Gold and Silver Greece and Short Positions

Commodities / Gold and Silver 2015 Jun 29, 2015 - 02:20 PM GMTBy: Alasdair_Macleod

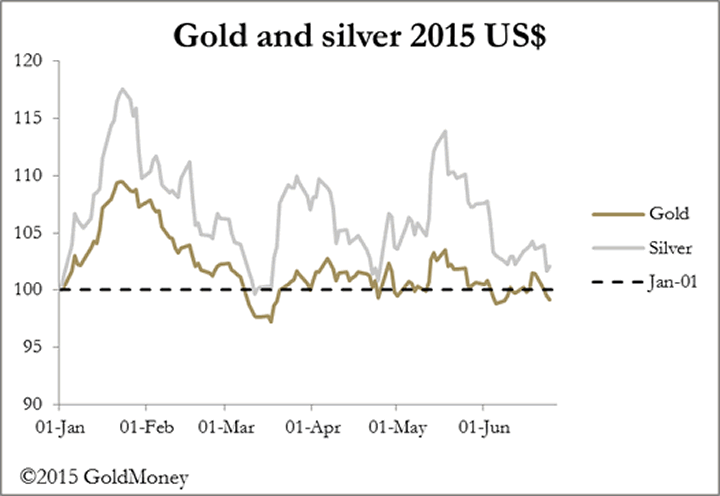

Hedge funds and high-frequency traders have finally forced gold into a US dollar loss this year as shown in our introductory chart, but silver is still in positive territory. This week gold declined $29 with a break from the $1200 level to $1171, and silver fell 40 cents to $15.70 early this morning in European trade.

Hedge funds and high-frequency traders have finally forced gold into a US dollar loss this year as shown in our introductory chart, but silver is still in positive territory. This week gold declined $29 with a break from the $1200 level to $1171, and silver fell 40 cents to $15.70 early this morning in European trade.

As I wrote last week, in the run-up to the half-year precious metals' prices face a conflict between window-dressing for the lowest possible valuation, and the systemic risk that is Greece. The window-dressing motive is still there, but the pressures from Greece lessened on Monday when everyone thought a deal had been agreed, leading to a relief rally in equity markets and a corresponding fall in gold. As the week progressed it became clear that the proposed deal was not acceptable to the troika* of the IMF, ECB and the European Commission, but precious metals continued to drift lower.

Understandably, the troika observed that the Greek government's proposals were harmful to the economy and ultimately will make her debt less secure. The lack of resolution therefore increases Greece's systemic risk, making precious metals more attractive as a hedge.

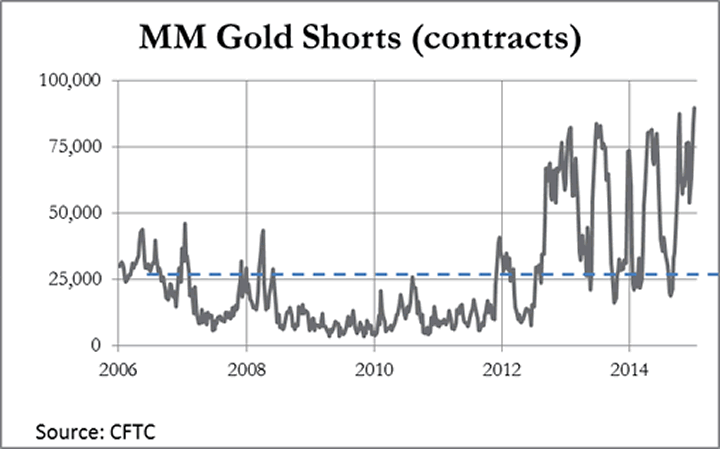

But not for now it seems. Monday's false hopes of a Greek resolution allowed the bears on Comex to drive gold and silver prices lower, which suits both commercial traders and money managers. The position however has become extreme, with money managers' short positions the highest they have ever been. This is shown in the next chart, which is updated to 16th June (the dotted line is the long-term average for reference).

In the last ten days Open Interest has risen by an extra 21,000 contracts, which suggests that Managed Money shorts are even further into record territory, as much as 100,000 contracts. At the same time, Managed Money long positions are only a little below average, suggesting some hedge funds do have an eye on systemic risk.

The extreme short position is therefore controversial with a minority in the investment community. Monitoring sentiment generally, we find a growing influential minority of big investors expressing serious concerns over the failure of monetary policy and the distortion on market valuations. These sentiments appear to be reflected in speculative hedges in precious metals on Comex. The preponderance of sellers has given the big four commercial traders an opportunity to reduce their shorts to a level book, which is significant given their historical net short position has averaged over 90,000 contracts. Swaps, mainly representing bullion banks hedging risk elsewhere, have also reduced their exposure to historically low levels.

Market sentiment is therefore telling us the shorts are like lambs, which as they put on weight are getting closer to their appointment with destiny. The potential for a bear squeeze against money managers short of gold futures is greater than it has ever been. Market insiders, whose greatest risk is always from sharply rising prices, have squared their books telling us that they see this risk as well.

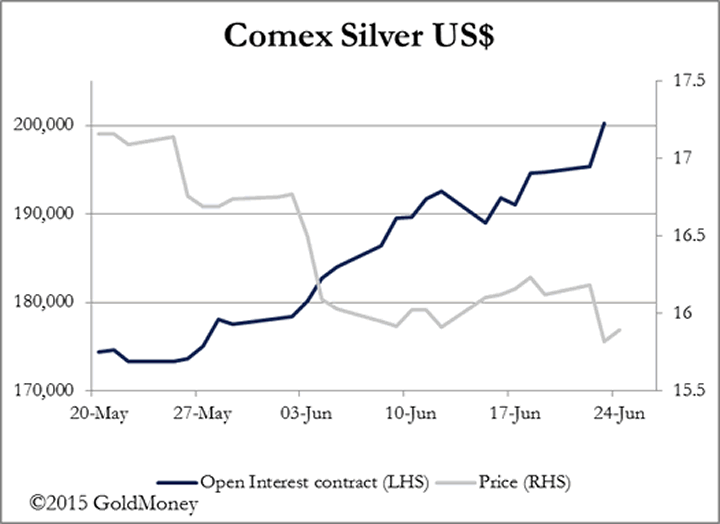

Meanwhile Open Interest in silver is not only at an all-time record, but continues to rise on falling prices, which is our last chart.

This is very unusual. Normally, Open Interest rises in phase with the price; instead it is rising on a falling price. In this case, Commercials including Swap Dealers have cut their net shorts by betting against new Managed Money short positions. The result is that outstanding bets in this market now exceed a billion ounces, not only a new record by far, but 115% of annual global mine production.

Next week

Monday

UK: Nationwide House Prices, BoE Mortgage Approvals, Net Consumer Credit, Secured Lending, M4 Money Supply, GfK Consumer Confidence.

Eurozone: Business Climate Index, Economic Sentiment.

US: Pending Home Sales.

Tuesday

Japan: Construction Orders, Housing Starts.

UK: Current Account, GDP (3rd Est.), Index of Services.

Eurozone: Flash HICP, Unemployment.

US: S&P Case-Shiller Home Price, Chicago PMI, Consumer Confidence.

Wednesday

Japan: Tankan Survey, Vehicle sales.

Eurozone: Manufacturing PMI.

UK: CIPS/Markit Manufacturing PMI.

US: ADP Employment Survey, Manufacturing PMI, Construction Spending, ISM Manufacturing, Vehicle Sales.

Thursday

Eurozone: PPI.

US: Initial Claims, Non-Farm Payrolls, Unemployment, Factory Orders.

Friday

Eurozone: Composite PMI, Services PMI, Retail Trade.

UK: CIPS/Markit Services PMI.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.