Gold Mining Stocks - Getting A Heartbeat

Commodities / Gold and Silver 2016 May 14, 2016 - 05:26 PM GMTBy: Richard_Mills

PricewaterhouseCoopers LLP (PwC) has recently released their 48th annual British Columbia Mining Report.

PricewaterhouseCoopers LLP (PwC) has recently released their 48th annual British Columbia Mining Report.

We all know commodity prices have been on a downward trend for the past five years. We also know several mines in the province have been put on care and maintenance and many early stage projects have seen their funding dry up.

Let’s take a look at some of the stats in PwC’s B.C. mining report:

- Gross revenues fell to $7.7 billion in 2015, compared to $8.2 billion in 2014.

- Capital expenditures are declining - $1.2 billion in 2015, $1.5 billion in 2014, $1.785 billion in 2013.

- Seven mines were put on care and maintenance by the end of 2015,

and one more in early 2016.

- Exploration expenditures dropped to $272 million in 2015, from about

$338 million in 2014.

The Association for Mineral Exploration British Columbia (AME BC) report, Framing the Future of Mineral Exploration in British Columbia is an overview about:

- The decreasing land base available to exploration/mining

- The lack of clarity in land access and use rules

- The overlapping nature of government regulations

Let’s focus on the decreasing land base for a moment. In 1977, 4% of the land base in British Columbia was closed to mineral exploration; today over 18% is closed. Access to another 33% of the land base is severely limited.

Discovering hidden mineral deposits requires access to large tracts of land to explore, but the actual land used for mining purposes is just 0.05% of British Columbia, of which more than 40% is under reclamation.

“Between 1927 and 1967, Cominco explored more than 1,000 properties in Canada. Of these, only 78 were of sufficient interest to warrant a major exploration program. Sixty were found to contain insufficient ore to justify production; 18 were brought into production, but of these, 11 were not sufficiently profitable to permit recovery of the original investment. Only seven of the original 1,000 properties became profitable mines. During that 40-year period, the company spent more than $300 million in its search for new mines.” Ken Sumanik, Potential impact on mining

Try and imagine the success rate, and cost, of trying to duplicate what Cominco did over half a century ago using today’s dollars and considering the low hanging mining fruit has been mostly picked.

“On average, a prospect will reach development stage between 15 and 20 years after discovery. In many cases, it takes years longer. The mines currently in production in BC, and those in the environmental assessment process, are a direct result of successful discoveries made through prospecting and exploration work conducted in the past, much of it decades ago. Very few grassroots exploration projects reach the advanced development stage, but each exploration program creates value to British Columbians through community and regional development and by increasing the region’s geological knowledge.” AMEbc

The TSX Venture composite index – heavily weighted with junior exploration companies – was down 27% in 2015 and is down 76% since 2011. The TMX Markets Group says B.C.’s mineral exploration companies raised $688.2 million through private placement financings in 2015.

That’s down 57 per cent from the $1.6 billion they were able to raise in 2014 and, going back to 2007, the lowest amount ever raised. Globally, total mining-related financing activity across all exchanges has fallen by 13.6% annually since 2007, an aggregate decline totaling more than 60% over that period.

“2015 saw an almost “complete drop off of any type of fundraising” among junior mining firms, save for…“survival financing,” private placements of say $50,000 to $500,000 to pay for things such as financial statements, listing fees and to maintain mineral claims.” David Penner, Economic Downturn hits B.C. mining exploration hard, Vancouver Sun

"What we saw in 2015, was another tough year of continued downturn in commodity prices, which remain the biggest threat to the industry's profitability.” Mark Platt, PwC

Not all doom and gloom

Junior exploration companies continue to be hammered by a lack of capital and investor confidence, as a result most B.C. miners and explorers are hunkered down hoping for the best. Unfortunately, if low exploration levels continue for too long, eventually the mining projects already in the pipeline get developed and there is nothing to take their place.

Thankfully it’s not all doom and gloom…some companies continued to acquire, explore, develop and advance projects in 2015.

In 2015, British Columbia attracted 19% of all exploration dollars spent in Canada, compared to just 6% in 2001. And 19 of the top 100 exploration projects in Canada are in B.C.

British Columbia should be a mining powerhouse, consider:

- Excellent geology

- Good transportation (road & rail) system

- Competitive tax rates

- Strategic location with respect to Asian markets. Two modern ports, Vancouver - Canada’s largest and the Port of Prince Rupert which is the closest of any of North America’s West Coast ports to Asia - up to 58 hours of sailing time shorter

- High quality and easily accessible geological data

- Mining friendly provincial government

- Communities receptive to resource extraction as a livelihood

- Attractive exploration incentives

- BC is the third largest generator of hydro electricity in Canada - one of the lowest power costs in North America. Natural gas is plentiful, cheap and resources are growing

- Some of the most modern education and telecommunications infrastructure in the world

Junior versus Major

Know this…

Many of the major mines in the world were discovered by B.C. based junior exploration companies – and closer to home, over 70% of all discoveries in Canada have been made by junior companies.

It’s a fact in the mining world that most discoveries are made by junior mining companies. Juniors, not majors, own the world’s future mines and juniors are the ones most adept at finding these future mines. They already own, and find more of, what the world’s larger mining companies need to replace reserves and grow their asset base.

A junior resource company’s place in the food chain is to explore for, find and develop, to a certain point, the world’s future mines; nowhere are juniors more important to mining then right here in British Columbia, a vast and under explored treasure trove of minerals.

There’s no doubt mining brings a great deal of revenue to the province, but let’s remember one important point – juniors find the deposits and prove them up to the point where a major would step in and buy them. Consider another point – when was the last time you heard of a major mining company making a discovery?

There’s no doubt mining brings a great deal of revenue to the province, but let’s remember one important point – juniors find the deposits and prove them up to the point where a major would step in and buy them. Consider another point – when was the last time you heard of a major mining company making a discovery?

Today the relationship between juniors and majors is so inextricably linked that it’s doubtful a major mining company could replace its mined reserves, let alone grow them, without keeping a close eye on junior’s activities and a check book handy.

One of the bright spots in the mineral extraction sector in B.C. is precious metals – gold and silver.

“Gold has special properties that no other currency, with the possible exception of silver, can claim. For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close. Today, the acceptance of fiat money -- currency not backed by an asset of intrinsic value -- rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold.

If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute.” Golden Rule, Federal Reserve Chairman Alan Greenspan (Ret.)

World Gold Council

Leverage

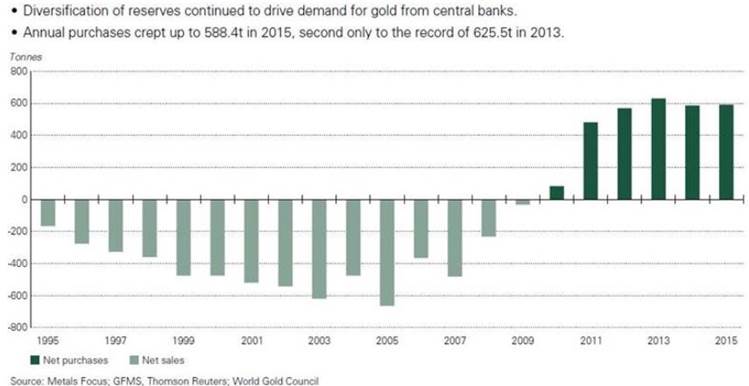

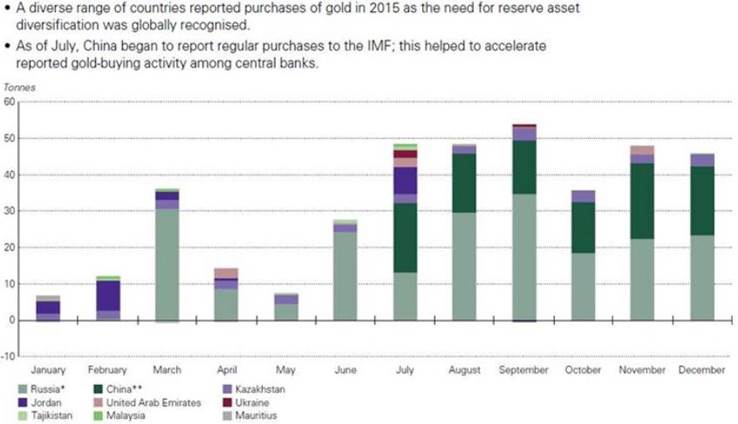

Gold and silver, in this author’s opinion, are extremely undervalued financial instruments. A portion of every investors portfolio needs to be dedicated to holding gold and silver bullion. After all, if the world’s central banks feel the need to diversify out of fiat currencies it might be a good idea for us to pay attention.

But historically, and perhaps especially so today, the greatest leverage to rising precious metal prices has been owning the shares of junior resource companies focused on acquiring, discovering and developing precious metal deposits.

Conclusion

New Carolin Gold Corp. (LAD:TSX, LADFF:OTC) has an exciting gold project and is one company that’s definitely not hunkering down.

LAD has, despite tough capital raising conditions for most juniors, been able to easily raise the money necessary to begin working on what might become it’s Coquihalla Gold Camp, potentially an entirely new, 144 sq km 100% owned gold district.

Success here could open up a lot of people's minds about junior mining overall.

Revitalizing New Carolin’s Ladner Gold Project could make it a cornerstone industry for the community of Hope, B.C.

All of us living in British Columbia need projects like this to succeed to reap the social and economic benefits that come from resource extraction.

New Carolin is definitely getting a heartbeat. Interest in the company and it’s great project - as evidenced by a huge volume increase and share price appreciation - is picking up.

New Carolin should be on every precious metal investors radar screen. Is it on yours?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2016 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.