Economic Calendar Forecasts and Analysis: Week Ahead In US Financial Markets (June 16-20 2008)

Economics / US Economy Jun 16, 2008 - 04:35 AM GMTBy: Joseph_Brusuelas

The market will observe a healthy amount of macroeconomic data to be released during the upcoming five trading days. The major data that have the capacity to move the market will be the release of the PPI and housing starts data for May, both of which will be released on Tuesday. Fed talk for the week will be light and Fed Chair Ben Bernanke will speak before a Senate committee on healthcare and US competitiveness on Monday.

The market will observe a healthy amount of macroeconomic data to be released during the upcoming five trading days. The major data that have the capacity to move the market will be the release of the PPI and housing starts data for May, both of which will be released on Tuesday. Fed talk for the week will be light and Fed Chair Ben Bernanke will speak before a Senate committee on healthcare and US competitiveness on Monday.

The week will kick off with the publication of the June NY Fed survey of manufacturing conditions and the total TIC flows for April. Wednesday will see the release of the May industrial production data and Thursday will see weekly jobless claims, May leading economic indicators and the June Philadelphia Fed survey published.

| Economic Calendar US- Week Of June 16-20 | ||||||

| Date Time | Event | Survey | Merk | Actual | Prior | |

| 06/16/2008 08:30 | Empire Manufacturing | JUN | -1,5 | -2,6 | - - | -3,2 |

| 06/16/2008 09:00 | Net Long-term TIC Flows | APR | - - | 61,5 | - - | $80.4B |

| 06/16/2008 09:00 | Total Net TIC Flows | APR | - - | 35,00 | - - | -$48.2B |

| 06/17/2008 08:30 | Current Account Balance | 1Q | -173,5 | 175,00 | - - | -$172.9B |

| 06/17/2008 08:30 | Producer Price Index (MoM) | MAY | 1,00% | 1,10% | - - | 0,20% |

| 06/17/2008 08:30 | PPI Ex Food & Energy (MoM) | MAY | 0,20% | 0,20% | - - | 0,40% |

| 06/17/2008 08:30 | Producer Price Index (YoY) | MAY | 6,70% | 6,60% | - - | 6,50% |

| 06/17/2008 08:30 | PPI Ex Food & Energy (YoY) | MAY | 3,00% | 3,00% | - - | 3,00% |

| 06/17/2008 08:30 | Housing Starts | MAY | 980K | 970 | - - | 1032K |

| 06/17/2008 08:30 | Building Permits | MAY | 955 | 945 | - - | 978K |

| 06/17/2008 09:15 | Industrial Production | MAY | 0,10% | 0,00% | - - | -0,70% |

| 06/17/2008 09:15 | Capacity Utilization | MAY | 79,70% | 79,70% | - - | 79,70% |

| 06/19/2008 08:30 | Initial Jobless Claims | 14. Jun | - - | 380 | - - | - - |

| 06/19/2008 10:00 | Philadelphia Fed. | JUN | -11 | -13,64 | - - | -15,6 |

| 06/19/2008 10:00 | Leading Indicators | MAY | 0,00% | 0,00% | - - | 0,10% |

| Market Consensus Obtained Via Bloomberg | ||||||

Fed Talk

The week of June 16-20 will see a light week of Fed talk. Fed chair Ben Bernanke will speak on health care and US economic competitiveness before a Senate Finance Committee 16 June at 1000 AM EDT. That same day Richmond Fed President (non-voter) will address the economic outlook at 1:00 PM EDT. San Francisco Fed President Janet Yellen will provide the opening remarks before the SF. Fed's “Asian Financial Crisis Conference.”

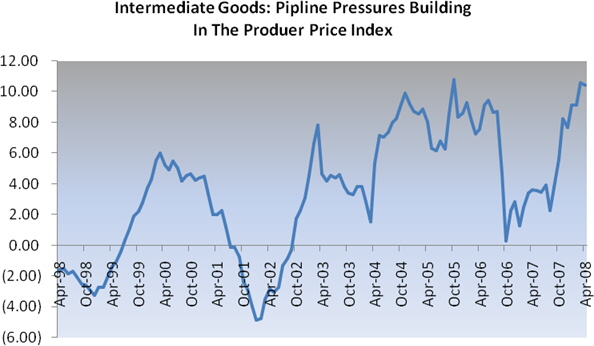

Chart of The Week

Empire Manufacturing (June) Monday 08:30 AM

We anticipate that the general business conditions headline inside the New York Fed manufacturing index will see the fourth negative reading over the past five months. The combination of the continuing surge in oil and commodity prices should provide the impetus for the dour outlook inside the domestic manufacturing sector. In addition, we expect that the lack of demand for new orders could weigh heavily on purchasing managers sentiment and is the source our expectation that the risk for the month is to the downside. Our forecast implies that the headline should move -2.6 for the reporting period.

TIC Flows (April) Monday 09:00 AM

The TICS flows for April should reflect the general view of the market that the economy did not fall into a free fall following a very difficult month of March. Although, the economy through the first month of Q2'08 did not illustrate any significant growth, the fact that it did not collapse shaped market sentiment during the period. We expect that the purchase of net long term securities will fall to $61.5ln and the monthly net TIC flows will increase to $35.0bln vs. the -$48.2bln recorded previously, with the risk for both to the upside.. The net short sale of securities in April was a reflection of the market disturbance surrounding the collapse of Bear Stearns in March. The April data should reflect the modest recovery from the unease that prevailed during the previous month.

US Current Account Balance (Q1 2008) Tuesday 08:30

We expect that the current account balance-the combined balances on trade in goods and services, income and net unilateral transfers-in Q1'08 fell to -$171.0bln. We anticipate that the improvement in net exports and the surplus in income payments due to a decline in payments to the external sector on their US investments. The trend in the improvement in the current account should continue through mid year and then flatten out on the back of the lagged impact of the modest improvement in the dollar and its impact on net exports. Based on Q4'07 data the US still must import $1.9bln a day to finance the gap in the current account.

Producer Price Index (May) Tuesday 08:30

The producer price index should reflect the strong move in input prices that have been observed over the past few months. Outside of the apparel and auto sector, prices have begun moving in a direction indicating inflation. The cost of residential gas increased 4.9% y/y and gasoline climbed 9.2% over that same time frame. Of more than passing interest to the market will be any revision in the gasoline component that the Labor Department had falling -4.6% for the month of April. Total intermediates continue to demonstrate pressure in the pipeline and were up 10.5% overall and the core ex food and energy are up 5.8% over that same time frame. We expect that headline producer prices will increase 1.10% m/m and 6.70% y/y and the core should climb 0.2% m/m and 3.0% over that same period.

Housing Starts/Building Permits (May) Tuesday 08:30

After a surprise increase in starts, which were inspired by a transitory surge in the building of multi-family dwellings, we have no doubt that the usual suspects will be calling for a turnaround in the market. We disagree. The absolute level of supply on the market and the expectation of the 2.0mln plus wave of foreclosures that will hit the market over the next two years should reassert their influence over the market and move to suppress the speculative appetite of the building community. Our forecast indicates that starts should fall to 970K and permits should decline to 945K for the month.

Industrial Production/Capacity Utilization (May) Tuesday 9:15

We expect that industrial production to continue to fall flat in May when our forecast implies no change in manufacturing activity and a capacity utilization to remain unchanged at 79.7%. The malaise in the auto sector and relatively restrained domestic demand for consumer goods should continue to offset the still strong demand from the external sector for industrial materials. The swing sector, as it always is with the change of seasons, will be demand for utilities. However, the early arrival of summer heat will not provide a net impact on total production until the June sampling period, and we think that the risk is to the downside for the month of May.

Initial Jobless Claims (Week Ending 14 June) Thursday 8:30

The claims data reasserted its upward march for the week ending 7 June and we expect that the data should see a modest correction to 380K. The week ending June 14 is the final sampling period for the June payrolls period and the market will be closely observing the evolution of the continuing claims series. We expect another increase in the series and expect a move above 3.15mln for the week.

Philadelphia Fed (June) Thursday 10:00

We expect the seventh consecutive reading indicating contraction in the manufacturing sector inside the Philadelphia Fed survey of manufacturing activity for the month of June. Our forecast implies that the headline will arrive at -13.64 for the month. We do urge our clients to recall that due to the unique composition of the Philadelphia Fed's survey, its headline general business activity question is not linked to the underlying components. Thus, we do expect that the increase in the prices paid component and a sixth straight negative reading in the new orders component may not be reflected in the June headline. That will have to wait until the July survey, when we expect another strong downside move in the headline.

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.