US Housing Market - It Looks Like the Dumb Money’s at It Again

Housing-Market / US Housing Jun 07, 2016 - 05:17 PM GMTBy: Harry_Dent

New home sales just went up a staggering 16.6% in April.

New home sales just went up a staggering 16.6% in April.

619,000 new homes were sold – the most since early 2008 just before the worst of the housing meltdown, and the highest rate of growth in 24 years.

So is this a sign that the economy is back on track?

Don’t count on it.

Home sales, like jobs, is a lagging indicator, not a leading one. It’s a sign of where we’ve been, not where we’re going. So this isn’t a big surprise to us.

In fact, this is just like stock indicators near a peak.

The dumb money is finally pouring in while the smart money is exiting. Except this time, it’s just in real estate.

Millennials have held back on buying homes for a variety of economic reasons since 2008. Tighter lending standards, for one. The concern that home prices could fall again, for another. And I’m sure $1.2 trillion dollars in student debt, falling real wages and higher unemployment for them (since more baby boomers are staying in the workforce longer) have something to do with it, as well.

So even while more millennials cross that 28 to 33 age timeframe when they’d normally buy a house… more and more of them have been opting out, choosing to stay at home with their parents, or rent. They’ve put off the biggest financial decision of their lives because they all know the worst could happen.

But, home prices have continued rising, and the inventory of homes for sale has been falling. Hence, new home sales keep advancing.

So last month, the most people in eight years decided that if they’re going to buy a new home, now’s the time to do it.

But how much longer can this trend continue?

Even with last month’s boost, new home sales aren’t anywhere close to where they were at the housing peak in 2005 when a million or more new homes were selling every month.

We’re not even close to where we were before the bubble started in 2000!

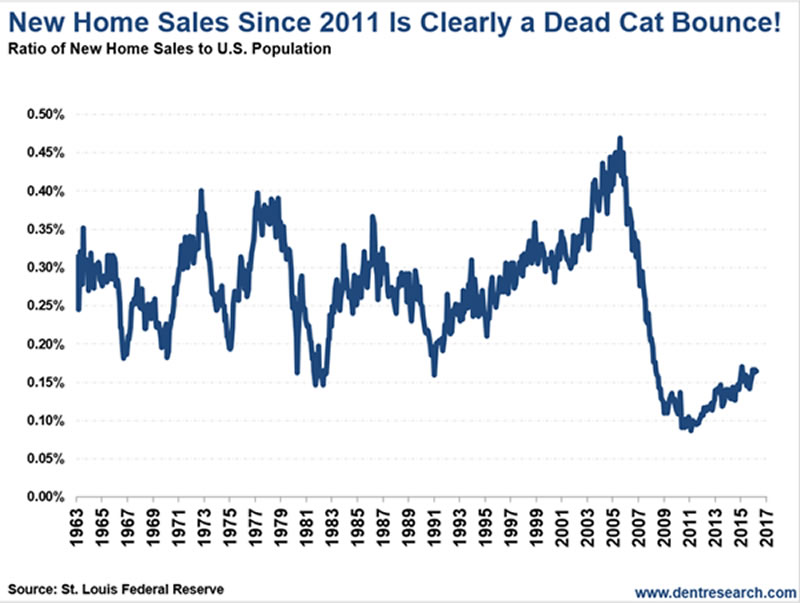

Just look at the reality of it in this chart, which adjusts new home sales for rising population growth:

The baby boomers carried us to new highs in the middle of last decade. After that, real estate suffered the most drastic fall in U.S. history.

The rise in new home sales since 2012 is nothing compared to that!

This one-month, 16.6% rise hardly even shows up!

A “dead cat bounce” is trader terminology for a very modest bounce that follows a substantial crash… meaning there’s more to come.

Do the bounces following major crashes in the early 1980s and early 1990s forward look like this one? Not hardly!

I warned of the bubble peak in housing prices in late 2005 before the bubble burst in early 2006.

And I’m warning now that the millennial generation will not carry the housing market to new highs the way the boomers did.

It’s not just the skittishness of these fragile new buyers. Their demand will simply not be enough to offset the retiring baby boomers who eventually die and become sellers by default.

And that’s why I’m predicting net housing demand will fall – even turning negative over the next two decades – especially starting later this year.

This critical demographic indicator shows it won’t turn positive again until after the year 2039 – 23 years from now. The same indicator explains why the echo boom in Japan never caused a bounce in housing, even 25 years after its all-time bubble highs and 60% crash.

What we’re seeing today is simply the “dumb money,” particularly the everyday household from the millennials, finally buying after holding back for years, now that they feel the risk of another housing downturn is waning.

Meanwhile, the “smart money” is retreating from the highest-end real estate in bubble cities like London, Manhattan and Miami – with more of them to follow.

The smart money is selling, like the richest family in China, and the everyday household is finally buying…

What does that tell you?

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.