The Fed is About to Trigger a $9 Trillion Debt Implosion

Stock-Markets / Financial Markets 2015 Dec 07, 2015 - 07:26 PM GMTBy: Graham_Summers

The US Federal Reserve (Fed) and European Central Bank (ECB) have created a very dangerous situation.

The US Federal Reserve (Fed) and European Central Bank (ECB) have created a very dangerous situation.

Throughout the last six years, there has been a sense of coordination between the Fed and ECB. This was evident both in terms of where capital went as well as how it was delivered via monetary policy.

For instance, when the Fed released its discount window documents in 2011, it became clear that most of the funds from QE 2 actually went to foreign banks located in the EU.

Similarly, when the EU banking system was close to imploding in 2012, the Fed coordinated with the ECB to announce QE 3 in an effort to prop up the EU banking system and calm overseas jitters to aid the Obama administration in its re-election campaign.

In short, from 2008 to 20414, the Fed and ECB worked together.

However, at some point this relationship was set to fracture. True, global Central Banks want to work together to maintain stability… but when every Central Bank is engaged in the competitive devaluation of its currency, at some point the relationship between Central Banks would become fractured as they individually had to choose to aid themselves over each other.

That point is today…

The Euro comprises 56% of the basket of currencies against which the US Dollar is valued. As such, the Euro and the Dollar have a unique relationship in which whatever happens to the one will have an outsized impact on the other.

This relationship first began to run off the rails in June 2014 when the ECB cut interest rates to negative. Before this, the interest rate differential between the Euro and the US Dollar was just 0.25% (the US Dollar was yielding 0.25% while the deposit rate on the Euro was at exactly zero).

While significant, the interest rate differential was not enough to kick off a complete flight of capital from the Euro to the US Dollar. However, when the ECB launched NIRP, cutting its deposit rate to negative 0.1%, the rate differential (now 0.35%) and punitive qualities of NIRP (it actually cost money to park capital in the Euro) resulted in vast quantities of capital fleeing Euros and moving into the US Dollar.

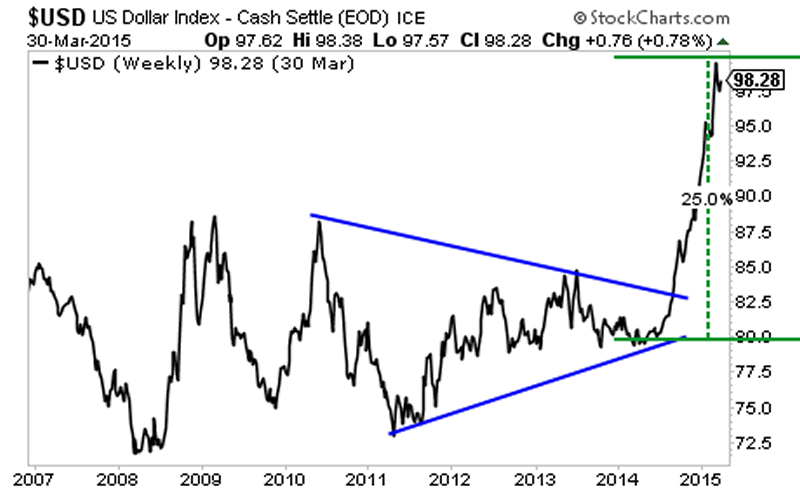

Soon after, the US Dollar erupted higher, breaking out of a multiyear triangle pattern and soaring over 25% in a matter of nine months.

To put this into perspective, this move was larger in scope than the “flight to safety” that occurred in 2008 when everyone thought the world was ending.

The reason this is problematic?

There are over $9 trillion in borrowed US Dollars sloshing around the financial system. And much of it is parked in assets that are denominated in emerging market currencies (the very currencies that have imploded as the US Dollar rallied).

This is the US Dollar carry trade… and it is larger in scope that the economies of Germany and Japan… combined.

In short, when the ECB cut rates to negative, the US Dollar carry trade began to blow up. The situation only worsened when the ECB cut rates even further into negative territory in September 2014 and again last week bringing the rate differential between the US Dollar and Euro to 0.55%.

Now, the Fed is talking of raising interest rates. Even a symbolic rate hike to 0.3% or 0.5% could trigger a complete implosion of the $9 trillion US Dollar carry trade.

If you think this is just fear mongering, you’re mistaken. The Treasury Dept. issued emergency kits to employees a few months ago in anticipation of systemic volatility during the rate hike. Similarly, the Fed boosted the size of its market operations department in Chicago case the NY Fed loses control of the system when rates increase.

In short, we could very well be on the eve of another systemic crisis. The financial elites have been preparing for this for months.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisory. is a WEEKLY investment newsletter with an incredible track record.

To whit, we just closed out two new double digit winners yesterday, bringing us to 40 straight winning trades over the last 12 months.

That correct, during the last year, we’ve not closed a SINGLE LOSER.

And if you go back further, 46 of our last 47 trades have made money.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS.

During that time, you’ll receive over 50 pages of content… along with investment ideas that will help you make you money… ideas you won’t hear about anywhere else.

If you have not seen significant returns from Private Wealth Advisory. during those 30 day, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory.

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.