Inflation is Here and the Fed Wants More

Economics / Inflation Mar 31, 2016 - 06:05 PM GMTBy: Graham_Summers

The Fed failed to hike interest rates in March despite the “data” hitting levels at which the Fed said it would hike. Indeed, the Fed even lowered its expected number of rate hikes for this year from four to two!

The Fed failed to hike interest rates in March despite the “data” hitting levels at which the Fed said it would hike. Indeed, the Fed even lowered its expected number of rate hikes for this year from four to two!

This confirms for us that the Fed does indeed want inflation.

In the last few weeks, several Fed officials, most notably Fed Vice-Chair Stanley Fischer stated not only that inflation was appearing in the US but that this is something the Fed “would like to happen.”

In separate prepared remarks in Washington, neither Fed Vice Chairman Stanley Fischer nor Gov. Lael Brainard made direct reference to next week’s meeting of the Federal Open Market Committee. But Brainard argued for patience in rate increases amid possible risks that inflation and U.S. economic activity will fall.

“Tighter financial conditions and softer inflation expectations may pose risks to the downside for inflation and domestic activity. From a risk management perspective, this argues for patience as the outlook becomes clearer,” Brainard said.

Source: CNBC

AND…

Inflation is showing signs it could accelerate in the United States, a top Federal Reserve policymaker said in comments that back the view that the central bank will hike interest rates again this year.

“We may well at present be seeing the first stirrings of an increase in the inflation rate,” Fed Vice Chairman Stanley Fischer said on Monday in prepared remarks, adding that faster inflation was “something that we would like to happen.”

Source: Reuters

With that in mind, take note that the Fed is finally achieving this, with US Core inflation well above the Fed desired rate of 2%:

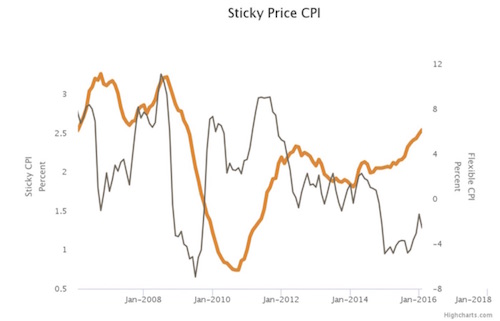

Moreover, “sticky inflation” (considered by some to be the purest “official” measure of inflation) has hit 3%.

And finally, the Cleveland Fed’s Median CPI is growing at an annualized rate of 2.8%.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.8% annualized rate) in February…

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.2% (-2.0% annualized rate) in February. The CPI less food and energy rose 0.3% (3.4% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, the CPI rose 1.0%, and the CPI less food and energy rose 2.3%.

Source: Cleveland Fed

Put simply, the inflation genie is out of the bottle. Core inflation is already moving higher at a time when prices of most basic goods are at 19-year lows. Any move higher in Oil and other commodities will only PUSH core inflation higher.

The Fed is cornered. Inflation is back. And Gold and Gold-related investments will be exploding higher in the coming weeks.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.