Bubble Blind Central Bankers

Interest-Rates / US Federal Reserve Bank Oct 10, 2016 - 04:47 PM GMTBy: Michael_Pento

Fed Head Janet Yellen is keeping alive the tradition of her predecessors, Messrs. Greenspan and Bernanke, by showing she is equally as blind-sighted to the bubbles central banks are blowing in the bond and equity markets. During her September press conference, Ms. Yellen stubbornly clung to the misconception that it is only possible to tell if a bubble exists after it bursts. And because of this delusion, in Yellen's eyes ninety-six months of a virtual Zero Interest Rate Policy (ZIRP) is merely, and I quote, "a modest degree of accommodation." Her blinders are so opaque that she claims to see, "no signs of leverage building up." And her feckless ability to spot market imbalances even resulted in this doozy of a Yellen quote: "In general, I would not say that asset valuations are out of line with historical norms."

Fed Head Janet Yellen is keeping alive the tradition of her predecessors, Messrs. Greenspan and Bernanke, by showing she is equally as blind-sighted to the bubbles central banks are blowing in the bond and equity markets. During her September press conference, Ms. Yellen stubbornly clung to the misconception that it is only possible to tell if a bubble exists after it bursts. And because of this delusion, in Yellen's eyes ninety-six months of a virtual Zero Interest Rate Policy (ZIRP) is merely, and I quote, "a modest degree of accommodation." Her blinders are so opaque that she claims to see, "no signs of leverage building up." And her feckless ability to spot market imbalances even resulted in this doozy of a Yellen quote: "In general, I would not say that asset valuations are out of line with historical norms."

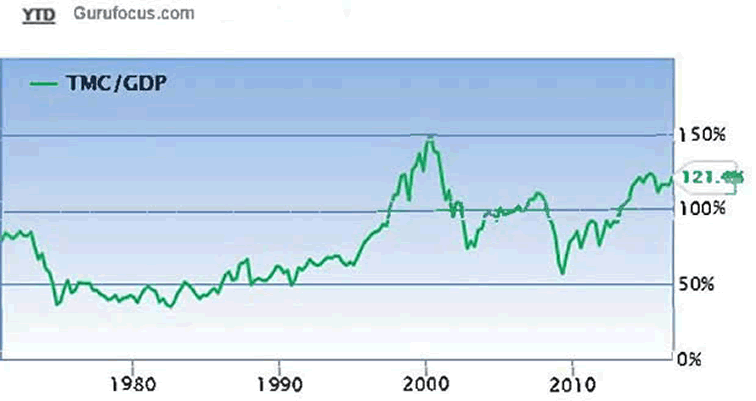

Can it really be the case that the women who holds a dictatorship on the cost of money, which is the most important price signal in an economy, is unaware that the stock market is at a level that is virtually the most overvalued in history? The Median PE, Price to sales and Total market cap to GDP ratios all show that the equity bubble is about as far detached from economic reality than at any other time in history. For example, the market cap of equities in relation to the size of the economy is over 70 percent points higher than the level experienced from 1975-1990.

We have indeed climbed up to the very thin air historically speaking on the 25 times trailing earnings on the S&P 500. And the air here is especially rare given the fact that earnings have fallen six quarters in a row. According to Fact Set, earnings will drop by 2.3% year over year; and that is despite the dollar falling 4% and crude oil rising 20% so far in 2016.

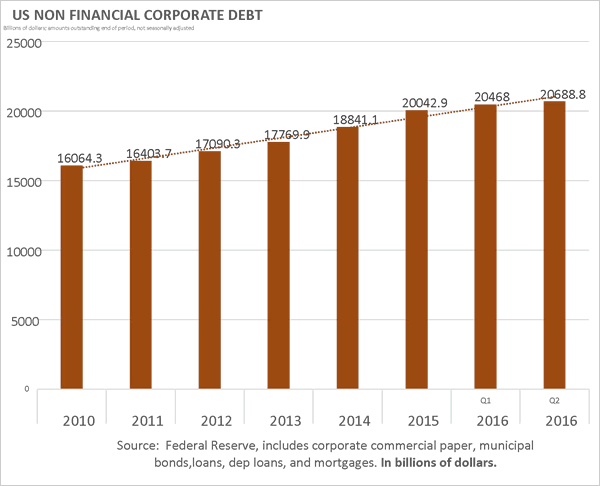

Furthermore, Yellen's reckless money printing has led to a humongous rise in corporate debt. And to see this bubble all she has to do is view the Fed's own data.

And this corporate debt bubble isn't limited to the United States, according to the UN Conference on Trade Development, corporate debt in Emerging Markets (EM) has swelled to $25 trillion. This is 104% of EM GDP, up from 57% at the end of 2008.

Household debt is also surging in the U.S., up to a record $14.3 trillion. And this impulse to take on debt at record low interest rates has spread across the globe. According to Institute for International Finance (IFF); China, Saudi Arabia, Thailand, and Korea led the way with the largest build-up in household debt per adult since 2010.

Indeed according to Deal logic, global debt issuance is up 5.02 trillion dollars so far in the first three-quarters of 2016; this would put it on course to rival the all-time high of $6.6 trillion hit in 2006. Central bank largess has caused government, household and corporate debt to surge across the globe; but according to Ms. Yellen there is nothing to see here.

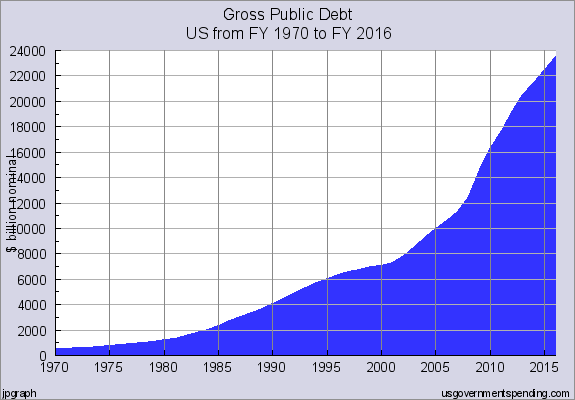

However, Ms. Yellen need not pour through the staid analysis prepared by the IFF or the UN Conference to see if central bankers have caused a debt pile with trillions of dollars' worth of free money. She only needs to muse the over-indebtedness of our over-leveraged Federal Government to see the bubble in bonds she has helped spawn.

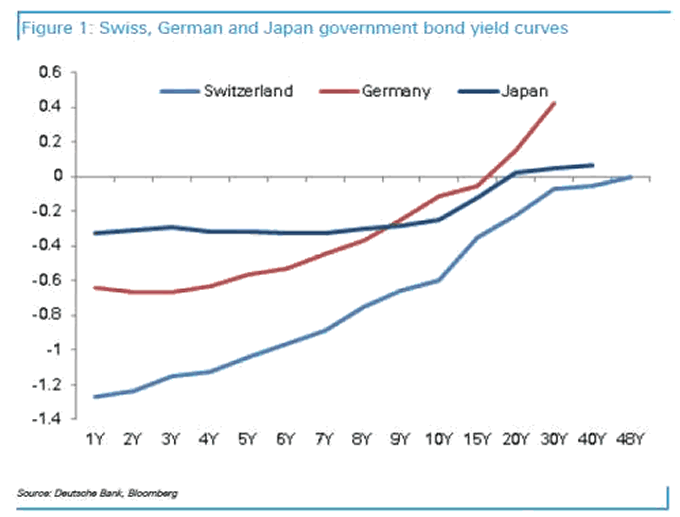

And if none of those points convince her, perhaps the former MIT and Yale Fellow should find it troublesome that close to $13 trillion of global sovereign and corporate debt trades at negative yields. Thirteen trillion in negative yields screams bubble! Its time Yellen took off her blinders and her senses.

For the first time in the history of economics, corporations and governments are getting paid to lend money. This is the direct result of the 96 months of nearly free money from the Fed and the combined $15 trillion increase in central bank balance sheets since 2007. And this rate of central bank money printing is still growing at a rate of $200 billion each month.

The consequences of these actions has produced, for the first time ever, record bond, stock and home prices that all exist concurrently. Therefore, one has to conclude Ms. Yellen is either bubble blind, or deliberately trying to cover up the massive distortions in asset prices that central banks have created. Perhaps this is because she is viscerally aware that there is no escaping these bubbles without destroying the phony economic recovery, which has been predicated on the Fed's wealth effect. Incredibly, she recently has gone so far as intimating that the direct purchase of corporate equity and debt could be an appropriate course of action for the Fed to take during the next downturn.

But for now, Ms. Yellen appears ready to resume the aborted rate hike cycle it began last December. However, any such increase in interest rates will expedite the flattening of the yield curve and usher in the next brutal recession, along with the third 50% haircut in equity prices since 2000. And then our perpetually bubble-blind Fed will get that opportunity to purchase a humongous amount of securities in order to reflate the bubble once again—which the Fed still won't admit its culpability, let alone be able to recognize.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.