Believe it or Not: More Kids Live At Home Now than Since The Great Depression

Politics / Social Issues Jun 21, 2016 - 03:14 PM GMTBy: Harry_Dent

We all know the situation in the markets is dire.

We all know the situation in the markets is dire.

Like, really, everyone knows.

There’s an old phrase from Margaret Thatcher’s day (and mine, I suppose) that has recently come back into use: There is no alternative.

There’s even an acronym: TINA.

There is no alternative example of a campaign advertising material of the CDU for the 1994 election for the Landtag of Thuringia.

That’s quaint, and all, but this meatily numbered piece shows the heart of what that phrase means.

There is no alternative, the markets will correct. They have to, regardless of how hard the Fed fights.

We’re long overdue, and the heart of this piece is the fact that we haven’t been here, in this way, since a year or so, after the Great Depression.

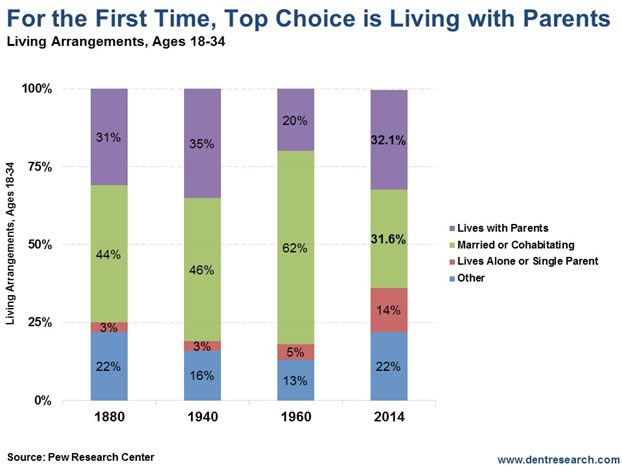

More 18- to 34-year-olds are now living with their parents than at any time since 1960, when the number hit an all-time low of 20%.

It’s now jumped up to 32.1%, and is as high as 36% for those with a high school education or less. The number jumped to 28% in 2007, with the Great Recession catapulting it to 32% in just seven years.

For the first time in history, living with parents has surpassed living with a spouse or partner, with over 30% of children now living with parents, as the chart below from Pew Research shows. Fourteen percent live alone or as a single parent, with more women at 16% than men at 13%.

The “other” category includes living with siblings, friends, and grandparents, or in dormitories.

The reason for this long-term trend is the decline of romantic coupling, and couples – once they do form – holding off on tying the knot.

The median age of marrying couples rose from 21.3 years old (22 for men, 20 for women) in 1956 to 27.8 today (28.3 for men, 27.2 for women). It has jumped two years just since the Great Recession of 2008.

Twenty percent today have never married and Pew says that 25% of adults will never get married… at any age! Financial security and a steady job is a prime reason for the holdouts. Men with only a high school education, or less, see 23% never married versus 17% for women.

For those with a high school, or less, education, it’s 25% versus post grad degrees at 14% for men, and 20% and 16%, respectively, for women.

With higher joblessness, the rate of unmarried men sits at 36% for blacks and 26% for Latinos. Asians are at 19% and whites at only 16%.

There was only one time in modern history where a higher percentage of kids lived with parents and that was 35% in 1940 – in the late years of the Great Depression.

I am confident this rate will exceed that in the Great Depression ahead by 2022.

Not surprisingly, divorced people have less interest in marrying again than people who have never gotten married in the first place. Almost half, or 45%, say “no thanks” to ever getting married again.

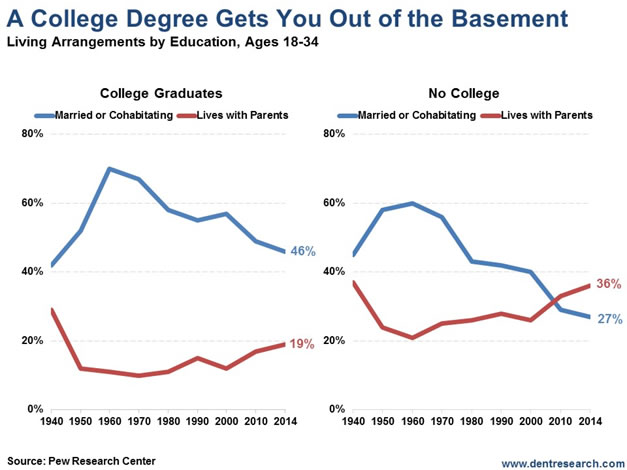

The most telling charts are the following ones. The most dramatic shift has come from non-college grads, falling from 60% of those married or living together in 1960, down to 27% in 2014, with 36% living with parents.

For the college-educated, people who were married or living together peaked in 1960 at 79% and has declined to only 46%, with 19% living with parents.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.