Hubris, Instability and Entertainment - The Only Thing That Grows Is Debt

Politics / Government Spending Jul 25, 2016 - 06:48 PM GMTBy: Raul_I_Meijer

John McDonnell, UK Shadow Chancellor of the Treasury (at least it sounds important) appealed to his -Labour- party on Sunday morning TV to “stop trying to destroy the party”, and of course I’m thinking NO, please don’t stop, keep at it, it’s so much fun. When you watch a building collapse, you want it to go all the way, not stop somewhere in the middle and get patched up with band-aids.

John McDonnell, UK Shadow Chancellor of the Treasury (at least it sounds important) appealed to his -Labour- party on Sunday morning TV to “stop trying to destroy the party”, and of course I’m thinking NO, please don’t stop, keep at it, it’s so much fun. When you watch a building collapse, you want it to go all the way, not stop somewhere in the middle and get patched up with band-aids.

It’s alright, let it crumble, it’s had its day. And if it’s any consolation, you’re not alone. Nor is that some freak coincidence. ‘Labour’-like parties (the ‘formerly left’) all over the world are disintegrating. Which is no surprise; they haven’t represented laborers for decades. They’ve become the left wing -and even that mostly in name only- of a monotone bland centrist political blob.

The other ‘half’ of that blob, the ‘conservative’ side, is disintegrating just as rapidly, as evidenced by the rise of Trump and a motley crew of Boris Johnson ilk.

The spontaneous self-immolation of the US Democratic Party mirrors that of the British Labour Party, but admittedly, it has even more entertainment value. America does entertainment like nobody else can.

In both cases, we see entire parties turn on their own candidates, it truly is a sight to behold. Especially since people like Bernie Sanders and Jeremy Corbyn are the only ones who do have a tangible connection to the people left that they represent.

One might even say Donald Trump falls in that category too, though in a slightly different way. The others, whether they are from the supposed left or right -and it really makes no difference anymore- rely on pure hubris. The WikiLeaks files on the DNC make that so clear it hurts.

And if one thing exemplifies what’s going wrong, it’s that the DNC in all its superciliousness seeks to blame the fact that there were leaks for the mess, not the content of what was leaked. And replaces one chair with another who was just as guilty as the first one of trying to bring down one of their own candidates. As the leaks show.

The reason all this high value entertainment is presented to us is that the political system is toppling over in line with the economic one. As I’ve argued before, this is inevitable, because they are one and the same system. If one part falls, so must the other. I wrote 7 weeks ago:

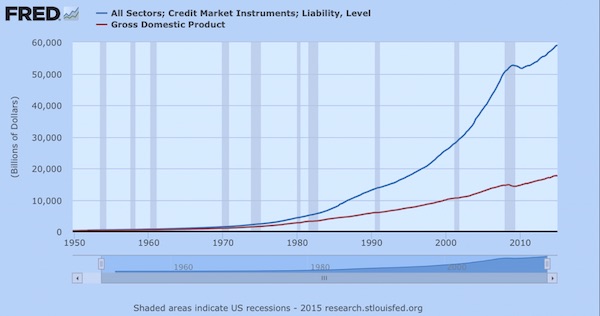

The Only Thing That Grows Is Debt

What we have is a politico-economic system, with the former media establishment clinging to (or inside?!) its body like some sort of embedded parasite. A diseased triumvirate.

With the economy in irreversible collapse, the politico part of the Siamese twin/triplet can no longer hold. That is what is happening. That is why all traditional political parties are either already out or soon will be. Because they, more than anything else, stand for the economic system that people see crumbling before their eyes. They represent that system, they are it, they can’t survive without it.

Of course the triumvirate tries as hard as it can to keep the illusion alive that sometime soon growth will return, but in reality this is not just another recession in some cycle of recessions. Or, at the very minimum this is a very long term cycle, Kondratieff style. And even that sounds optimistic. The system is broken, irreparably. A new system will have to appear, eventually. But…

‘Associations’ like the EU, and perhaps even the US, with all the supranational and global entities they have given birth to, NATO, IMF, World Bank, you name them, depend for their existence on an economy that grows. The entire drive towards globalization does, as do any and all drives toward centralization. But the economy has collapsed. So all this will of necessity go into reverse, even if there are very powerful forces that will resist such a development.

And here’s the graph that I said depicts very well what is the problem with the economic system, in an ‘all you need to know’ kind of way:

We’d already be well aware of what’s wrong with our economies if our governments and media hadn’t consistently lied to us about it for all these years. These lies make sense from their point of view; they’d be out of a job and out of power once they would stop lying.

Outside of the media, in people’s own experience, there is no recovery, it’s a fairy tale. And there is no growth the way stock exchanges portray, or employment numbers. You can’t lie to all of the people all of the time. Again, though, the attempts are often good for many hours of solid amusement.

Take the way a word like populist is (ab-)used. Grab a handful of names of people who’ve been labeled populist recently, like Putin, Trump, Tsipras, Varoufakis, Sanders, Corbyn, Chávez, Maduro, Morales, Le Pen, Beppe Grillo, Wilders, etc etc, and you notice they are very different people in more ways than one.

But they have one thing in common: they reject the western establishment, at least to a degree (many merely want to ‘tweak’ it). Which makes it tempting for establishment media to slap the populist label on them, because it has such a bad connotation. Courtesy of the same media, of course.

Still, that’s only mildly funny, more in a subtle kind of way. There are better ones. Where do you think these buttons, for example, find their origin?:

Even better, Zero Hedge and Bryan MacDonald have a nice set of ‘plagiarized’ headlines. Altogether now on the all time favorite whipping boy, Vlad V. Putin. The DNC was at him again today as well, even though by the looks of it they don’t seem to need any help at self-destructing. That’s the one thing left they’re really good at.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.