Silver Tunnel Vision 'Experts'

Commodities / Gold and Silver 2015 Jul 01, 2015 - 01:05 PM GMTBy: Dan_Norcini

Over the past month, we have been subjected to one breathless article after another predicting a huge upside blowout in silver as "the trapped shorts are forced out".

Over the past month, we have been subjected to one breathless article after another predicting a huge upside blowout in silver as "the trapped shorts are forced out".

"The rise in open interest to a record high, even higher than when silver was trading near $50, tells us that some big money is going into silver and it is just a matter of time before the shorts are given a religious experience".

Thus would the summation be of the crux of the silver perma-bull "analysis".

Now that silver has fallen apart, maybe there is a lesson to be learned. This jibberish started when silver was trading above $17.00 and continued as the metal began to fall lower and lower.

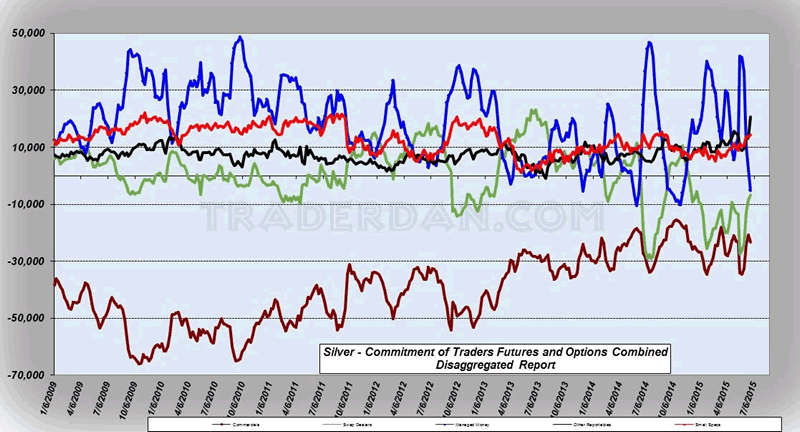

We have sent up articles here at the site noting the breakdown of the various players as laid out for us by the Commitments of Traders reports. We especially focused on the positioning of the Swap Dealers, whose record when it comes to trading silver is unparalleled. Their building of a huge short position was a warning sign that the metal, when it moved, was NOT going to move higher, but was going to move lower, much to the consternation and dismay of the silver bulls, whom truth be told, can be even more obnoxious at times than the gold cult members.

One particular "analyst", seems to have a penchant for perpetually whining about those who short the silver market. In his mind, silver is undervalued and therefore anyone who has the opposite opinion, is turning a blind eye to what in his view is something that must be taken to the authorities, namely, illegal price manipulation.

Never you mind that all of the rest of the industrial metals are moving lower. Silver, according to the perma-bulls, MUST move higher. That it is not, is just more proof that it is illegally manipulated.

What a wonderful line of thought! It leaves the "analyst" and those who embrace his or her opinion completely blameless when his or her calls for higher prices never materialize. It's a win-win - for the analyst that is.

If the price rises, the analyst can boast about how market savvy he or she is and thus attract more paying subscribers to their newsletter. If the price falls, then the same analyst can simply blame his failed predictions on the "illegal price manipulation". Thus, there is never any admission of error. That enables the same individual, who otherwise should have been discredited after making so many false predictions, to retain their credibility and keep on building a following.

One wonders how many people bought into silver recently after reading the articles by those pointing to the record open interest build as somehow meaning that a huge price rise was just around the corner and that the "evil silver shorts" were finally going to get their deserved comeuppance.

So what is the lesson in all this? That the gold cult and silver cult members are going to be constantly calling for higher prices? No, that it is as certain as the sun rising in the East. No amount of facts or understanding of technical analysis will ever get this bunch to change their stripes. Once a member in the cult, it is no longer about making strategic investment decisions or trading positions. It is all about being "committed to the cause" of "ending the farce that have become our markets".

I should add here that it is a "farce" only because the price is not going in the direction that they hope it will go. When the price does rise, the market is functioning "correctly" in the view of so many of these cultists. When it does not, it is a "farce".

It is frightening to me how this phenomenon works. Otherwise intelligent, rational people, who ought to approach investing or trading with the objective to make money and earn a return on invested capital, seem to collectively lose their sanity when it comes to these precious metals. Instead of reading a simple price chart, and making decisions based around that, they instead embrace a "gloom and doom" vision and let that mindset inform every single one of their investment decisions.

I have said it more times than I can recall and have written it more times than I can recall - investing and trading is about making money. Anything that short circuits that GOAL is self-defeating and should be avoided. Some eventually learn this, the hard way, after losing large sums of money listening to these bozos. Some however never do. They continue arguing why they are "right" and the rest of us are wrong no matter how great their losses become. For them, to actually close out a losing trade or losing investment, is akin to heresy and apostasy from the faith. How sad yet how completely unnecessary.

The question any would be investor or trader needs to ask themselves is very simple - "Is my net worth from my investing/trading decisions greater than it was last year at this time or not?

If not, then the next question should be, "Why not? In every case the answer will be the same:" you did not listen to the price chart but chose instead to listen to a self-appointed expert".

This is what we try to do here, namely, teach you how to read and interpret a chart and get a sense of the sentiment at work in those markets. The charts detect any shift in sentiment and being on the correct side of that sentiment is how you make money. It is that simple.

Now sometimes it is easier said than done, especially when markets are in choppy phases and can flip back and forth, often without much rhyme or reason. Those markets should be avoided except for all but the most seasoned traders and those with a very short term trading objective. That being said, once a support level is taken out, do not argue with it. The same goes for a resistance level that is taken out. Both gave way for a reason. Do not fight the reason!

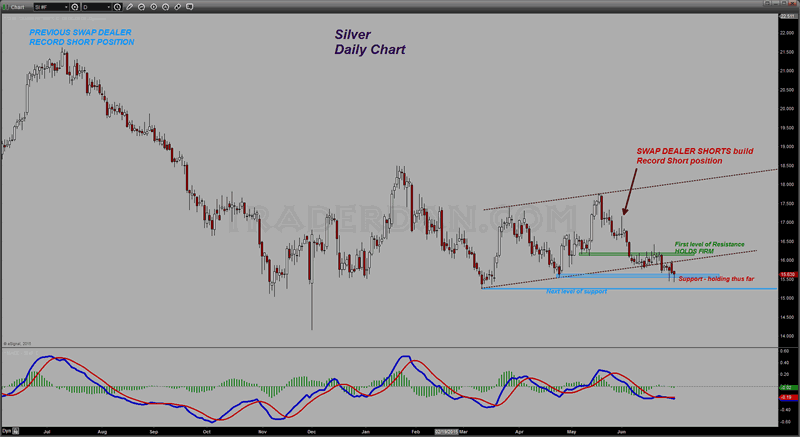

Back to silver however - here is the latest price chart.

Silver Daily Chart

Notice the Swap Dealer short positions at key chart points. In both cases, the market fell. In the most recent case, the market tried to rally back up but strong selling emerged between the $16.50-$16.25 level. The COT reports show us that was hedge fund selling as they were trapped on the long ( and WRONG) side of the market and began liquidating using the rally to get out as well as establish some new short positions. Meanwhile, the Swap Dealers were quietly buying back their short positions and making money.

Silver COT

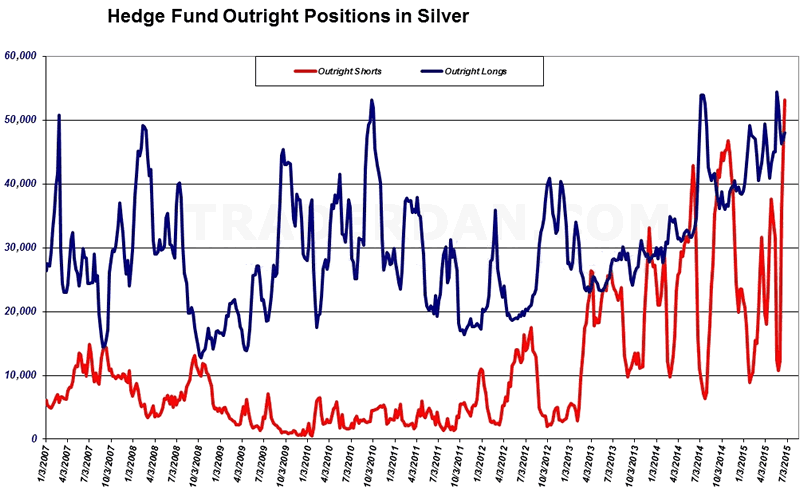

It is interesting to see the outright positions of the hedge funds in silver, which had built up a record long position only to have the market crash lower on them. Look at how they are now starting to liquidate those longs and come back in on the short side. Keep in mind that all of this is extremely profitable for the Swap Dealers!

Hedge Funds Outright Positions in Silver

Where silver goes from here is unclear. We make no predictions here. What we are watching instead is the chart to see whether or not it can stay above broken support (so far it is managing to do so) or whether it will move lower yet to the next level of support and test that.

One thing however that is important. As mentioned in an article yesterday - silver requires an inflationary bias if it is to perform well to the upside. It has clearly shown us that in a deflationary/slow growth/anemic growth environment, it does not do well at all.

Then again, neither do any of the rest of the industrial metals.

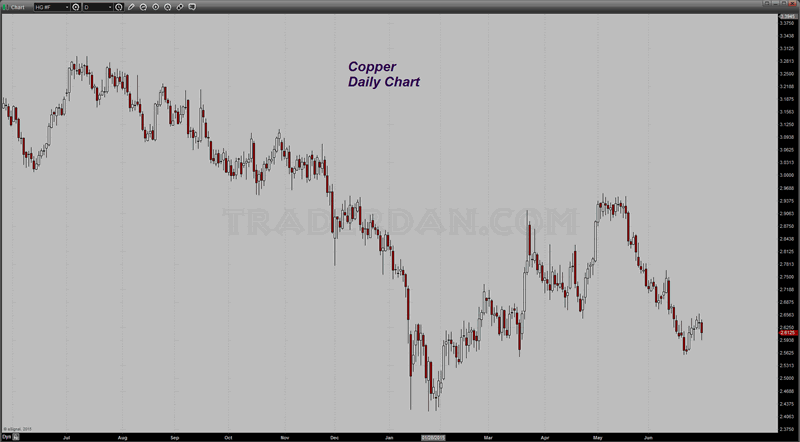

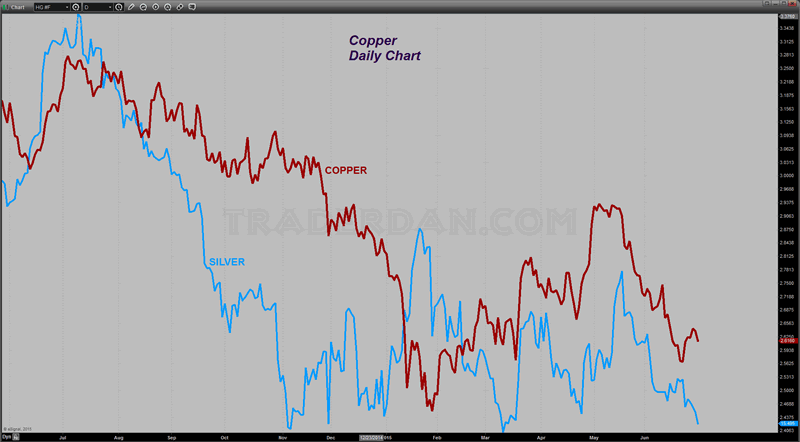

For example, here is a chart of copper.

Copper Daily Chart

Would anyone like to argue that this chart is decidedly bullish? I did not think so. The question for the tunnel vision "silver experts" is a simple one: "why should silver prices be expected to undergo some sort of huge upside rally when the price of copper (and gold) are both going down?"

Copper and Silver Daily Chart

As you can see from the chart, while there are indeed periods when silver will deviate from copper, the linkage between the two is close enough the majority of time that it is foolish to ignore it when approaching the silver market.

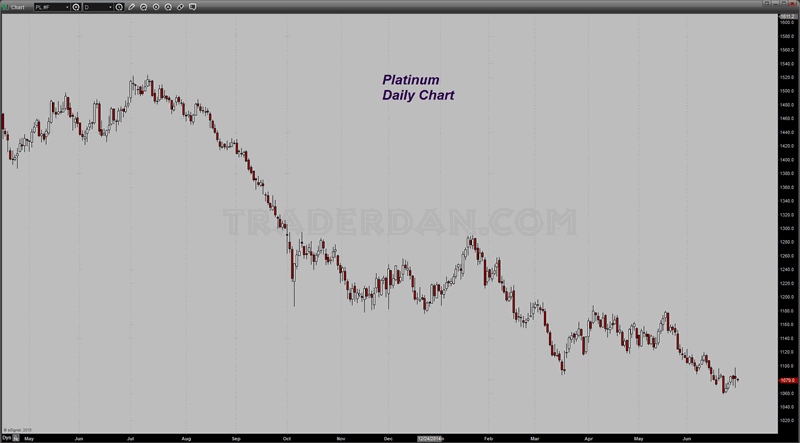

Platinum Daily Chart

Here is another chart. this one is of Platinum, one of those metals which is similar to silver in the sense that it can be regarded as both an industrial metal and a precious metal. What does its chart tell you?

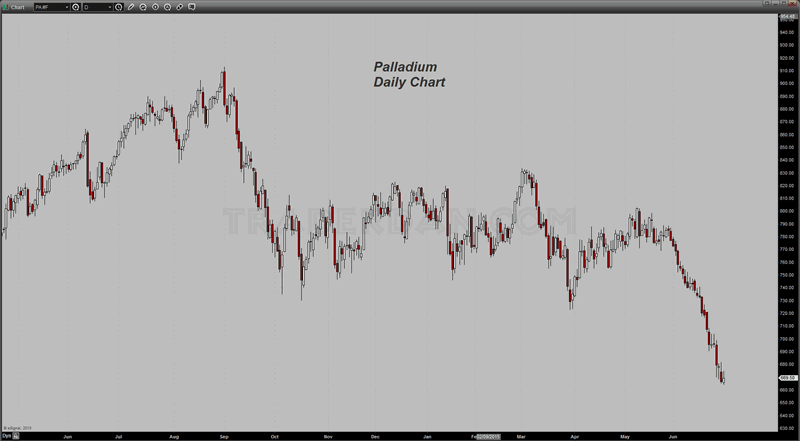

Palladium Daily Chart

One more chart - this one is of Palladium, a sister metal to Platinum with both industrial uses and sometimes used as a precious metal as well. Which way is the trend?

What I wanted to point out is that copper, platinum, palladium and gold are all moving lower. Why therefore should silver be expected to "give the shorts a religious experience"?

In closing, let me simple add, that I am not "anti-silver". I have merely tried to make the case that those calling for perpetual moon shots in the precious metals, gold, or in this case silver, should knock it off with the reckless predictions and instead show some humility and OBJECTIVITY instead. The only thing that is served by these incessant "huge bull market" prediction is the ego of those who keep making them. After all, what is the point? So that one can brag about getting it right? How many times should they be allowed to "get it wrong" before being discredited?

All one needs is the price chart. It will save you a lot of grief and more importantly, a lot of money! If the metal can hold support, then fine. If not, that also is fine. Go with the flow.

Good trading to you all!

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.