for a saving of $30-billion. For copper, China increased its purchases +7% last year, while prices declined -20%. Some 400,000-tons of the copper purchased was stashed in its strategic reserve. Unlike other countries, China’s hasn’t depreciated its currency, so it gets the full benefit from buying less expensive commodities priced in US$’s.

Ironically, one reason for the 4-year Bearish trend in the commodities markets has been the notable slowdown in China’s economy, - from a +10% growth rate, on average, for the past few decades, to less than +7% this year. Officially, Beijing set a +7% growth target for 2015, which would mark the slowest expansion in a quarter of a century, if it came to pass. However, on March 15th, China’s Premier Li Keqiang admitted it would be a big challenge to meet that target. Yet in today’s markets, a sharp slowdown in China’s economy, and shrinking company profits, is no reason to sell Chinese equities.

Beijing Shifts to Easier Credit and Liquidity stance; On March 15th, China’s Premier Li Keqiang issued a rare “hot-tip” of advice, saying the ruling Politburo can do much more to allay fears about a stumbling economy. Li assured traders that policymakers would prop up the Chinese stock market, especially if economic growth is at risk of breaching a “lower limit.” “In recent years, we have not taken any strong, short-term stimulus policies, so we can say our room for policy maneuver is relatively big, the tools in our toolbox comparatively many. If the slowdown in growth approaches the lower-limit of a reasonable range, we will stabilize policies in the market, and at the same time, we will increase the intensity of targeted policy control,” Li said. Traders interpreted these remarks to mean that further cuts in interest rates and bank reserve requirements would be on their way in 2015.

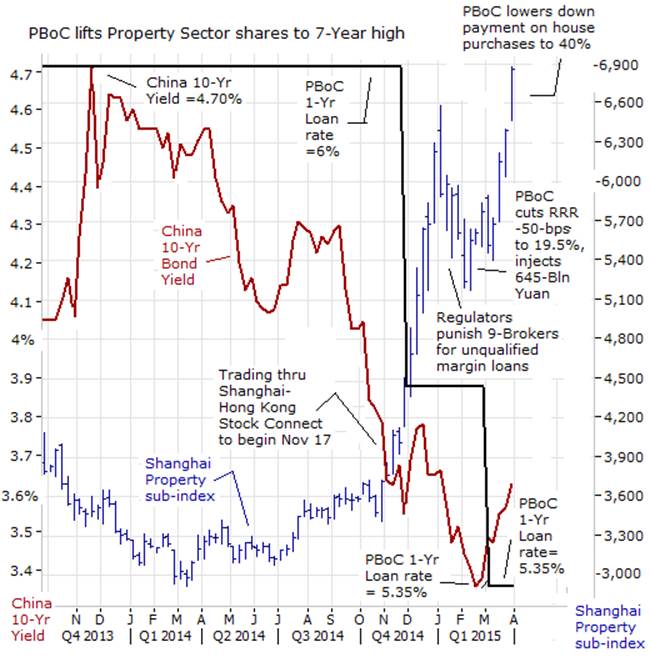

“China needs to be on alert for deflation,” PBoC chief Zhou Xiaochuan warned on March 30th, adding the central bank was also on the watch for deflation around the world, and falling commodity prices. “China’s inflation is declining. We need to be vigilant to see if this trend continues, and if it will lead to deflation.” On Feb 28th, the PBoC lowered its 1-year loan rate -25-basis-points to 5.35%, - its second rate cut in just over three months. The PBoC also made a system-wide -50-bps cut to bank reserve requirements to 19.5%, the first time it has done so in over two years, to unleash a fresh flood of liquidity to fight off economic slowdown and deflation. The reduction of -50-basis points can free up 600-billion yuan ($96-billion) or more held in reserve at Chinese banks - which could then mushroom into 2-to-3-trillion yuan of added liquidity floating in the economy due to the multiplying effect of bank loans.

On March 30th, the PBoC took additional measures to boost the local economy, it lowered the amount of money needed for a down payment to buy a house to 40%. The PBoC said on its website that all banks “are encouraged to offer commercial support to families to buy their own home with the down payment not lower than 40%.” All these measures - unleashed by the PBoC - helped to power Chinese stock indexes to a seven-year high. Real estate stocks included in the Shanghai composite property sub-index closed at all-time highs, even after Chinese property sales in the first two months of 2015 plunged -16% against January-February last year, amid a glut of housing supply. In other words, bad news on the economy is good news for stocks, if its leads to fresh liquidity injections.

Just how high can Chinese Red-chip stocks fly? It’s not wise to stand in front of a raging Bull in a China shop. But if history is any guide to the future, Shanghai A-shares did soar to a +95% premium over H-shares at the peak of the Chinese stock market rally in Oct-2007, before succumbing to the PBoC’s tightening of its monetary policy. This time around, Shanghai red-chips are +32% above H-shares, on average, and have the wind of PBoC easing at its back, so it wouldn’t be surprising to see the China-300 index climb above the 5,000-level in the year ahead, up from around 4,125 today.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Global Money Trends filters important news and information into (1) bullet-point, easy to understand reports, (2) featuring “Inter-Market Technical Analysis,” with lots of charts displaying the dynamic inter-relationships between foreign currencies, commodities, interest rates, and the stock markets from a dozen key countries around the world, (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, posted Monday and Wednesday evenings, with the latest news and analysis on global markets. To order a subscription to Global Money Trends, click on the hyperlink below,

http://www.sirchartsalot.com/newsletters.php

or call 561-391- 8008, to order, Sunday thru Thursday, 9-am to 9-pm EST, and on Friday 9-am to 5-pm.

This article may be re-printed on other internet sites for public viewing, with links to:

http://www.sirchartsalot.com/newsletters.php

Copyright © 2005-2015 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.