Gold Price Forecasts Revised Higher To $1,400/oz - Citi Says "Buy the Dip"

Commodities / Gold and Silver 2016 May 30, 2016 - 06:53 PM GMTBy: GoldCore

Gold price forecasts have been revised higher in recent weeks and Citi became the latest bank to revise higher their projections for gold, despite the recent weakness in the price.

Gold price forecasts have been revised higher in recent weeks and Citi became the latest bank to revise higher their projections for gold, despite the recent weakness in the price.

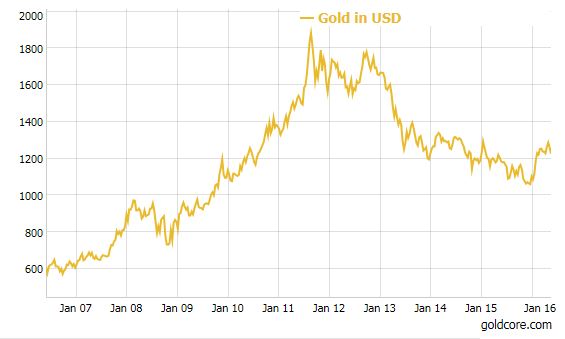

Gold in USD – 10 years

Citi Research, the research division of one of the world’s biggest banks, raised its gold price forecast to an average $1,280 in the current quarter, $1,300 in the July-September period, and $1,250 in the final three months of the year.

Citi has become bullish not just on gold but on a large section of the commodities complex, including oil:

“Commodities markets appear to have turned the corner and, led by the petroleum market, are accelerating their price recovery from the lows of the last year, especially since this past January,” Citi said. “While the price increases experienced since early 1Q (first quarter) remain subject to the ‘new normal’ of relatively high volatility, it appears there is no turning back any time soon.”

Citi said that despite the recent gold pullback, now is an “opportune moment” for buyers and now is the time to invest in gold:

“While prices have fallen 3% (month to date) in May, we believe this may in fact prove to be an opportune moment to ‘buy the dip,’” strategists wrote in a note issued Tuesday, titled “Let the Sunshine in as Commodities Enter New Age of Aquarius.”

A U.K. exit from the European Union aka “Brexit” could hinder the Fed in raising rates. While acknowledging the Federal Reserve’s hawkish tone in its April minutes, Citi nonetheless doesn’t think the central bank will raise interest rates in June.

“The risk of ‘Brexit’ is likely to complicate matters for U.S. policymakers, and we do not expect the Fed to move until after the June referendum,” the note said. With the presidential election in November, the Fed likely can pull off only one rate hike this year, it added, “effectively limiting the likelihood of a correction in gold prices for the next two quarters.”

Citi joins other banks in revising their gold forecasts higher, many of whom now have a $1,400 price target:

- Saxo Bank believes that gold bullion may hit as much as $1,400 an ounce this year.

- J.P. Morgan is in favor of a possible $1,400 by the end of this year. Negative interest rates in several developed economies are behind this optimistic forecast, as nearly $8 trillion in global sovereign debt is caught in the web of negative yield.

- BNP Paribas is yet another believer of $1,400 gold over the coming one year.

- Goldman has a 12-month target of $1,150 an ounce, up from the previous target of $1,000 an ounce. Goldman’s gold price targets have been quite poor and misleading.

- Natixis , the French bank, also upped its gold forecast for 2016 by 22% to about $1,185 an ounce from its prior forecast made in October. But it means around 4.9% downside from the current level.

- Macquarie raised its gold forecast by 5% for 2016 to $1,199 per ounce (down about 3.8% from the current level) and by 3% for 2017 to $1,251. The bank expects prices to go up to above $1,400 in 2019.

Source of bank gold analysts revisions here

Citi’s 2016 average price forecast is now $1,255 — up 17% from a late January estimate of $1,070.

While higher gold price forecasts are welcome, rather than focusing on price, investors need to focus on the value and benefits of owning physical gold. Direct legal ownership of individually segregated and allocated gold coins and bars will again protect and grow wealth in the coming years.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.