Stock Market Challenging the 50-day Moving Average

Stock-Markets / Stock Markets 2016 May 13, 2016 - 02:02 PM GMT The SPX Premarket shows it challenging the 50-day Moving Average. How the market opens will tell us whether that support is broken. The odds of a break of the Cycle bottom and Head & shoulders neckline would be high once the 50-day is behind us.

The SPX Premarket shows it challenging the 50-day Moving Average. How the market opens will tell us whether that support is broken. The odds of a break of the Cycle bottom and Head & shoulders neckline would be high once the 50-day is behind us.

ZeroHedge reports, “Global stocks have started Friday the 13th on the wrong foot, with not only Hong Kong GDP unexpectedly tumbling by 0.4%, the worst print in years while retail sales fell for a thirteenth straight month in March, the longest stretch since 1999 as the Chinese hard landing spreads to the wealthy enclave, but also following a predicted collapse in Chinese new loan creation, which will reverberate not only in China but around the globe in the coming weeks. The latest overnight drop in the Yuan hinted that should the recent USD strength continue, China will have no choice but to repeat its devaluation from last summer and winter.“

It further reports, “One recurring question over the past few weeks has been "who is buying" stocks in a world in which not only the smart money, but everyone else too is selling. The latest Lipper data will not provide the answer because as BofA reports, in the latest week there was another $7.4bn in outflows (the 5th straight week) driven by $4.8bn in mutual fund outflows and $2.7bn ETF outflows, leading to a $44bn equity exodus past 5 weeks, which as Michael Hartnett points out is the "largest redemption period since Aug’11", or when the US downgrade sent US stocks into a bear market tailspin.”

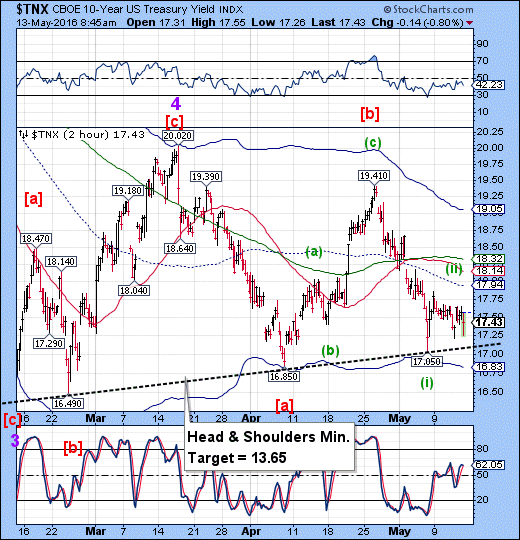

TNX declined this morning, but no new low. This give it a rising probability of completing Wave c of (ii), possibly to the mid-cycle resistance at 17.94 or even higher. What might cause this, I don’t know. We simply have to wait for resolution.

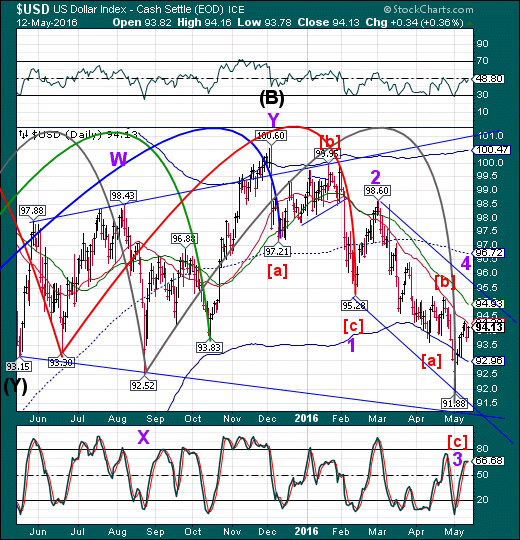

A comparison of the Wave structure and the Cycles calendar suggests that the dollar decline may not be over.

USD has rallied again this morning to a high of 94.66, thus far, just beneath its 50-day Moving Average. I have drawn a potential trendline to show a probable limit of Minor Wave 4. This, in turn, may set off another Yuan devaluation, which may be the catalyst for the next SPX decline, along the same reaction that we saw in August and January.

China’s economy is coming into a hard landing. ZeroHedge reports, “In the latest indication of contracting global growth, overnight Hong Kong reported that its Q1 GDP fell off a cliff 0.4% qoq, widely missing estimates of 0.1% growth as retail sales plummeted and the property market continued its collapse. On a y/y basis, the economy grew only 0.8% when compared to the same period last year, less than half the 1.9% y/y growth reflected in Q4.”

It appears that we are going into a very difficult period. By the looks of things, everything will be done to delay the flash crash until next week.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.