Gold Sector Inputs That Actually Matter and Stock Market Refugees

Commodities / Gold and Silver 2015 Dec 12, 2015 - 10:34 AM GMTBy: Gary_Tanashian

The word play in the title is in reference to the ridiculous fuss over COMEX gold inventory and other promotions masquerading as fundamentals put out by cartoons masquerading as analysis.

The word play in the title is in reference to the ridiculous fuss over COMEX gold inventory and other promotions masquerading as fundamentals put out by cartoons masquerading as analysis.

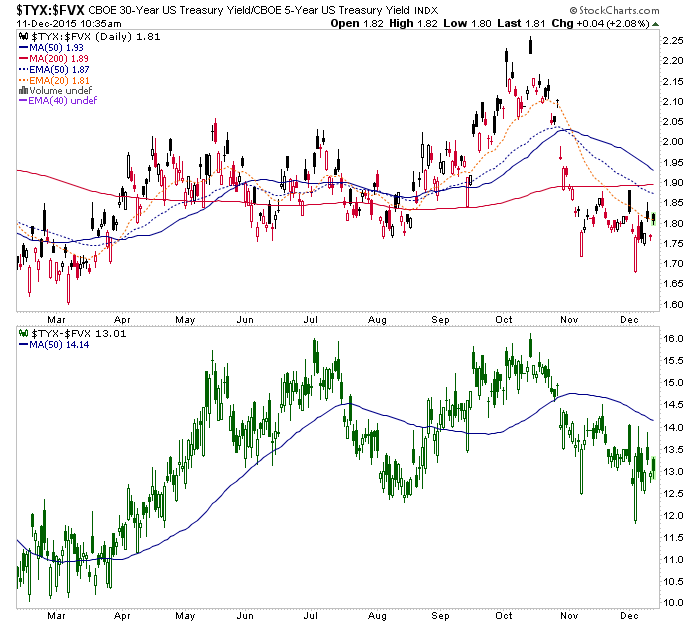

30 year divided by, and 30 year minus 5 year are neutral at best. Yield spreads would be rising in a gold-positive environment. As a side note, this spread also tends to bring trouble for the stock market during its initial stages of rising.

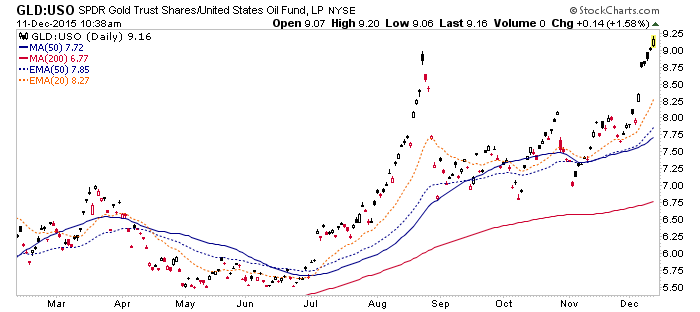

Gold vs. Crude Oil is getting bullisher and bullisher for the gold mining industry.

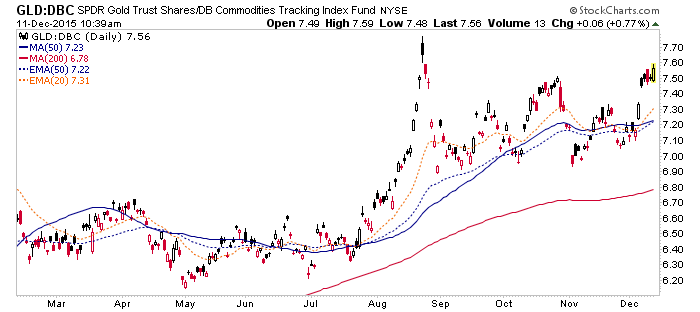

Gold vs. Broad Commodities is also looking bullish.

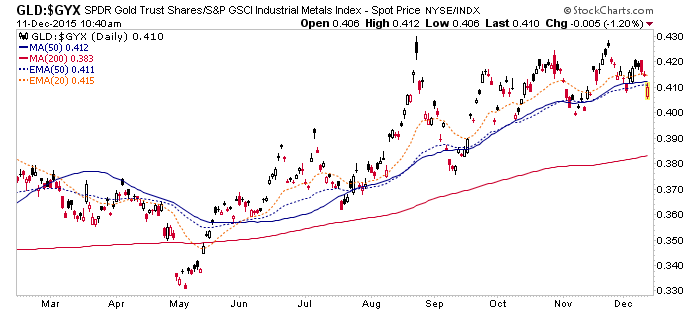

Gold vs. Industrial Metals is a little wobbly, but in an uptrend for months now.

Gold is still not preferred for safety in relation to Uncle Sam himself. The implication is that confidence is intact in government, in policy makers, in the whole ball of wax. That’s okay, we’ve got time (and patience).

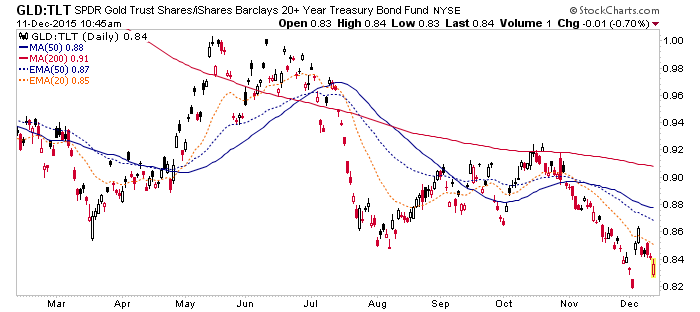

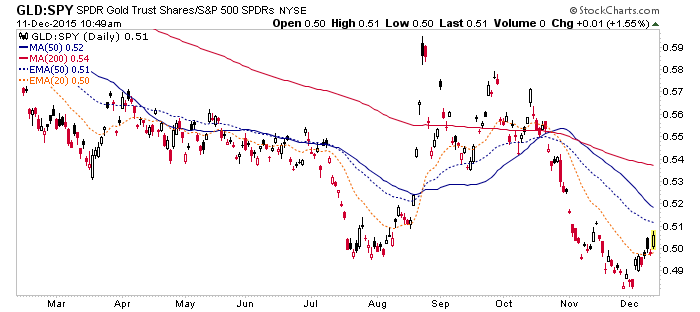

Gold is once again bouncing in SPX units. When this trend changes a major macro fundamental underpinning will be in place for the gold stock sector. This is at this point a bounce, not an uptrend.

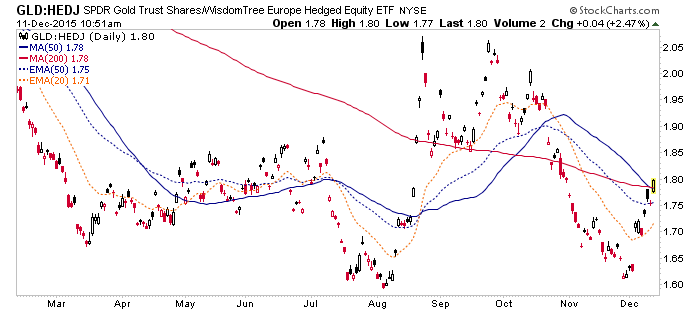

Gold vs. Euro-hedged European stocks is the kind of chart that makes me think ‘hmmm, a trend change has got to start somewhere…’, but as yet, no trend change.

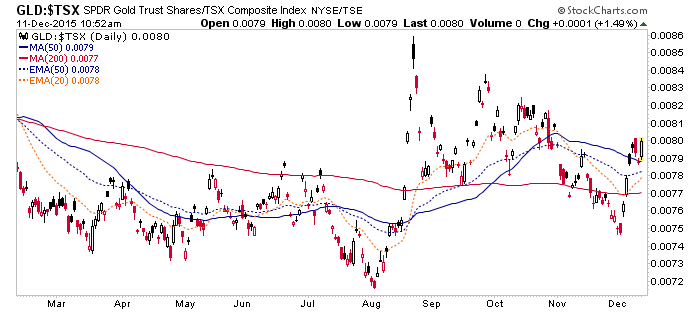

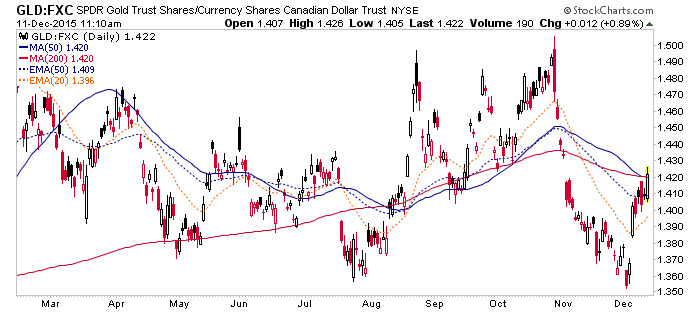

Gold vs. un-hedged Canada is better still.

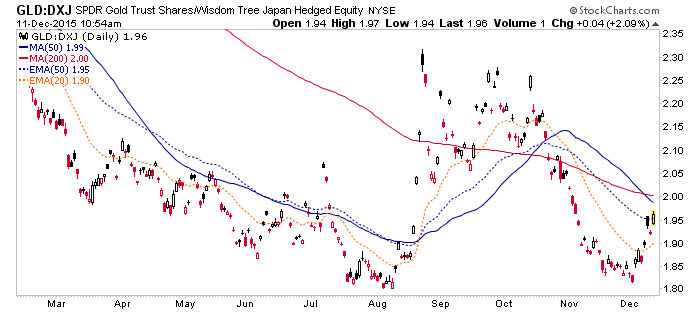

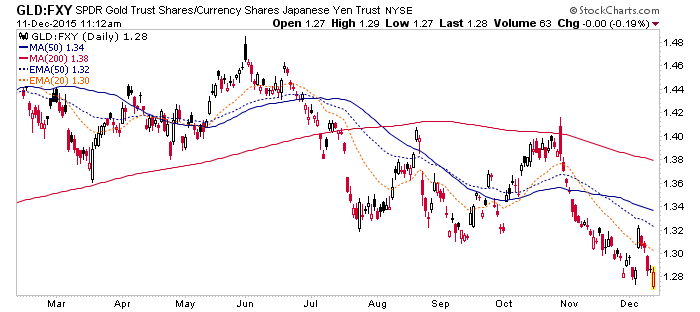

GLD vs. Yen-hedged Japan is bouncing.

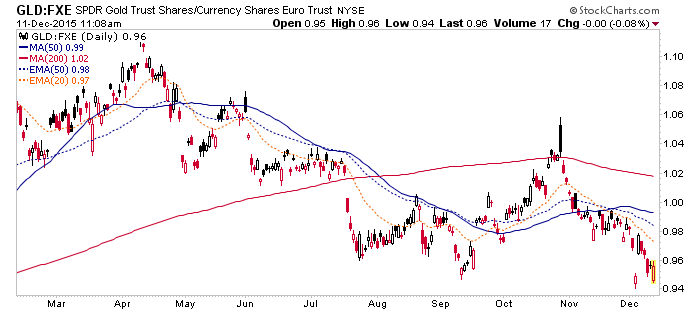

Gold vs. a currency that is actually under attack by the ECB, is bearish. Imagine that, this chart would tell Europeans to own the currency that is being devalued by policy makers instead of owning gold.

Canadian gold owners are once again bouncing vs. Canadian dollar owners.

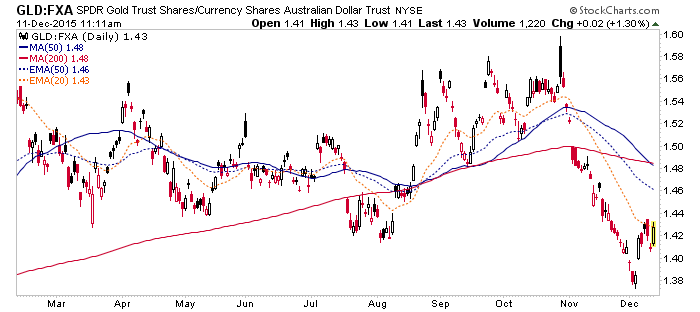

Gold vs. Aussie, not so much.

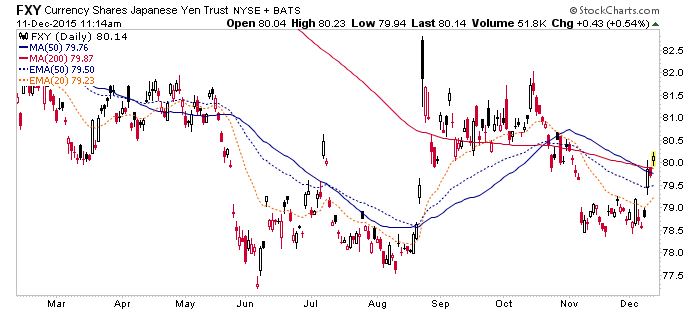

Gold vs. Yen has Japanese saying “buy Japanese stocks, I’m not going to help you”. Oh wait, Japanese stocks are correcting a bit as well.

Maybe Japanese might just want to hold Yen for a while until the dust settles.

Bottom Line

Gold funda are on another bounce but when stock markets (including and especially US markets) crack, policy makers are not so firmly revered (and obeyed) and risk ‘off’ becomes more prevalent, confirmations will start coming in.

Gold is in a bear market, technically. That is indisputable. Gold may have ended its bear market as well, with no technical parameters yet confirming. But I do believe that the above represent on balance, a long, slow march toward change.

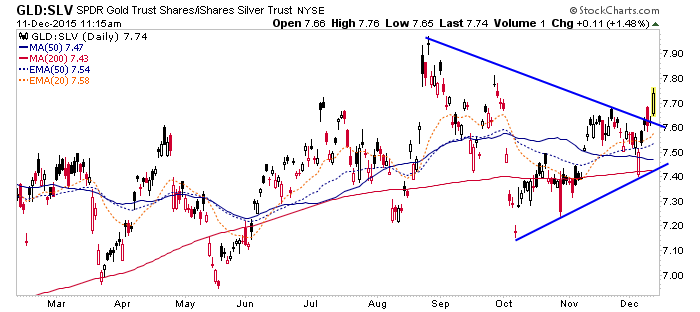

Meanwhile, the general game plan is for the gold-silver ratio (GSR) to indicate systemic stress as it rises (we noted a fledgling breakout in GSR a few days ago in an NFTRH update) and today, in-day, we have a resumed breakout. That would be bad chicken.

Click the pic, laugh and consider that the GSR has to top out and silver then needs to indicate a new inflation phase out there somewhere on the horizon. As is happening today, the gold sector can rise with a rising GSR (as fundamentals grind out improvement), but if silver takes over later on, watch out. That would be the momo time when casino patrons (AKA stock market refugees) start paying attention to the sector.

“That’s not gonna be good for anybody…”

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.