Flatline Investing and Dead End Debt Schemes

Stock-Markets / Stock Markets 2015 Jun 27, 2015 - 12:37 PM GMTBy: Doug_Wakefield

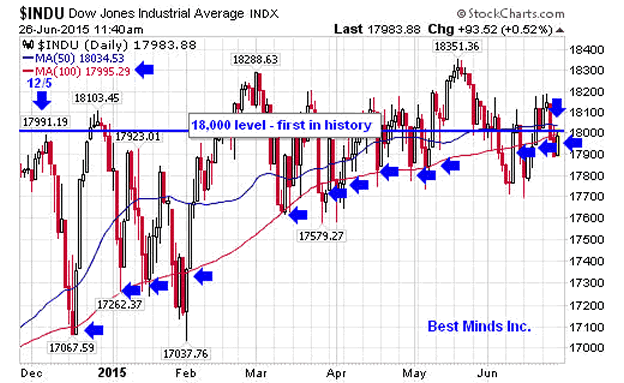

Next Tuesday is the end of the first half of 2015. As of today, the Dow has once again rallied up to break the magical 18,000 line, holding this level after coming within inches of this level for the first time on December 5, 2014....now 139 trading days ago.

Next Tuesday is the end of the first half of 2015. As of today, the Dow has once again rallied up to break the magical 18,000 line, holding this level after coming within inches of this level for the first time on December 5, 2014....now 139 trading days ago.

Does this mean that the patient is about to flat line, yet rather than this being a huge negative; we will merely turn off the speed of light algos, close down the "assistance", and watch the Dow 18,000 live on into perpetuity?

Does this mean that with enough central bank planning and political meetings, whether US stocks or Greece finances, that everything will eventually lead to lasting happiness, a world of constant wins, and no risks to worry about?

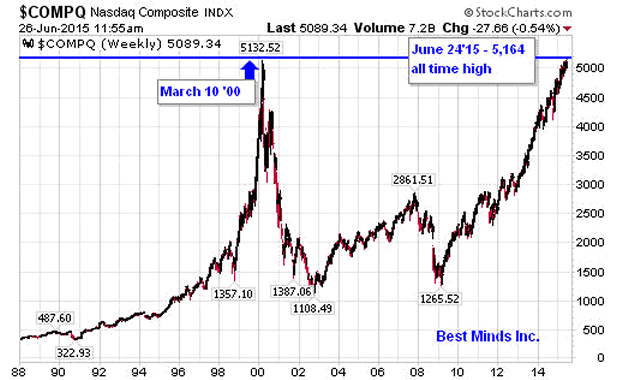

Or does the NASDAQ Composite's break to "all time high" cause us to pause, remembering what happened the last time we were here in 2000?

Yes it may appear nice to have a market that seems completely removed from fear by any daily headlines, geopolitical crisis, or economic reality any more, but do we also remember that one cost in this drama was the tripling of the US national debt since the last time "the patient" was at "all time high" 2000?

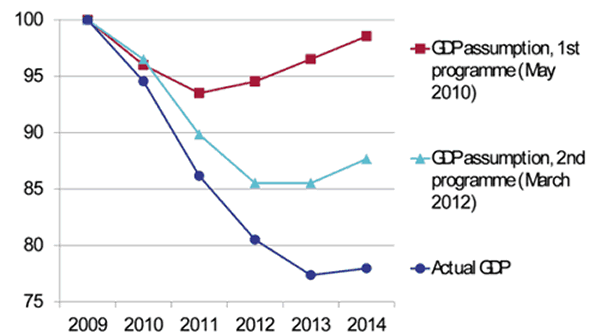

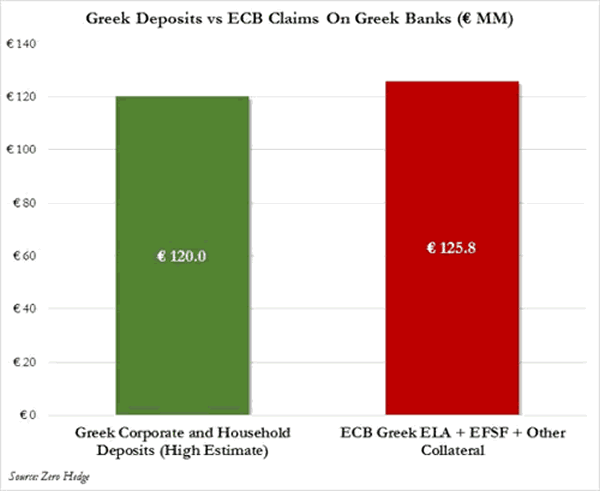

So while after weeks of dealing with realities like huge short-term loans from European central banking institutions to cover the rising level of money exiting the banks of Greece, and a slowing economy since this experiment in global/political leaders started in 2010, we will go into the weekend with the possibility of learning once more at the final of the final until there is a final deal to kick this can down the road some more....the global/political establishment has once again come to "the rescue".

[Source - Zero Hedge, June 21 '15]

[Source - Zero Hedge, June 25 '15]

Greece Crisis - Merkel Says Eurogroup Talks Will Be Decisive on Saturday, The Guardian, June 26, '15

Troika Offers Greece Third Bailout Program, Prepares Emergency Plan If No Deal, Zero Hedge, June 26 '15

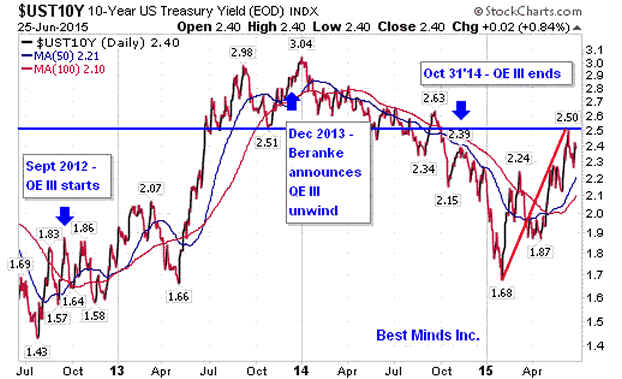

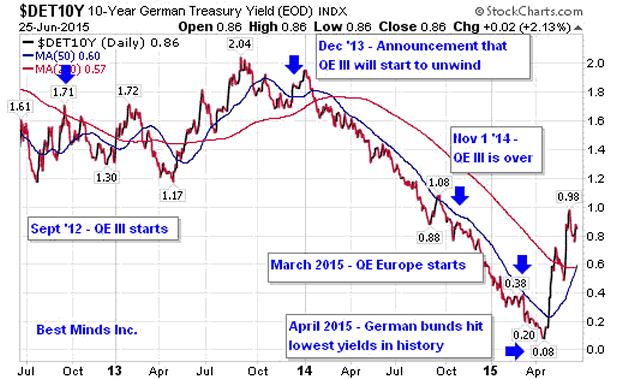

Yet, as we get past the latest crisis that only a group of global/political central planners can save - you know, telling nations to cut expenses, sell asset, and raise taxes so we will give you more debt - the debt markets themselves, twice the size of the equity markets, don't look too pleased with what has been unfolding.

The crowds in the bond markets seem to be saying, there are REAL consequences from playing with the idea of unlimited bailouts, based on unlimited debt.

Treasuries - Long Dated Yields Hit Nearly 9 Month High on Hopes of Greece Deal, CNBC, June 26 '15

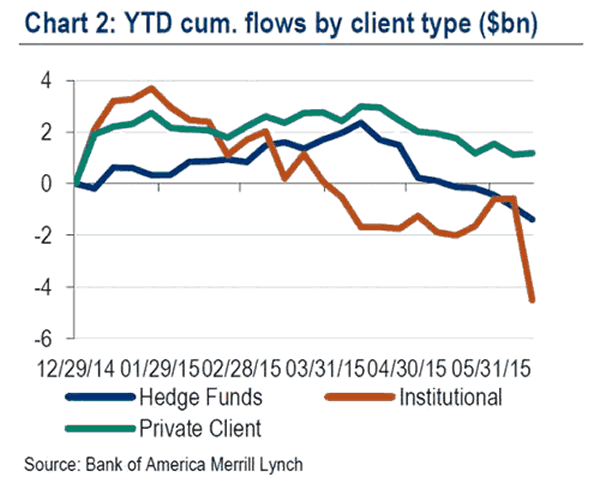

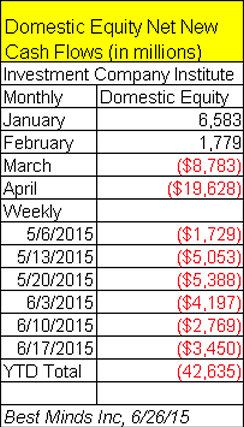

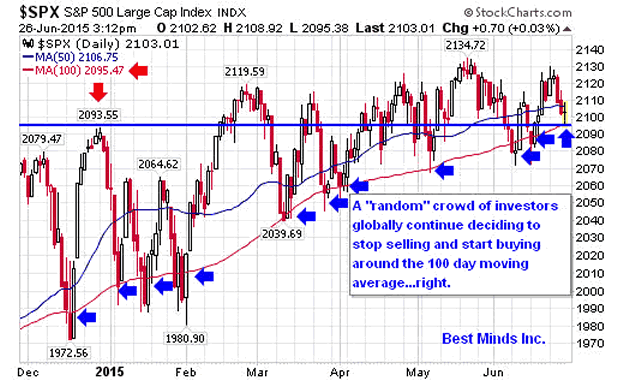

So while someone continues to "assist" the "random" crowd in American equities, supporting the illusion that flatline is better than hard decline, there are those that continue to show serious doubts about this scheme, and have been increasing their speed toward the exit of this madness.

Smart Money Just Sold The Most Stocks in History, Zero Hedge, June 23, 2015

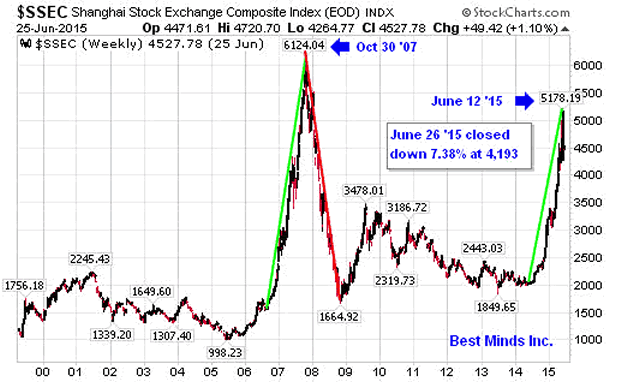

And across the ocean in China, the crowd of new investors pouring into the casino for the new ride up, are once again learning the lessons from '06/'07, that until recently, had been old history, and not worth considering during the party of "unlimited riches".

[Source - Zero Hedge, April 28 '15]

China's Market Selloff Accelerates, WSJ, June 26 '15

"China's stock markets plunged Friday, a sharp turnaround after a year of strong gains, as investors start to question the sustainability of that breathless rally.

China's smaller Shenzhen market has fallen 20% from its recent peak, entering bear territory, while the Shanghai market has dropped nearly as much from its high earlier this month."

So while a "rescue" from the Troika to Greece might continue the media narrative of "global political/banking elites save stock investors" a little longer, the period of investment heaven by constant zapping of the global markets by central banking bailouts, could soon turn into a period of investment hell.

There are ways to make money in the period ahead, but it will not be smooth and backed by constant intervention. We have trusted in a centrally planned rally too long. Soon, buy and never sell, will be turned over to watch, trade, and expect high volatility.

"A crash is a collapse of the prices of assets, or perhaps the failure of an important firm of bank....The system is one of positive feedback. A fall in prices reduces the value of collateral and induces banks to call loans or refuse new ones causing mercantile houses to sell commodities, households to sell securities, industry to postpone borrowing, and prices to fall still further. Further decline in collateral leads to more liquidation." - [Manias, Panics, and Crashes: A History of Financial Crises, Fourth Edition (2000), Professor of Economics at MIT, Charles P. Kindleberger,]

Charts from Zero Hedge in this article:

Greek GDP: The Shocking Reality Vs IMF Forecasts; And Who Is To Blame For The Greek Implosion, ZH, 6/12/15

Bundesbank Slams ECB's "Bridge Financing" to Greece, ZH, 6/25/15

Smart Money Just Sold The Most Stocks In History, ZH, 6/23/15

Chart of the Day: Over 4 Million New Chinese Trading Accounts Opened Last Week, ZH, 4/28/15

Being a Contrarian, Remembering 2000

The big shift from longs to shorts and shorts to longs continues to rumble, a warning that continues to grow louder with each passing week now.

Click here to start the next six months reading the newsletters and trading reports as we come through this incredible year.

With the NASDAQ Composite finally breaking its March 10, 2000 high on Thursday, April 23, 2015, I really cannot think of a better time to benefit from independent, contrarian research.

On a Personal Note

I have recently started a blog called, Living2024. It is a personal blog, not business. I wanted to have a place to write some deeper stories about where this entire drama seems to be taking us all. Check out my latest post, A Centrally Planned Sex and Financial Life.

Doug WakefieldPresident

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2011 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.