Gold Stocks Retreat at Resistance

Commodities / Gold and Silver Stocks 2016 Jun 10, 2016 - 06:11 PM GMTBy: Jordan_Roy_Byrne

Over the past two weeks gold stocks have surged more than 20% as the awful jobs report forced the bears to capitulate. That strong of a move in a brief amount of time will naturally slow or correct. Furthermore, gold stocks touched resistance Friday morning which led to a bearish reversal. While the bullish trend remains intact, the odds favor lower prices in the days ahead.

Over the past two weeks gold stocks have surged more than 20% as the awful jobs report forced the bears to capitulate. That strong of a move in a brief amount of time will naturally slow or correct. Furthermore, gold stocks touched resistance Friday morning which led to a bearish reversal. While the bullish trend remains intact, the odds favor lower prices in the days ahead.

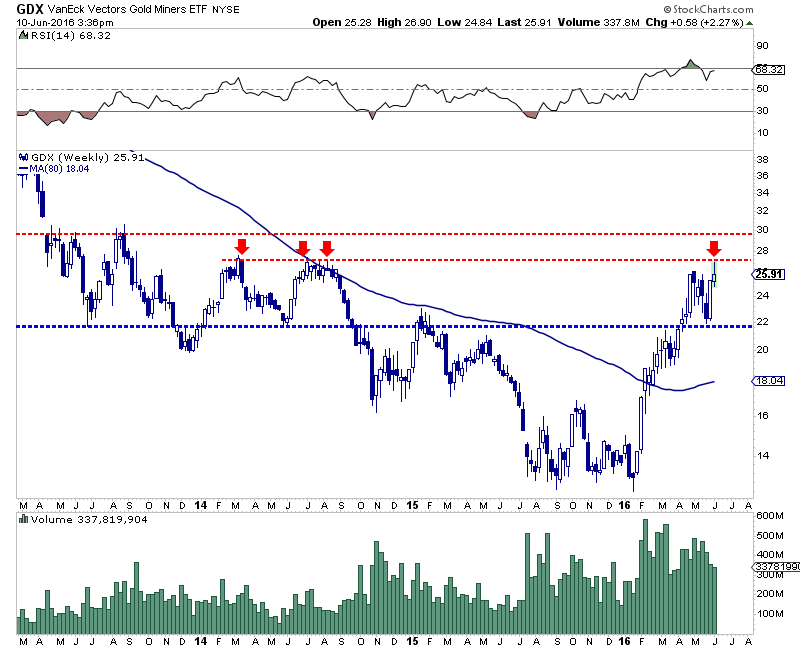

The weekly chart below shows that GDX ticked resistance near $27 yet will close off the highs of the week. That is not a surprise considering the market tested resistance amid a very overbought condition. It was unlikely to crack resistance on the first try.

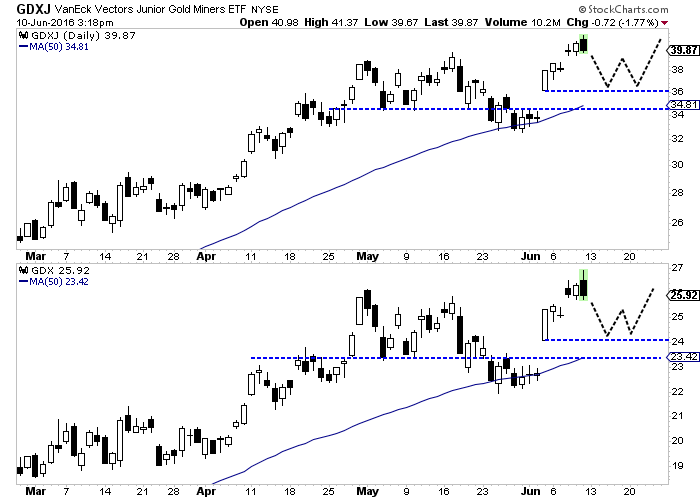

We zoom in on the short term by looking at daily candle charts for both GDX (bottom) and GDXJ. The miners pushed to higher highs but formed a bearish reversal on Friday. I expect Wednesday’s gap to fill and the miners to potentially test last Friday’s opening prices (GDXJ $36 and GDX $24). We sketch how the correction could evolve with the presumption of a bullish outcome.

Buying opportunities within this sector have been few and far between and that could remain the case for the time being. However, if the miners correct here as expected then we should get a minor buying opportunity in the days ahead. If GDXJ tests $37 that would mark a 10% decline. Buying +10% weakness has been a profitable, lower risk strategy and we think that will continue to be the case. Hold your positions and take advantage of weakness.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.