Marc Faber Warns “Own Some Solid Currency, In Other Words … Gold”

Commodities / Gold and Silver 2016 Feb 19, 2016 - 03:43 PM GMTBy: GoldCore

“Leave a million dollars with a bank, and in a year, you get only something like $990,000 back,” Marc Faber, respected publisher of the Gloom, Boom & Doom Report, told Bloomberg by phone yesterday.

“Leave a million dollars with a bank, and in a year, you get only something like $990,000 back,” Marc Faber, respected publisher of the Gloom, Boom & Doom Report, told Bloomberg by phone yesterday.

“I would rather want to own some solid currency, in other words … gold” warned Faber.

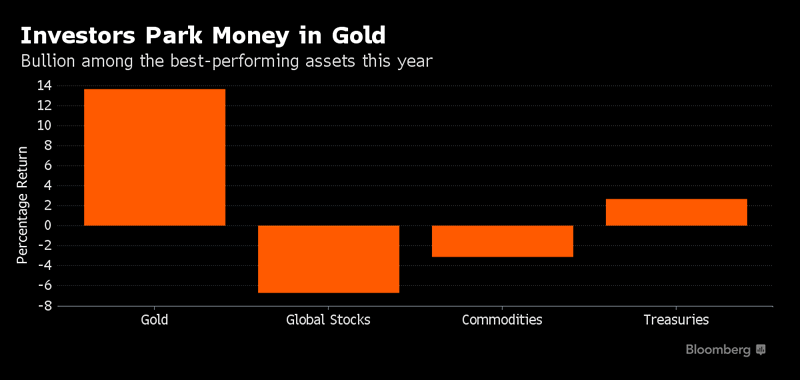

Gold bears for years fed off the prospects for higher borrowing costs. Now bulls are thriving in a world where negative rates are becoming commonplace.

The Bank of Japan adopted negative rates last month to spur growth, joining central banks in Denmark, the euro area, Sweden and Switzerland. With about a quarter of the world economy facing negative rates in some form and growth faltering, gold has become one of this year’s best investments.

It’s a big turnaround for the metal which slid to a five-year low in December as the Federal Reserve readied for its first rate increase in almost a decade. With China’s slowdown roiling markets, there’s less chance the Fed will move again until next year. Negative rates mean depositing cash would leave investors with less than when they started, making traditional stores of value such as gold more appealing.

You can read the full article on Bloomberg here

Marc Faber is an eloquent advocate of owning physical gold which he describes as being a way to become “your own central bank.” He believes an allocation to physical gold will serve as vital financial insurance and that Singapore is the safest place to own gold in the world today.

Marc Faber Webinar on Storing Gold in Singapore

Essential Guide To Storing Gold In Singapore

LBMA Gold Prices

19 Feb: USD 1,221.50, EUR 1,101.14 and GBP 853.35 per ounce

18 Feb: USD 1,204.40, EUR 1,082.41 and GBP 841.19 per ounce

17 Feb: USD 1,202.40, EUR 1,080.57 and GBP 838.84 per ounce

16 Feb: USD 1,212.00, EUR 1,083.75 and GBP 838.04 per ounce

15 Feb: USD 1,208.45, EUR 1,078.94 and GBP 834.57 per ounce

For the week, gold is 0.4% lower and gold appears to have recovered from the falls seen on Sunday night and Monday morning.

For the week, silver is 0.7% lower and also appears to have recovered from the falls seen at the start of the week.

Both appear over valued in the short term and under valued in the medium and long term.

Smart money will continue to accumulate and dollar cost average into bullion.

Gold and Silver News and Commentary

“Bullion brokers GoldCore declared a bull market” – South China Morning Post

Gold sparkles amid global gloom to brighten mining sector – South China Morning Post

Gold firm above $1,200 as lower equities stoke safe-haven bids – Reuters

Gold Resumes Rally as ETP Assets Swell Amid Demand for Haven – Bloomberg

Gold rises, reverses earlier losses as equities pull back – Reuters

‘Helicopter money’ on the horizon, fund manager Dalio says – Finfacts

Gold Set to be the Most Popular Investment in 2016 – Prague Post

Questions and Answers with Bill Holter and Jim Sinclair – GoldSeek

New York Fed Suggests Large Asset Managers Are Systemic Risk Due To Runs – Value Walk

Negative interest rates a ‘dangerous experiment’ for the world as monetary policy hits buffers – Telegraph

Click here

This update can be found on the GoldCore blog here.Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.