Will Trump Cause Geopolitical Chaos?

Stock-Markets / Financial Markets 2016 Dec 09, 2016 - 05:05 PM GMTBy: Arkadiusz_Sieron

Before the U.S. presidential election analysts pointed out that Trump's administration would be positive for the yellow metal, because of the elevated general uncertainty, possible geopolitical turmoil (due to trade wars or recalibration of foreign policy), slower economic growth (due to protectionism), as well as widened fiscal deficits and higher inflation (due to tax cuts and higher government spending).

Before the U.S. presidential election analysts pointed out that Trump's administration would be positive for the yellow metal, because of the elevated general uncertainty, possible geopolitical turmoil (due to trade wars or recalibration of foreign policy), slower economic growth (due to protectionism), as well as widened fiscal deficits and higher inflation (due to tax cuts and higher government spending).

In this edition of the Market Overview, we will analyze these issues in greater detail. We will focus immediately on the foreign policy's impact on the gold market, while in the next parts we will examine the relationship between Trump's domestic policies and the shiny metal. Although gold reaffirmed its unquestionable position as a safe haven during election night, investors should not count on this channel only. It's true that Trump is less likely to continue with the status quo, and no one really knows what to expect from the new administration. Investors do not like vagueness, so they may refrain from making investments or turn into safe havens, such as gold.

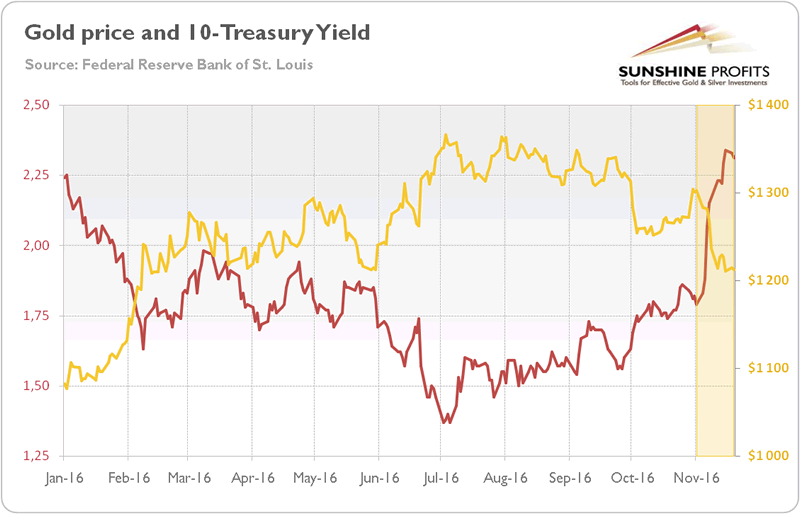

However, this lack of clarity should be already priced in. Moreover, Trump's rhetoric and, thus, the reception of him, should soften after the harsh campaign. And if anything, uncertainty should now only decrease along with finding out the successive details of economic program and completing the new administration. Indeed, this is why we see fast and furious asset reallocation after elections – when Trump won, it became clear which assets should benefit from such an outcome, so investors started to recalibrate their portfolios. As the chart below shows, Trump's rally led in particular to a rout in both bond and gold markets (and to increase in profits of those who had been holding short positions in precious metals, like our subscribers). The rise in bond yields (the decline in bond prices) reflects the rise in risk-appetite.

Chart 1: The price of gold (yellow line, right axis, London P.M. Fix) and the 10-year U.S. Treasury Constant Maturity Rate (red line, left axis, in %) from January 4, 2016 to November 10, 2016.

Surely, the next president could abandon the climate change deal or raise tariffs on imports on China relatively easily (but only to a certain extent), however other policies (such as an effective withdrawal from NAFTA) should be more difficult to enact, as they demand the Congress's consent. Investors should remember that presidents change, but nation's interest remain and the administration and civil service may simply block the most dangerous ideas. There is evidence that bureaucracy often steers presidents, not the other way around (and we do not refer here to the “deep state”, but rather to the asymmetric information between provisional government and lasting civil service).

That being said, the geopolitical risk should rise given the change in government and its protectionist and isolationist stance. Protectionist policies can trigger trade wars, risking global slowdown or instability. Moreover, if Trump suggests some radical changes in the foreign policy, uncertainty and the safe-haven demand for gold should rise. The biggest threat is probably the U.S. exit from NATO, which would reshape the current international American-backed order and put many U.S. allies at risk.

Although Trump's presidency may imply a less interventionist or more isolationistic America (however some analysts speculate now about a joint military effort with Russia and Syrian President Bashar al-Assad to defeat Islamic State), it is extremely difficult to predict how it will affect the gold market. On the one hand, it may raise uncertainty (and safe-haven demand for gold) as American military engagement increases safety in many parts of the world, especially in South Korea and Japan worried by North Korea and China, as well as in Europe endangered by Putin's Russia. Moreover, if Trump manages to abandon the Iran nuclear deal, the global tensions would increase. On the other hand, if a new foreign policy stance diminishes the number of conflicts, it may reduce fears and, consequently, the attractiveness of gold.

Therefore, long-term investors should not make their decisions on the basis of the Trump's foreign policy and its impact on the geopolitics only, but always look at the fundamentals, which depend more on the U.S. economic stance and the Fed's actions. It seems that Trump's imprint on fiscal policy is now much more important for the gold market.

Summing up, Trump's victory was supposed to be very bullish for the gold market. Trump was believed to raise the appeal of the shiny metal as the safe haven (due to elevated uncertainty, since the new president is an outsider who was elected as a voice against the status quo and who does not have experience in foreign policy), the inflation hedge (because of higher government spending and tax cuts), and a bet against the U.S. dollar (due to higher inflation and bigger fiscal deficit). These hopes did not materialize and the price of gold declined after the election. Surely, Trump's presidency may turn harmful for the economy and positive for the bullion in the long-run, however investors focus now on the short-term consequences of higher infrastructure spending and its (alleged) stimulatory effects, which put the yellow metal under downward pressure. The current biggest concern (and hope for gold bulls) is Trump's foreign policy. Although there may be some important shifts, their impact on the gold market should be limited (or short-lived), as geopolitical risks do not drive the price of gold in the long run.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.