Comex Gold Rigging – Fact or Myth?

Commodities / Gold and Silver 2016 Mar 18, 2016 - 04:09 PM GMTBy: Arkadiusz_Sieron

The U.S. gold market is second, after the London gold market, as the most important center for gold trading. Although the U.S. has a well-developed OTC spot market for gold, it primarily trades paper gold, i.e. gold derivatives (futures and options) and ETFs. The first gold futures market was established in Winnipeg, Canada, at the Winnipeg Commodity Exchange in 1972, but when private gold trading again became legal in the U.S. a few years later, Americans jumped at the opportunity and opened their futures markets. In December, 1974, the Commodity Exchange Inc. (Comex), launched gold futures trading and quickly gained a dominant position. Although the volume built up slowly, the trading expanded and Comex launched gold option trading in 1982 (options are on gold futures, not on the bullion itself). In 1994, Comex merged with the New York Mercantile Exchange (Nymex), officially becoming its division responsible for metal trading. Since 2008, Nymex and Comex have been owned and operated by the CME Group, the largest derivatives marketplace in the world.

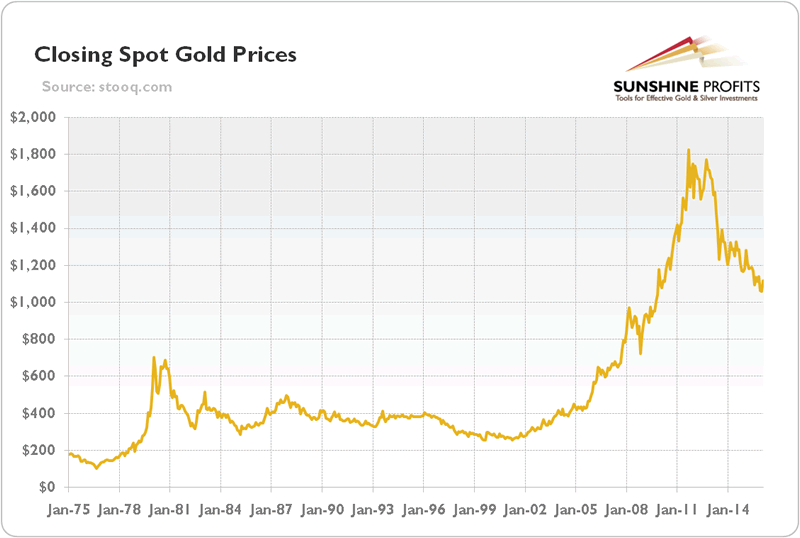

Comex hosts futures contracts trading (along with options). This exchange is the largest gold futures exchange in the world. Gold futures are contracts on a delivery of a specified quantity and grade of gold at a specified time and for a predetermined price. Each gold futures contract on Comex represents 100 troy ounces (of minimum 995 fineness) and is quoted in US dollars per troy ounce, while minimum tick size (i.e. the minimum price movement) on these contracts is 10 cents per troy ounce. Trading is conducted on the electronic Globex platform, from 6:00 P.M. to 5:00 P.M. from Sunday through Friday, for delivery during the current calendar month, the next two calendar months, any February, April, August, and October falling within a 23-month period, and any June and December falling within a 72-month period beginning with the current month. The spot price is derived from the nearest future price. The chart below presents the historical closing spot prices.

Chart 1: Comex closing spot prices for gold from January 1975 to February 2016

Although gold futures are physically delivered upon expiration, most contract positions are closed prior to the delivery period. This is reflected in the modest size of the gold inventories in Comex vaults. It does not prove any aberration on the market. Most gold futures are simply liquidated before maturity, and the bullion is never delivered. Generally speaking, delivery of futures contracts seldom takes place as investors want to avoid the costs of storage, insurance, or transport of bullion.

Comex also enables investors to leverage their positions using futures. In the futures exchange the investors do not have the total value of the contract on their accounts. Instead, a margin is required, which is only a small part of the value of the contract (currently an initial margin, i.e. the amount of money that must be deposited to open a position in a futures contract, is $4,675 –a small percentage of the total value of the contract).

Investors are drawn to Comex by the leverage, high liquidity, covering positions (liquidating them instead of dealing with physical delivery), low transaction costs and minimized counterparty risk (due to compulsory margins, marking-to-market mechanisms and clearing operations of the futures exchange). Comex also attracts speculators interested in making money on the direction of the gold price. We should not throw stones at them – we all do speculate in an uncertain world. Moreover, speculators provide liquidity to the market and take risk from hedgers. Their actions enable the gold industry to protect itself from market risk. Hedgers include mine producers wanting to guarantee profitable prices for their production, refiners and jewelers seeking to cap their raw material costs, or bullion dealers wishing to hedge their inventory against declines in prices.

The bottom line is that Comex is the largest and most influential U.S. gold futures (and gold options market) exchange. Because the vast majority of investors liquidate their positions before maturity, very little gold actually trades hands in the futures markets (unlike the OTC spot market). This is why Comex is used by speculators to speculate on the future direction of prices, but also by hedgers to hedge themselves against adverse price changes.

If you enjoyed the above analysis and would you like to know more about the structure of the gold market, we invite you to read the March Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.