Stock Market Pause in the Downtrend

Stock-Markets / Stock Markets 2015 Aug 18, 2015 - 10:22 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market

sIntermediate trend - SPX may has started an intermediate correction

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

PAUSE IN DOWNTREND

Market Overview

Last week, SPX made another stab at the support level and found it holding once again! This, however, is likely to be the last time. As we get closer to the cycle lows in late September/October, the downward pressure should intensify and push it through. If the current rally continues much higher, it could alter that scenario but, so far, after reaching 1290, the uptrend has morphed into a sideways move. It's a little too soon to tell if it will continue the sideways motion or pick-up some upside momentum. Even if it does, the odds of developing enough strength to challenge the former highs are very small.

One could argue that a "pause in a downtrend" is a misnomer for the SPX, but it would not be for a number of other indexes which already have well-established declining patterns. The DJIA, NYA, Transports, etc... are some examples, as is the RSP (SPX equal weight). In fact, the RSP and TRAN, which were both ahead of the other indices in establishing downtrends, are both ahead of them in making what looks like a mid-decline consolidation. If the assessment of the market condition is correct, these two indices should be the first to resume their downtrends.

Indicators Survey

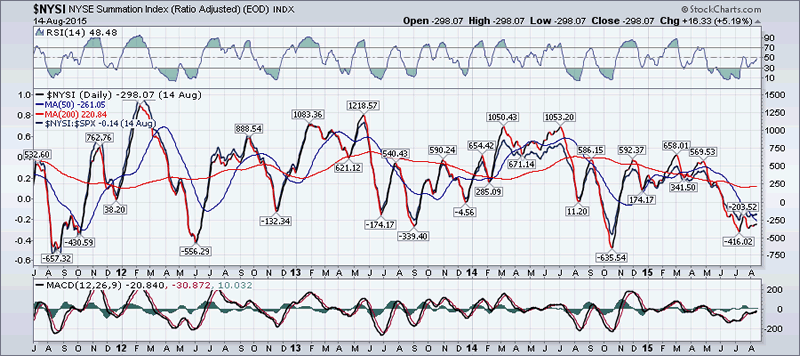

Last week, the weekly MACD continued to decline in spite of the rally.

The daily MACD has been essentially flat for the last three weeks and slightly negative.

If last week's rally was important, this would be reflected in the Summation Index (courtesy of MarketCharts.com), but it is not. There is nothing here to suggest that we are about to see some sustained market strength over the near term.

On its 1X1 P&F chart, the SPX has already created what may be an important distribution pattern, unless it turns out to be accumulation which could push the index higher.

The 3X3 chart shows that the SPX is trying to establish a downside channel. That pattern could be significantly altered if the index develops a lot of strength next week.

Chart Analysis

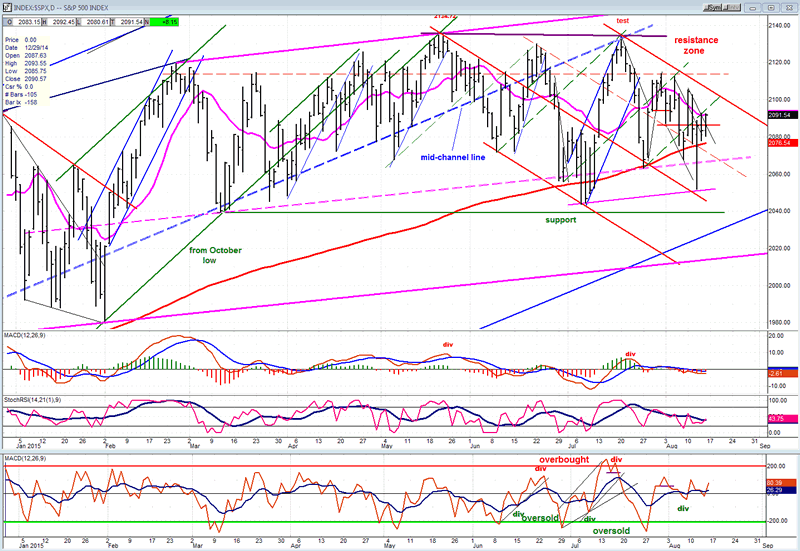

This is a chart of the Daily SPX (chart courtesy of QCharts.com as others below).

Going from large to small, the blue trend lines represent the intermediate channel which started at the October 2011 low. The pink channel is the channel within which the index has been trading since early February. The red lines represent the downtrend channel which the index has been trying to establish since it made its high of 2134 in March. If next week prices push outside of it, it may have to be revised.

Let's look at the pink channel which shows that SPX has been in a shallow uptrend since the beginning of February. Since early March, prices have been confined to the upper part of that channel by remaining above the dashed pink line which was slightly breached only twice with prices immediately returning above. I suspect that during the last phase of the decline (which could start at any time), the dashed line will be decisively penetrated with prices dropping at least to the bottom of the pink channel (ca. 2020), and perhaps lower. There is probably not enough time left going into the cyclic low to establish a sustained decline of any magnitude. We'll see!

For the past three weeks, prices have consolidated above the dashed line and the 200-DMA. Wednesday's dip was an emotional aberration caused by China. If you look at the indicators which are based on the daily close, they have been essentially flat (as have closing prices). When this consolidation is over and we close below the dashed line/200-DMA, we will most likely keep going to 2040 and beyond.

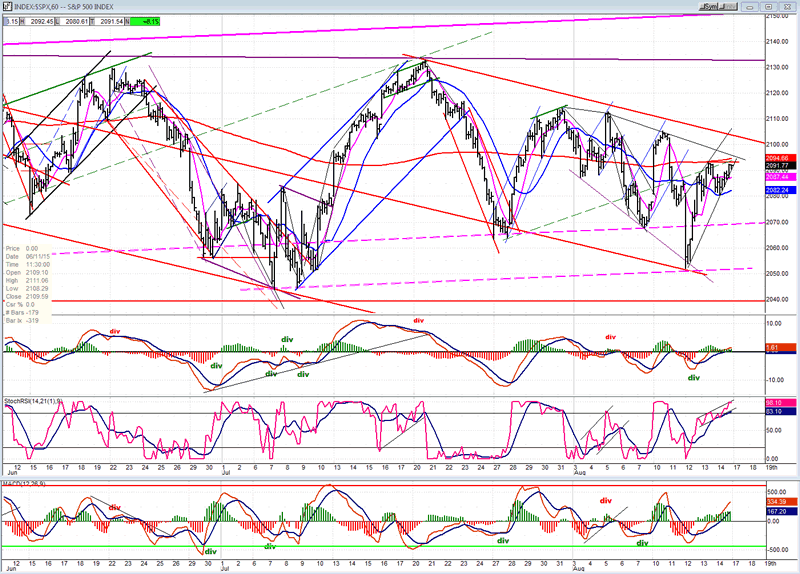

The red lines which you see on the Hourly chart are the same ones that are shown on the daily chart. The rally may stop at the top red line, which would be ideal. On Friday, even though it kept moving higher, it did so with little momentum and simply crawled along the trend line. On Monday, it will have to pull away from it to keep on going. It will also have to move above the former minor top, the 200-hr MA, and the black downtrend line in order to get up to the red line. These are not major obstacles to overcome, but it failed to overcome them on Friday.

The oscillators were still moving up at the end of the day with no sign of negative divergence, so there may be room for a little more uptrend in the price. The P&F pattern indicates that if 2093 is exceeded, 2100-2105 is possible. The lower count would put it right at the red trend line.

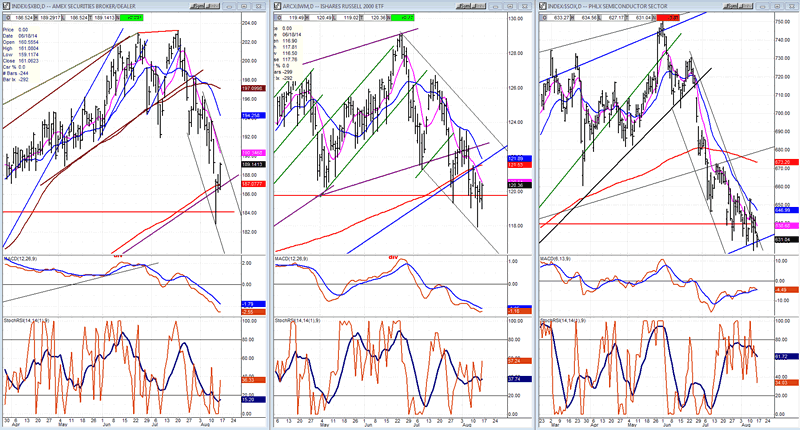

XBD -- IWM - SOX

Even a cursory look at the charts of these three market leaders tells us that SPX is not really representative of the overall market trend. All three have now penetrated the horizontal red trend line which is drawn on their charts. This line is the equivalent of the 2040 level on the SPX, a level above which it closed by 50 points on Friday. Even XBD, which was the last holdout finally breached it last week.

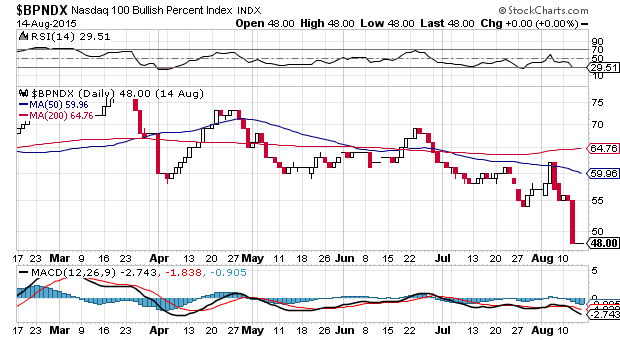

The next chart also gives a much more accurate representation of the developing internal market weakness. This is the Bullish Percent Index for the NASDAQ 100 (NDX), one of the better indicators of market health. The index closed below 50% last week and, by the most basic interpretation, this favors the bears. It's ironic that this sell signal has been given by the strongest index on the board!

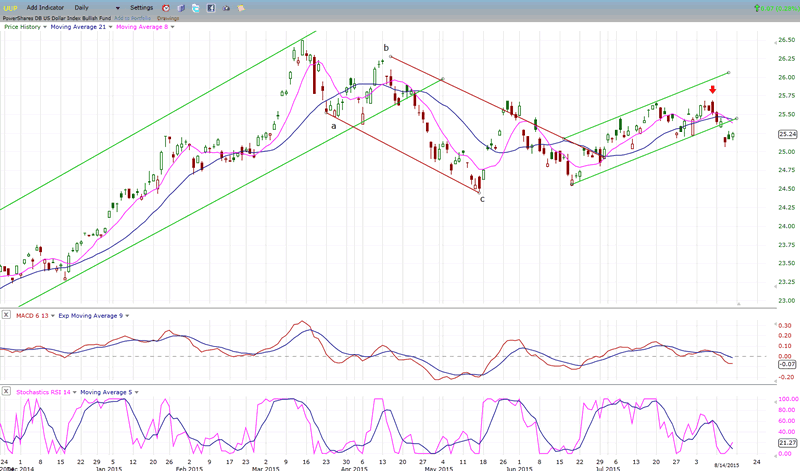

UUP (dollar ETF)

Last week I mentioned that on the previous Friday UUP had ended the day with a very bearish candlestick pattern. Sure enough, a decline followed which has already broken below the previous near term low. Odds are that this is only short-term weakness which is part of the overall consolidation pattern, but even if there is a pause here, lower prices should be expected over the short term.

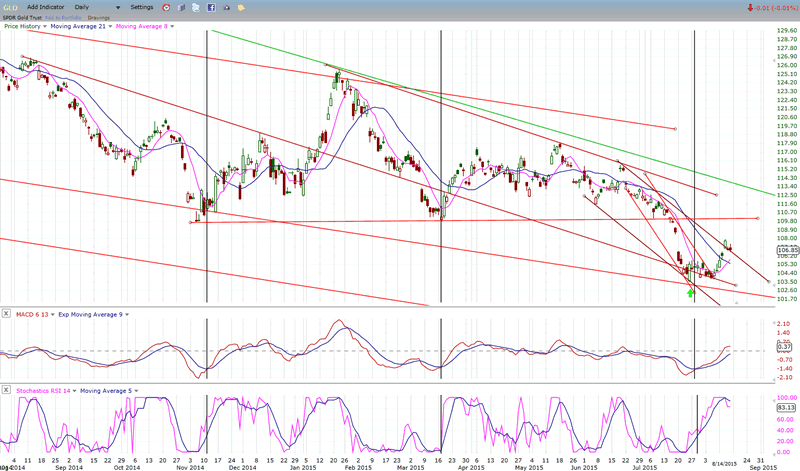

GLD (Gold trust)

GLD broke out of two minor channels and rose 3+ points from its low. It is currently consolidating outside of the second channel and may have to spend a little more time doing so. If the consolidation is fairly shallow, it will most likely extend its upward move. It has a potential P&F projection to 109, a level where it will meet with resistance caused by the two former lows whose level it recently penetrated. After that, there is a risk that it could resume its decline down to its 101 projection. If it can rise high enough to get past the longer declining red line from 125.58, the 104 level could become an intermediate low.

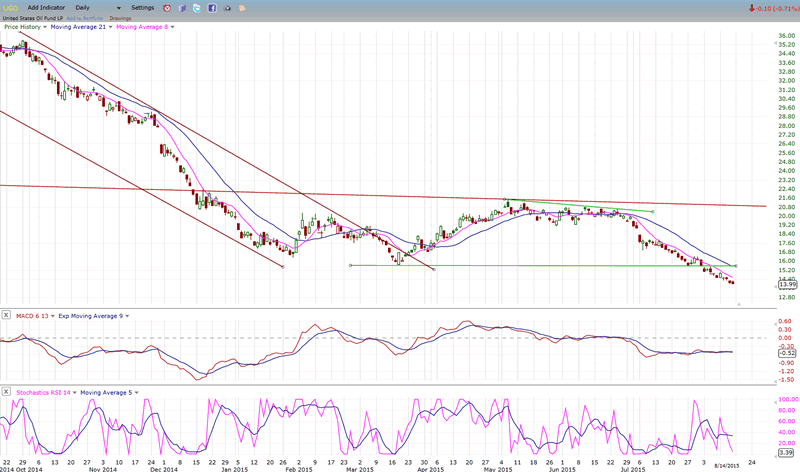

USO (US Oil Fund)

USO continued to decline last week reaching 103.98, essentially filling my 113 projection. Let's see if it goes a little lower before making an attempt at reversing. The indicators do not look quite ready for this right now.

Summary

SPX is undergoing a consolidation in a downtrend using the 200-DMA as support. A daily close below 2073 which does not hold, should bring about the next challenge to the 2040 major support level.

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.