UBS States; “Gold Has Entered a New Phase “

Commodities / Gold and Silver 2016 Jul 06, 2016 - 12:40 PM GMTBy: GoldCore

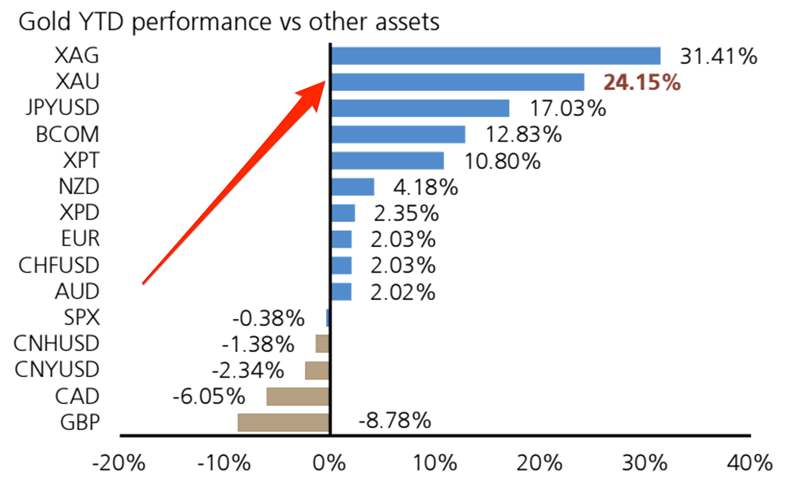

With gold prices having risen by 24% in dollar terms already this year, UBS analyst Joni Teves declared in a note to clients yesterday that “gold has entered a new phase”.

Key drivers include: 1) low/negative real rates, 2) the view that the dollar has peaked against DM currencies, and 3) lingering macro risks. We expect the next leg to be driven by an extension of the trend of strategic portfolio allocation into gold from a diverse set of investors. This trend should now deepen, attracting more participants and encouraging those who have been hesitating to get more involved. Relatively orderly retracements, which have typically been shallow and brief, indicates strong buying interest. This suggests that gold’s floor is likely higher now given an even stronger fundamental argument for holding gold.

Teves continues:

The UK’s vote to leave the EU further underpins gold’s macro narrative, reinforcing the themes of further dovish shifts in monetary policies, consequently lower yields, and heightened uncertainty. We continue to expect US real rates to fall from here and ultimately for equilibrium real rates to settle lower and have limited upside. These factors justify strategic gold allocations across different types of investors and we expect this trend to continue.

Gold and Silver News

Read More Here

Gold Prices (LBMA AM)

06 July: USD 1,347.00, EUR 1,239.71 & GBP 1,059.01 per ounce

05 July: USD 1,344.75, EUR 1,207.05 & GBP 1,023.89 per ounce

04 July: USD 1,348.75, EUR 1,213.07 & GBP 1,016.42 per ounce

01 July: USD 1,331.75, EUR 1,199.51 & GBP 1,001.34 per ounce

30 June: USD 1,317.00, EUR 1,183.59 & GBP 976.82 per ounce

29 June: USD 1,318.00, EUR 1,191.64 & GBP 984.36 per ounce

28 June: USD 1,312.00, EUR 1,185.79 & GBP 985.84 per ounce

Silver Prices (LBMA)

06 July: USD 20.43, EUR 18.46 & GBP 15.75 per ounce

05 July: USD 19.73, EUR 17.69 & GBP 14.99 per ounce

04 July: USD 20.36, EUR 18.31 & GBP 15.36 per ounce

01 July: USD 19.24, EUR 17.29 & GBP 14.48 per ounce

30 June: USD 18.36, EUR 16.48 & GBP 13.61 per ounce

29 June: USD 18.21, EUR 16.42 & GBP 13.55 per ounce

28 June: USD 17.57, EUR 15.84 & GBP 13.17 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.