Gold And Silver – A Clarion Alarm Call For All Paper Assets

Commodities / Gold and Silver 2016 Apr 30, 2016 - 10:19 AM GMTBy: Michael_Noonan

Perhaps the most successful Ponzi scheme of all has been the Rothschild-led takeover and sapping of the entire United States since the American Civil War that started in 1861. The final stages were set with the not-so-lawfully-passed but fully implemented Federal Reserve Act on 23 December 1913. The fact that it purportedly passed two days before Christmas, when the custom was for no legislation to be enacted, while most politicians were en route or already home for the holidays, and the main opponents for this specific Act were indeed absent when the vote was made before a select skeleton group that stayed in Washington to ensure “passage” of the Act, this was all a huge red flag that was kept hidden from the public.

Perhaps the most successful Ponzi scheme of all has been the Rothschild-led takeover and sapping of the entire United States since the American Civil War that started in 1861. The final stages were set with the not-so-lawfully-passed but fully implemented Federal Reserve Act on 23 December 1913. The fact that it purportedly passed two days before Christmas, when the custom was for no legislation to be enacted, while most politicians were en route or already home for the holidays, and the main opponents for this specific Act were indeed absent when the vote was made before a select skeleton group that stayed in Washington to ensure “passage” of the Act, this was all a huge red flag that was kept hidden from the public.

The Federal Reserve Act gave the Rothschild bankers the control of all money issued in the United States, giving renewed life to Amshel Rothschild’s famously portentous words:

” Give me control of a nation’s money supply, and I care not who makes it’s laws.”

The trap was set.

In 1933, with FDR’s declared banking holiday, it was game, set, match. The purpose of the bank holiday was to shut down the entire US bank system and have it reopen fully

under control of the Federal Reserve System, itself controlled by foreign bankers and not at all a part of the United States government. Another hidden fact kept from the public.

Why was this not-so-slight-of-hand necessary? The bankers forced this country into bankruptcy, and the entire United States, all assets, all levels of government, from the president on down, were totally owned by the bankers. If you do not think this was not

without decades of planning, go back to the passage of the 14th Amendment, adopted on 19 July 1868. It states that the public debt cannot be challenged, [the international bankers planned on shoving as much debt down the throats of the public that contuse to this day, and counting, and it created the de facto US citizen of the de facto United States where all Rights were replaced with privileges. All Americans were relegated to serf status, almost all without the slightest clue, and even more so to this very day.

During the first half of the 20th century, the international bankers stole virtually all of the available silver and gold from the US. That has always been the Rothschild plan, and it is still carried out today: Libya, Greece, Ukraine, London, Venezuela, Brazil, everywhere.

Why?

Rothschild has always known that there is no other form of true money than silver and gold, and it has been why each and every country in debt to the globalists was forced to give up whatever gold and silver that country had, in return for mountains of fiat debt.

What are the two assets most in demand in the world, bar any other asset, and yet has been purposefully kept at their lowest price relatively possible? Of course, gold and silver.

Why?

Gold and silver are money. There are no other substitutes, unless people are willing to be duped into believing otherwise, and history proves people are infinitely willing to be shorn like sheep, and not just financially, either. Freedoms are gladly forfeited, inferior schooling is widely accepted. Governments that are supposed to serve the people have turned the tables so that people serve the government. The governmental tape worm is in the process of consuming its collective hosts. You can stick a fork in the United States. It is done, as a viable country.

The European Union, the brainchild of the CIA and deep state within the US from as far back as the 1950s, is another unhealthy situation, worse even than this country. All former European countries are run by government heads totally subservient to the globalists. Those that run Europe are unelected, unaccountable, highly paid globalist sycophants. One of the sorriest and most disappointing examples has been Angela Merkel, Chancellor of Germany by title, globalist puppet in day-to-day actions, leading her country into ruin.

The point of this backdrop information is to serve to explain why the price of gold has not responded to the natural laws of supply and demand. Those natural laws have been displaced by the unnatural rulings of the globalist moneychangers. Just as no fiat currency has survived over the past 5,000 years of financial history, the current globalist-dominated fiat paper system is coming apart at the seams, doomed to fail, but at such a huge expense and toll on unsuspecting people.

It is important to always remember an ounce of gold or silver does not ever change. What changes is the [falsely]perceived [worthless]”value” of fiat paper currencies. The ounce of gold that is constant recently cost $1,100 fiat “dollars”. Now, it takes nearly $1,300 fiat “dollars” to purchase that same ounce. The worthless fiat paper is losing value relative to gold. Soon, it will continue to take more and more of those fiat pieces of paper to exchange for the constant 1 ounce of gold. The same is true of silver.

We stopped trying to explain the phony pricing of PMs in terms of China, Russia, and India buying as much gold as possible, the record demand for silver rounds and gold coins purchased voraciously by the public, mines [supply] shutting down, etc. None of these legitimate demand factors had any impact on the pricing of either metal.

The only thing that mattered was the war-like United States wrecking the entire Middle East in the game to control oil and gas, trying to cut out Russia as the main supplier of energy to Europe. All other countries in Europe, Africa, South America were subject to US financial wars that destroyed each country forced to take on debt that could never be repaid. These countries were then subject to being controlled by the IMF, and their natural resources taken over by mostly US corporations, all under globalist control.

The world’s stock markets are surviving on political fumes, again financially muscled by globalist central bankers. This form of paper assets is getting closer to another 2008 nosedive from which recovery will be unlikely. Those who [unwisely]choose to own paper assets of any kind, especially in the stock market and digital currency held in banks, are being given a clarion alarm call by gold and silver that your time has reached its expiration date.

Neither China nor Russia will come in and save the day with their tonnes and tonnes of gold. China will never back its Yuan with gold. Russia is not in a position to establish a world reserve currency. Both countries are backers of the IMF. China just had its Yuan become a part of the SDR basket. Guess what the globalists have planned for their next step in their One World Order world domination?

The SDR [Special Drawing Rights]. Another trap has already been set.

If you do not own and personally hold physical gold and silver, the odds of your current wealth surviving the next disaster are close to nil. For the past few years, we have been advocating the purchase of physical gold and silver, at any price, and especially at these once in a lifetime remaining bargain prices.

Whatever the globalists have planned, it does not include your financial well-being. It is literally each man and woman for themselves. Take heed.

Here is an excellent view on how we see charts:

Those who have knowledge don’t predict. Those who predict don’t have knowledge – Lao Tzu, 6th century BC poet.

Unlike so many who have been “predicting” a bull move has started in gold and silver over the past few years, always wrong, based on subsequent lower lows, we use charts to read developing market activity in the form of price and volume, and we follow what the market

has to say based on those inputs.

The gold:silver ratio has come in from the 84:1 area to 72:1, with silver outperforming gold. We expect this ratio to continue to favor silver to the point of reaching 40:1, and

potentially still lower than that. 15:1 used to be a long-standing relationship, so beyond

the ratio favoring silver, it is pure guesswork as to how far it will contract.

For anyone unfamiliar with what the ratio means, at 84:1, it takes 84 ounces of silver to exchange for one ounce of gold. Now near 72:1, it only takes 72 ounces of silver for a single ounce of gold. This means the price of silver is doing better than the price of gold. Given a choice between the two metals, silver represents a better buy for potential gain than gold, although both will still rise in value.

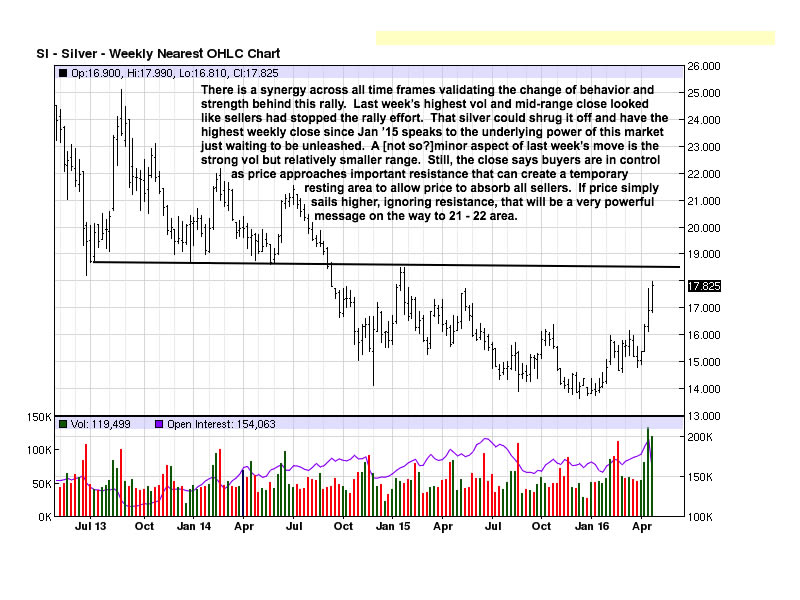

Silver has been impressive in its ability to sustain gains with very little give-back, to date, in the current rally underway. April has been a breakout month for silver that has been long-awaited by so many.

The weekly chart is equally as impressive in performance. The 18+ area has been long-standing resistance, and price has finally arrived to begin mounting a challenge that should be overcome, in time. One can never know how a market will develop, so we will just have to wait to see how price responds to that important resistance area, and respond accordingly.

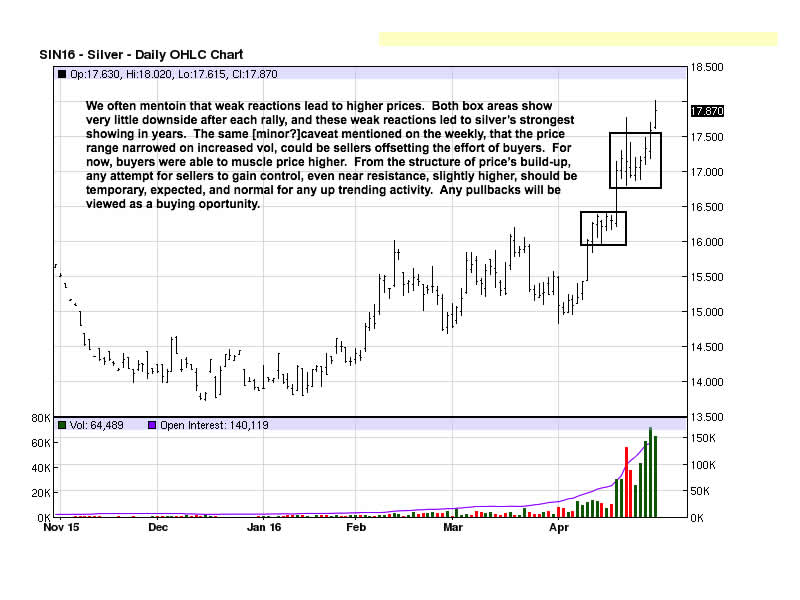

Once price broke through the 16 level, it showed a degree of strength not seen for the past few years, and this is an important change in market behavior. With a proven trend established, it becomes easier [relatively speaking] to select entry points to establish new positions in the paper market.

By contrast, the physical silver market has always been a simple buy and hold.

The implications of price/volume behavior can sometimes only be known after the fact, which is never too late because now one has a greater level of certain knowledge. The spike in volume for March could have been sellers overwhelming buyers, and a correction lower would soon follow. There was no correction. What the volume tells us then is that buyers were the most active, taking everything available sellers could offer, and that is why price rallied so strongly.

What has been gained from the after-the-fact observation is knowledge that buyers are now in greater control of the market than sellers. This gives a boost in confidence that the up trend will continue, and purchases made in the direction of the trend have a greater probability of gain over loss.

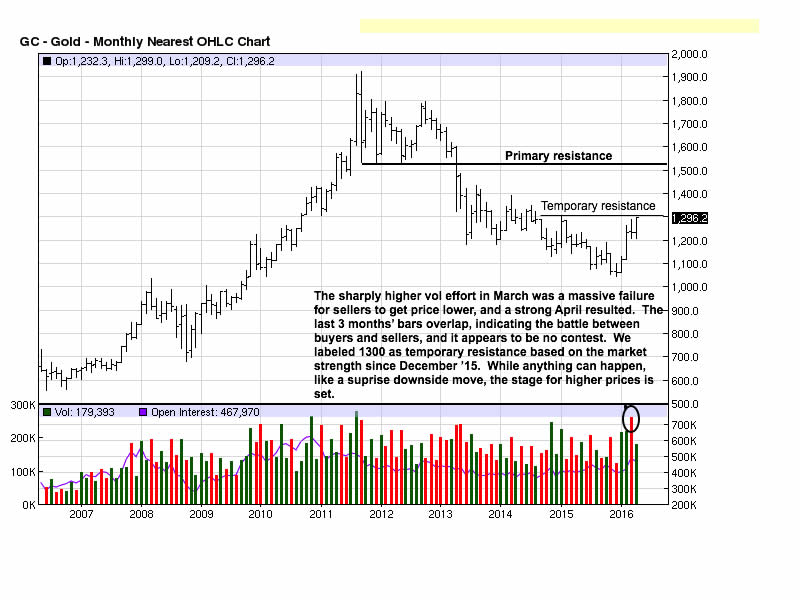

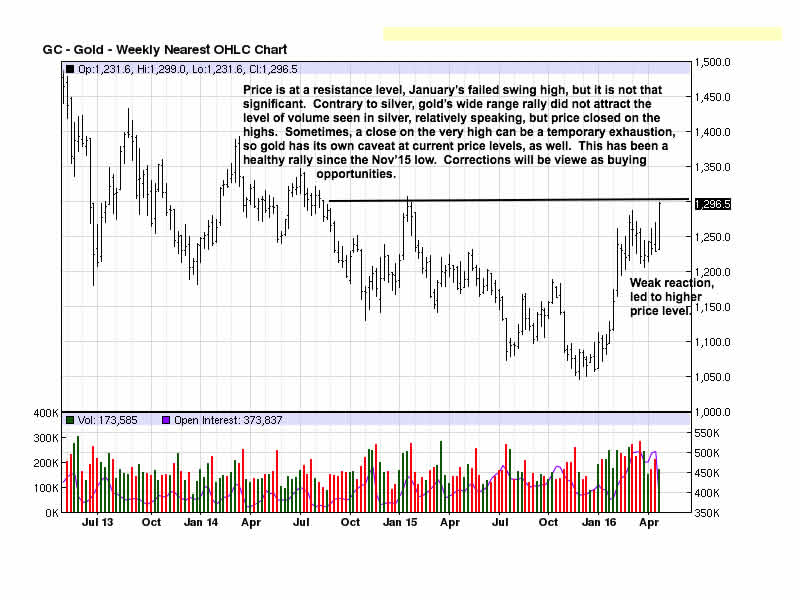

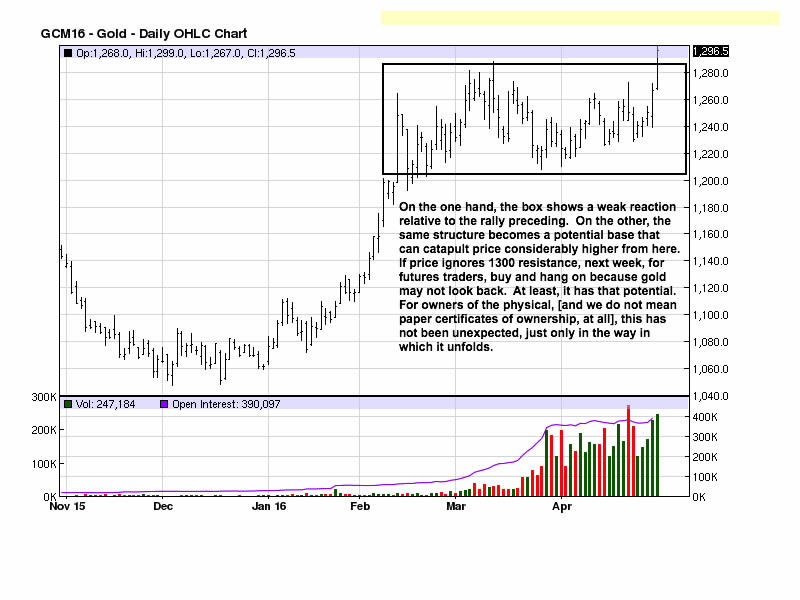

Here is an example of not knowing for certain how price will develop, next week. Gold is at resistance, but the question is, was last week’s rally out of a congestion TR [Trading Range], a breakout to the upside and strong gains will follow immediately? Or will the resistance area put a temporary stop on the rally and generate consolidation or even a reaction lower?

Let the market declare itself, and then follow accordingly.

This is a really interesting chart. The sideways correction for over two months was relatively weak, and weak reactions almost always lead to higher prices. Additionally, as noted on the chart, the sideways TR is also a potential base from which gold could launch much higher, having already started last Thursday and Friday. Either way, the developing market activity is showing positive signs not seen for the past few years, and this spells opportunity.

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.